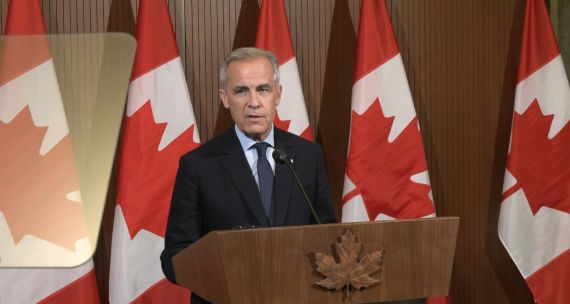

Prime Minister Mark Carney will travel to Beijing from January 13 to 17, marking the first visit by a Canadian prime minister to China since 2017. The trip comes amid mounting economic and political pressure from the Trump administration and reflects the Carney government’s stated objective to diversify Canada’s economic partnerships and double non-U.S. trade over the next decade. At the same time, the visit underscores the complexity of engaging China at a moment of heightened geopolitical competition, economic coercion, and growing security concerns.

1. What would make this trip a clear success for Prime Minister Carney?

Success will depend on whether Prime Minister Carney can strike a difficult balance: seizing economic opportunities—especially in the energy sector—while at the same time protecting Canada’s national and economic security.

He also has to manage competing domestic interests, from Ontario’s auto sector to Saskatchewan’s canola producers, while keeping a close eye on how any deals with Beijing could affect Canada’s relationship with the United States and upcoming CUSMA negotiations.

Carney’s trip will be closely watched at home, in Washington, and in capitals across the Indo-Pacific as a test of whether Canada can pursue pragmatic economic engagement with Beijing without compromising its economic security or strategic autonomy. Both the substance and the optics will matter. A successful visit will require discipline, strategic clarity, and careful execution from the Canadian government.

2. What economic deals and outcomes are on the table?

We are likely to see new deals around energy—both conventional and clean. China is already a major buyer of Canadian crude oil and LNG, and uncertainty around China’s oil supply from Venezuela creates additional opportunities for Canada to expand energy exports. The Prime Minister has also signalled interest in co-operation on climate technology and green energy, though the specifics remain unclear. Any announcements related to climate-linked investment into Canada will be especially important to watch.

On canola and EV tariffs, Canada will need to proceed with caution. Given how complex and politically charged these issues are, Ottawa should not rush into deals that could leave Canada vulnerable in the longer term. Decisions around EV tariffs will be closely linked to discussions about the future of the auto sector in Canada and its continued integration into the North American supply chain. Sequencing and timing on whether and when to drop tariffs on Chinese-made EVs will need to be guided not only by discussions with Beijing but also by negotiations with Washington.

More broadly, Canada needs a selective approach to economic engagement with China. We should engage where interests clearly align—such as energy—diversify beyond China where we are overly dependent, including canola and critical minerals, and avoid co-operation in sensitive areas such as AI, quantum, dual-use technologies, and defence and security.

Finally, to benefit economically from engagement with China, Canada must have strong domestic guardrails in place—updated investment-screening mechanisms and robust tools to address foreign interference and cybersecurity risks—to protect its security and strategic interests.

3. What should Canada be cautious about when engaging with China economically?

Canada must remember that China has a track record of using economic relations for political leverage. We have seen the Chinese Communist Party deploy economic coercion not only against Canada but also against Australia, Japan, the EU, and others.

Over-reliance on any single partner is a risk—especially in today’s turbulent geopolitical environment. Canada has learned that lesson the hard way with China, and increasingly with the United States.

Pragmatic engagement and dialogue with China are necessary, but Canada cannot afford to be naïve or succumb to diplomatic amnesia. Instead, we should continue to diversify our international partnerships—deepening ties with Japan, South Korea, Taiwan, Australia, the Philippines, Indonesia, India, and Europe. Canada has options, and should embrace them rather than repeating the mistakes of the past.

4. Would a “strategic partnership” with China strengthen Canada’s position in dealing with the U.S.?

A “strategic partnership” is not the right frame for Canada–China relations. Canada agreed to such a partnership in 2005, a far more optimistic period when China was led by a different leader. Much has changed in the past two decades.

China remains an economic partner, but it is also a competitor. In many areas, the policies of the Chinese Communist Party run directly counter to Canada’s interests—whether on Ukraine, the South China Sea, the Arctic, or issues of human rights and foreign interference.

This is a complex relationship with both opportunities and real risks, and it is likely to remain so for the foreseeable future.

What truly strengthens Canada’s position with the United States is investing at home—boosting productivity, advancing major projects, investing in AI, quantum, and other emerging technologies, and diversifying and deepening relationships with reliable partners in Europe and Asia.

5. What should observers watch for during the visit?

The visit is likely to produce some concrete outcomes, including new deals and commitments to co-operate in select areas, particularly on climate-related initiatives and green technology. The optics and rhetoric surrounding the trip will also be important.

Language matters. Observers should look for evidence that Canada’s approach to China remains clear-eyed, that economic engagement is carefully managed and that it does not drift into strategic alignment. Maintaining a focus on economic security and preserving Canada’s strategic autonomy should remain central.

Selective engagement and sustained dialogue with China are necessary. However, framing that engagement as a strategic partnership—comparable to Canada’s relationships with Japan or Australia—would risk blurring important distinctions in how Canada approaches partners, competitors, and systemic rivals. How that line is drawn, in both substance and language, should be closely watched during this week’s visit.