The Takeaway

Battery-powered carmakers from China are vying for a bigger slice of the global market. But a recent European Commission investigation could hamper these efforts. The probe, the latest effort by the European Union (EU) to reduce reliance on Chinese exports in the bloc’s green transition, could trigger new tariffs on Chinese electric vehicles (EVs). If Beijing bites back, industry watchers warn of economic consequences for both sides.

In Brief

Tensions escalated between China and the EU on September 13 when European Commission President Ursula von der Leyen announced an investigation into Chinese EV manufacturers. She claimed that state subsidies have allowed Chinese firms to price their EV exports "artificially low," resulting in a flood of low-cost Chinese imports to Europe. Chinese EV models are typically 20 per cent cheaper than their European counterparts, although Chinese models are still priced higher in Europe than in China.

China’s Ministry of Commerce rebuked von der Leyen’s statement, denouncing the investigation as not “conducive to the stability of the global supply chain,” nor “in the interest of anyone, including the EU.” Industry representatives in China also pushed back against her claims, arguing that Chinese carmakers are competitive because of their innovative capacities and manufacturing and supply chain efficiencies. Bloomberg suggests the EU could impose a new duty of nearly 30 per cent nine to 13 months after the probe's launch.

Implications

Since China joined the World Trade Organization in 2001, the country’s automotive industry has experienced robust growth on the international stage. In the first half of 2023, China became the world's largest car exporter, shipping more than 2.34 million vehicles compared to Japan's 2.02 million. China’s growing dominance is increasingly driven by the popularity of made-in-China new energy vehicles (NEVs) — a category that includes EVs, hybrids, and fuel cell vehicles — propelled by abundant government support programs, a competitive advantage in producing lithium and other battery materials, and the burgeoning global demand for non-gasoline cars. In the first six months of 2023, China exported roughly 800,000 NEVs — double the number from the same period in 2022. Those 800,000 NEVs accounted for 34 per cent of China’s total car exports during that stretch.

In the EU, where efforts to ban combustion engine vehicles by 2035 have led to a surge in demand for EVs, Chinese car imports have made significant inroads. In the first seven months of 2023, NEV shipments to the economic bloc saw a year-on-year increase of 112 per cent, and a 361 per cent increase from 2021. Chinese companies now capture eight per cent of the European EV market, with projections by the European Automobile Manufacturers' Association indicating this share could reach 15 per cent by 2025.

To better access their European clients, many of China’s biggest car companies have established production bases in Europe. For example, Gotion High-tech, China’s fourth-largest EV battery maker, opened its first European factory in Germany on September 16 and has signed several co-operation agreements with EU-based corporations like BASF, ABB, Ebusco, and Ficosa. This level of expansion has concerned some European automakers, who fear being crowded out by lower-cost Chinese imports, as was the case with Europe’s solar industry a decade ago. Without action from European policymakers, experts anticipate that Chinese automakers could cost their EU counterparts C$10.1 billion (7 billion euros) in foregone profits annually by 2030.

There are supporters and opponents of this protectionist probe within the bloc. Member states like France — home to brands like Renault, Citroen, and Peugeot — have relatively less exposure to the China market and are expected to benefit the most from any potential anti-subsidy tariffs. Meanwhile, German automakers that have close relations with (and exposure to) the China market have voiced their concerns regarding the investigation, even though the European Commission said the purpose is to “de-risk” but not to “de-coupl(e)” from China. Should Beijing retaliate against the probe, companies like Volkswagen AG, BMW, and Mercedes-Benz could be hurt by major sales revenue losses and sourcing complications.

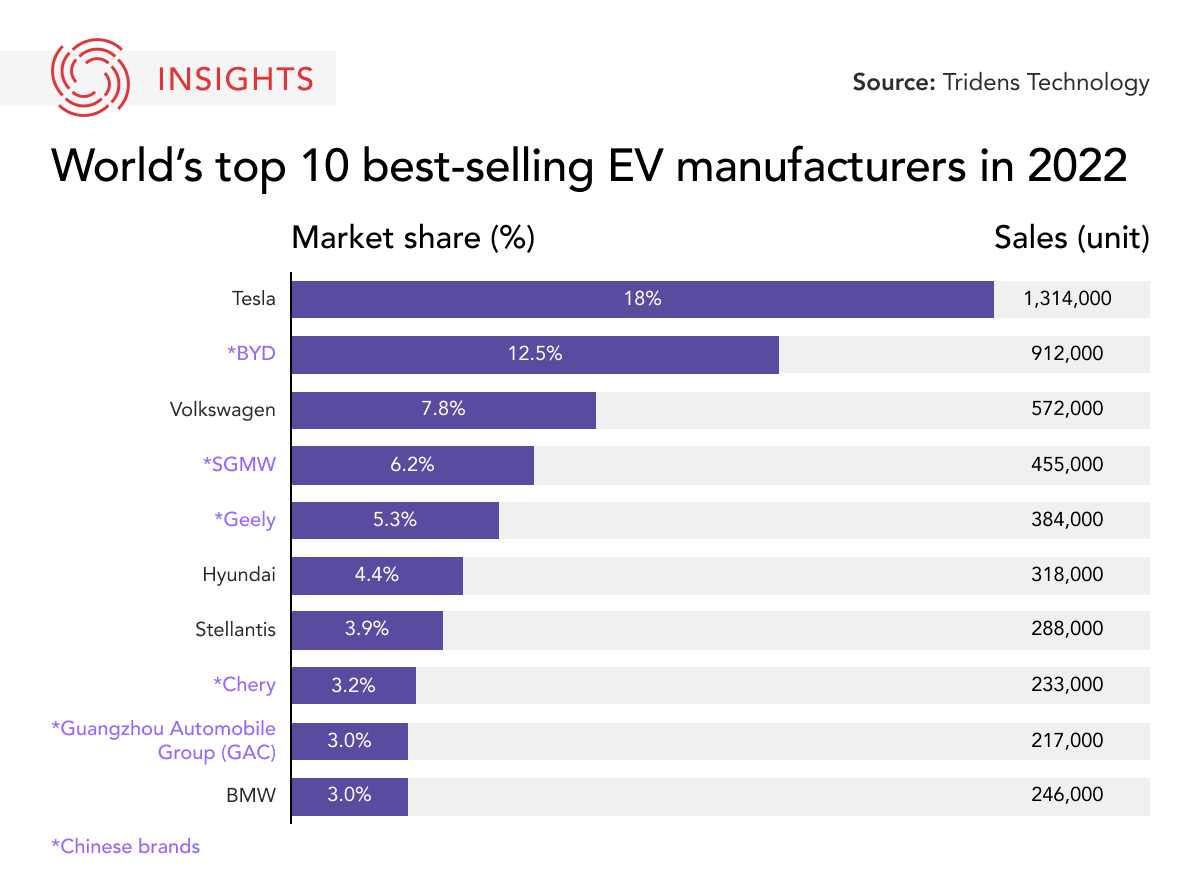

With more than two million China-made NEVs projected to be sold annually to Europe by 2030, potential EU tariffs could have major consequences for China’s growing EV industry. At the same time, other obstacles hinder China’s true dominance in the global EV market: the country's leading automakers have yet to break out of the low-cost EV market, and Chinese companies’ profitability and brand value are still dwarfed by traditional rivals from the U.S., Germany, and Japan.

Nonetheless, major changes are expected from the world’s largest car exporter as it navigates geopolitical tensions while exploring growth opportunities in markets such as Africa, Southeast Asia, and Latin America.

What's Next

- China’s (possible) game plan: back to the batteries

While the EU is keen on keeping its EV factories running, China will likely react to higher-than-normal tariffs by leveraging its massive stock of raw EV-related materials and production facilities, where 90 per cent of the world's rare earth concentrates are refined. Production of this kind is almost non-existent in Europe. As China just raised its rare-earth mining quota by 14 per cent, this edge may grow even stronger.

- Stronger ties with regional partners likely

In view of potential alienation, Chinese automakers will likely seek stronger relations with regional trade partners like ASEAN. With Thailand and the Philippines already top export locations for Chinese EVs and recent regional initiatives to strengthen partnerships in the sector, Chinese brands will likely take advantage of this more friendly business environment and increase their activities in the Asia Pacific.

• Produced by CAST's Greater China team: Maya Liu (Program Manager); Karen Hui (Analyst); and Chloe Yeung (Analyst).