U.S. President Donald Trump unveiled his global barrage of tariffs yesterday, the most comprehensive and disruptive effort yet to “overhaul” the U.S.’s trading relationships and the global trading system at large.

The White House wagers that the tariffs will push companies to relocate to the U.S., reviving American manufacturing and, in the process, generating government revenue to offset tax cuts. The wisdom of this approach will be tested in the weeks to come, as prices rise and tariffs begin to bite at home.

Markets have responded with skepticism to Trump’s policies: this week, the S&P 500 index posted its worst quarter since 2022. The Russell 2000 — an index of smaller, domestically focused U.S. companies — dropped 9.7 per cent over the same stretch.

Auto tariffs rattle Japan, South Korea

In addition to the so-called ‘reciprocal’ tariffs announced yesterday, at midnight, Washington imposed a 25 per cent tariff on imported vehicles.

In 2024, the U.S. imported US$41 billion worth of vehicles from Japan, the second-highest total of any country, trailing only Mexico. American imports of vehicles from South Korea totalled US$38 billion.

“Concern has been growing in Japan about the economic impact of the tariffs,” according to Japan’s Asahi Shimbun. Japan’s prime minister, Ishiba Shigeru, pledged to take “all possible measures” to support businesses hit by U.S. tariffs and suggested he may return to Washington to negotiate directly with Trump.

About half of all South Korean car exports are destined for the U.S. The ratio is much higher for General Motors Korea, which employs 11,000 workers across South Korea. Without a tax break from Seoul, the company may be forced to relocate.

South Korea’s stock market rebounded briefly this week, buoyed by the prospect of political stability. After months of drama and delays, on Friday morning (local time), the country’s top court will issue its verdict on whether to uphold or dismiss the impeachment of President Yoon Suk Yeol.

‘Elbows up’ or ‘head down’?

Negotiations seem to only go so far with Washington; as one tariff recedes, another tariff takes its place.

So far, Canada has mounted the most vocal defence of any country targeted by tariffs, a stance likely influenced by Trump’s apparent desire to economically absorb the country. Polls suggest Canadians are outraged by Trump’s threats.

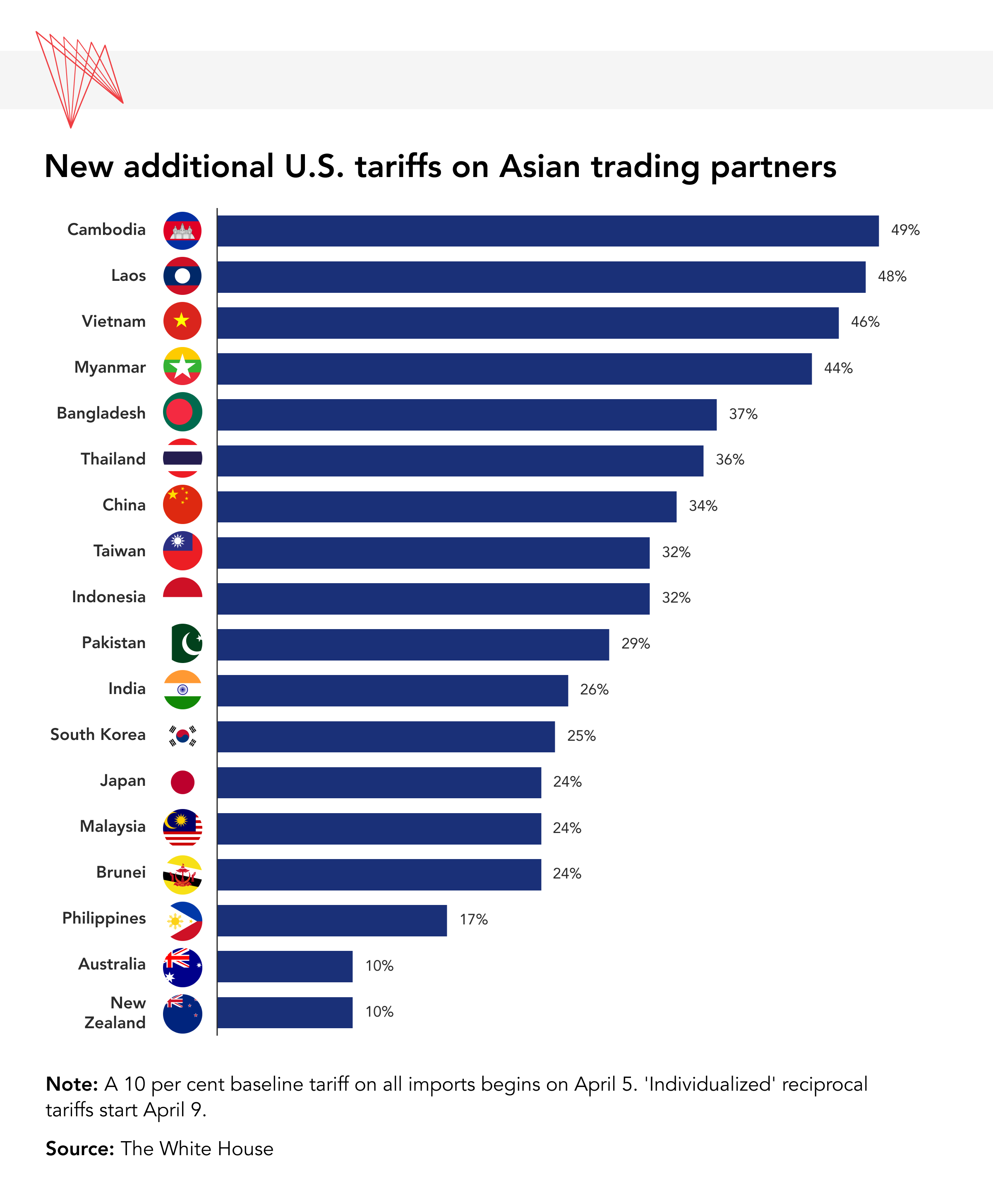

Countries such as India and Vietnam adopted a ‘wait-and-see' approach, largely staying mum. Hanoi, which boasts a large trade surplus with the U.S., was proactive in granting concessions to the U.S., including pre-emptive bilateral tariff cuts.