Vietnam is one of the world’s fastest-growing economies, with a GDP growth rate averaging 6.1 per cent from 2013-22, putting it well above the Asia Pacific average of 4.4 per cent. Much like its Southeast Asian neighbours, Vietnam achieved its impressive growth through a “develop first, clean up later” framework, which prioritizes development through the use of fossil fuels. With half of the nation’s electricity originating from fossil fuels, Vietnam has struggled to wean itself off coal and gas, especially as it faces the twin challenges of rising energy demand and the worsening effects of climate change.

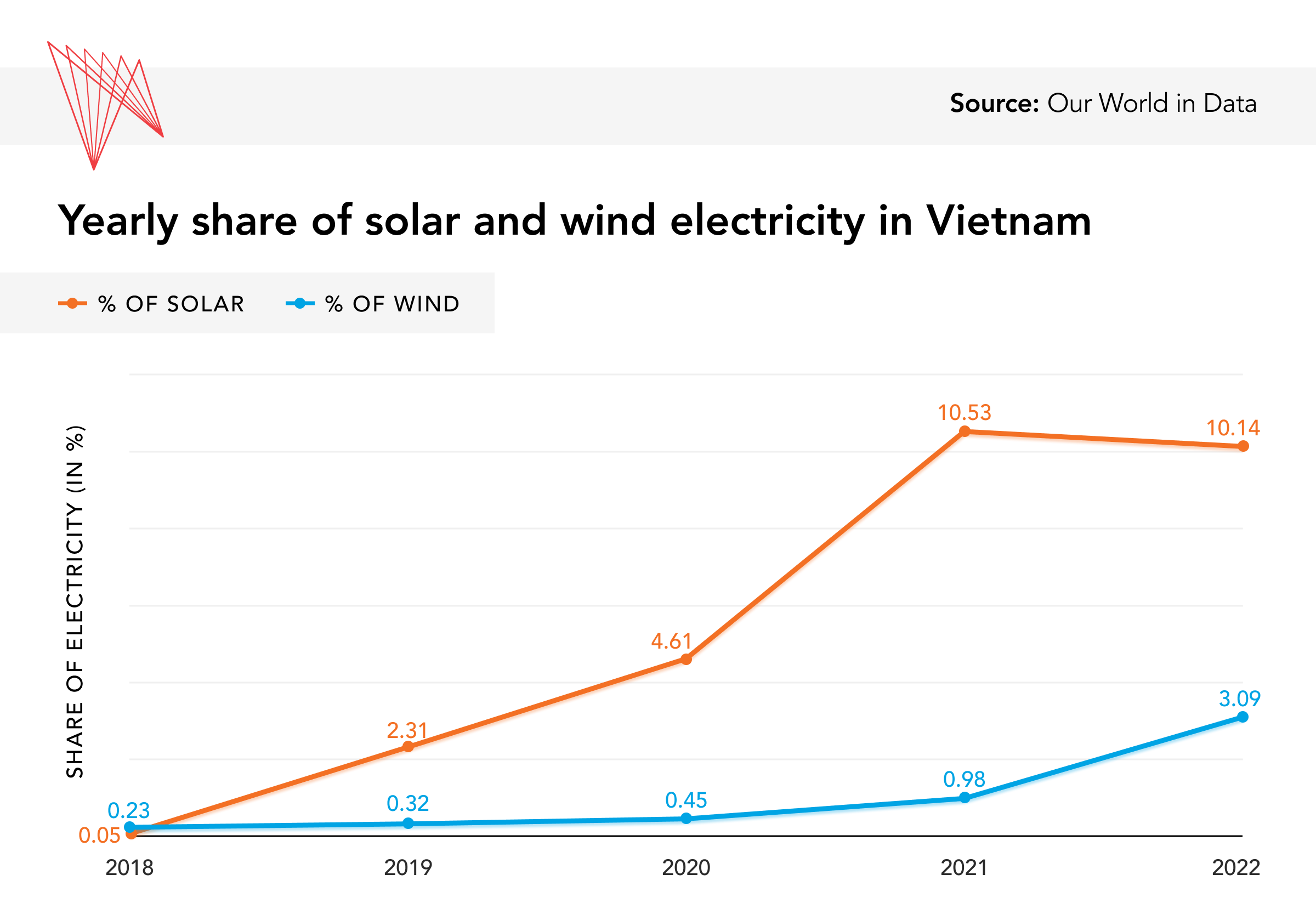

Vietnam’s recent boom in renewables, however, reflects a positive shift in the country’s efforts to decrease its fossil fuel dependency. Beginning in 2019, Vietnam’s solar and wind capacity rose rapidly, generating around 15 per cent of the nation’s electricity in 2022 — a remarkable improvement given that it had consistently trailed behind the capacity of neighbours Thailand and the Philippines.

Vietnam’s climate ambitions have not yet extended to broader industrial emissions controls and pollution management, despite the severe negative impacts of elevated pollution levels on human health and the environment. As public scrutiny intensifies around the government’s capacity to confront escalating energy insecurity and sustain robust economic growth, the energy sector has emerged as a key sector for addressing these dual challenges. In addition to renewables bolstering energy security, Vietnam’s energy industry is becoming a highly sought-after destination for foreign investment. As a member of the Just Energy Transition Partnership (JETP) international financing program, the ruling Communist Party of Vietnam (CPV) has signalled its commitment to prioritizing renewables while gradually reducing the country’s dependency on fossil fuels.

Plans for phasing out coal, ramping up renewables

In late 2022, Vietnam, along with Indonesia, became a recipient of a JETP. The JETP aims to expedite Vietnam’s transition away from fossil fuels by retiring coal plants and improving energy infrastructure to support the use of renewable energy sources. Through the JETP, Vietnam will receive C$21 billion over three to five years, with funding primarily provided by the International Partner Group (IPG). The IPG is a partnership comprising Canada, Denmark, the EU, France, Germany, Italy, Japan, Norway, the U.K., and the U.S., as well as various private sector investments from multilateral and national development banks.

In mid-2023, Vietnam created its own JETP secretariat to work closely with the IPG in advising on and administering the commitments made under the partnership’s declaration. The JETP secretariat also drafted Vietnam’s Resource Mobilization Plan, which outlines changes to the national energy regulatory framework, targets for reforming its energy sector, and a framework for monitoring the challenges experienced and progress made under the JEPT.

To meet the goals of the JETP, the CPV has started to amend Vietnam’s national energy frameworks to expand the share of renewables. In May 2023, the CPV released the Power Development Plan 8 (PDP8), a long-term plan for national power production and distribution. Under the PDP8, Vietnam intends to increase its proportion of electricity from renewables — excluding hydropower — to more than 30 per cent by 2030. Vietnam has also pledged to ultimately hike this figure to 47 per cent with support from the JETP.

In August 2023, the CPV also approved the National Energy Master Plan (NEMP), a broad road map for Vietnam’s energy sector to reach net zero by 2050, with plans to generate sufficient energy to sustain long-term economic growth Again, the state emphasized the rapid deployment of renewables with plans to increase the share of renewables in the country’s power supply to 85 per cent by 2050. However, the NEMP allows for local coal mining and coal imports to continue into the next decade, before peaking in 2035 and gradually being phased out by 2050.

Alongside the international climate funding via the JETP and state policies aimed at boosting renewables in the country’s energy mix, the CPV has implemented an array of economic incentives to ramp up local investments in renewables. For example, generous feed-in tariffs (FITs) — policies providing energy producers above-market rates for selling their energy — introduced in 2017 have allowed private solar companies to sell their electricity to state-owned utility company Vietnam Electricity and its subsidiaries at a much higher price than coal or hydropower plants. This scheme attracted local investors in solar energy production and led to a renewables surge in Vietnam, with solar electricity doubling each year since 2019 and providing close to 10 per cent of the nation’s total electricity supply in 2022.

But despite an initial period of successful uptake, many of these incentivized projects have reportedly been halted or forced to shut down. For instance, the resulting strain on Vietnam’s transmission grid from the sudden surge in renewables under the 2017 FITs program, and a lack of new coal or hydropower plants to stabilize the country’s energy baseload, left many households and businesses struggling for sufficient power. Compounding these challenges, some investors failed to meet local government guidelines that would qualify them for the FITs, while other projects were found to have violated certification and licensing requirements.

Pollution persists

In other areas of sustainability, the CPV has failed to take more ambitious measures, particularly in curbing businesses’ pollution levels. Air quality has consistently worsened, with Hanoi and Ho Chi Minh City ranked among the top 15 most polluted cities in Southeast Asia. Despite recording around 60,000 air pollution-related deaths in 2018, stringent management of industrial pollution remains inadequate.

In 2020, the CPV revised the Law on the Protection of the Environment to implement a more robust and nationally comprehensive anti-pollution framework. As part of the amendment, a pilot carbon credit system will be implemented by 2025, allowing the state to allocate carbon credits and certify GHG emissions quotas. New guidelines on air pollution also stipulate that businesses play a greater role in monitoring and improving air quality, requiring them to detail and report their emissions in their company databases. However, businesses often fail to fully disclose this information, undermining efforts to reduce air pollution.

More worryingly, the omission of third-party environmental monitoring means that much of pollution inspection is left to Vietnam’s Environment Ministry or businesses themselves. Given ongoing allegations against the CPV of colluding with companies to either cover up industrial pollution or downplay the extent of damage to the surrounding environment and communities, the absence of independent monitoring and reporting mechanisms has fuelled distrust in the government and public discontent.

Prioritizing the energy sector to maintain economic growth

Vietnam’s prioritization of the energy industry over environmental imperatives may be due to pressures it is facing to maintain high economic growth amid growing energy insecurity. In 2023, intense droughts in northern Vietnam forced 11 hydropower plants to shut down, cutting off electricity for thousands of residents and triggering a series of unplanned and unannounced blackouts. These sudden energy disruptions have forced many large manufacturers, including Foxconn and Samsung Electronics, to halt operations, curtailing productivity. Furthermore, with a rapidly growing middle class, which is expected to encompass more than half of the Vietnamese population by 2035, energy security has become a major concern for both the public and the state.

At the same time, Vietnam’s high vulnerability to climate change is also disrupting its economic performance. According to the Global Climate Risk Index, Vietnam ranked sixth globally among countries most affected by extreme weather events between 1998 and 2018. In 2020, for instance, Central Vietnam experienced unusually long rainfalls leading to floods and landslides which were followed by nine major typhoons. Considered as one of the worst disasters to hit the region in the past 100 years, the floods cost Central Vietnam around C$1.7 billion in damages and killed nearly 200 people.

Amid the struggles of balancing economic prosperity and energy security through worsening climate change, the CPV may be promoting renewables because they help address both economic and energy concerns. In 2022, the country received C$14.4 billion in foreign investments in its renewables sector, which excludes upcoming funding from the JETP. Vietnam’s energy industry is also being considered a promising recipient in an C$11-billion investment led by 15 U.S. businesses, including chip manufacturers.

Canada-Vietnam co-operation

Canada, meanwhile, continues to assist in Vietnam’s acceleration of renewables. In addition to the JETP, Canada funds various renewables projects, such as the Floating Solar Energy Project located on the reserves of the Da Mi hydropower plant. Canada is also one of Vietnam’s top consumers in renewables, accounting for more than C$123 million in solar panel imports in 2020. In late 2023, the Canadian government announced trade missions to Vietnam and Malaysia as part of its Indo-Pacific Strategy and its efforts to deepen regional collaboration on trade and sustainability.

Canada has also aided some of Vietnam’s pollution management projects. Between 2018 and 2021, Ottawa launched the Vietnam Solid Waste Management Project. Through the Federation of Canadian Municipalities, and in collaboration with the Association of Cities in Vietnam, a C$1-million fund was provided to assist two medium-sized Vietnamese cities in developing technological strategies to alleviate short-lived climate pollutants in the solid waste industry. In 2019, Vietnam’s Environment Ministry and the Embassy of Canada to Vietnam hosted a joint workshop on ocean plastic pollution as part of Canada’s C$100-million investment in helping developing nations reduce ocean pollution.

Moving forward, Vietnam’s leadership will need to navigate an array of issues, both economic and environmental, requiring a rapid transition away from fossil fuels alongside an accelerated decarbonization of Vietnam’s booming industries. With the CPV still heavily focused on advancing Vietnam’s clean energy sector while maintaining its historical economic advancement, Canada-Vietnam partnerships in renewables are expected to deepen, possibly paving the way to increased collaboration on securing clean technology components such as critical minerals. Whether this co-operation will expand to other sustainability commitments remains to be seen.