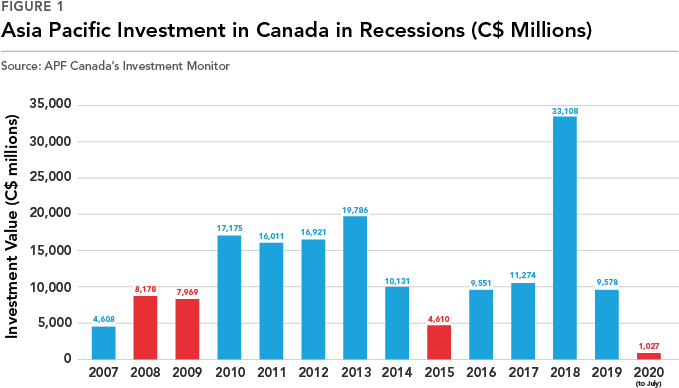

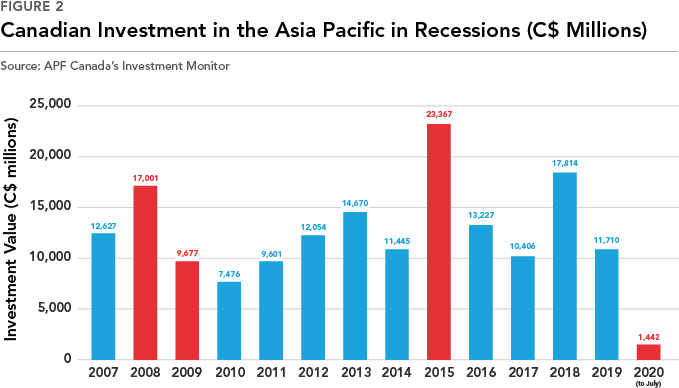

With Canadians increasingly concerned about a COVID-19-induced recession, many are looking to past recessions for potential lessons on what to expect in the months to come. For many, the ‘Great Recession’ of 2008-09 springs readily to mind. But 2008-09 is only one of two ‘technical recessions’ – defined as two consecutive quarters of declining GDP – that have occurred in recent history. Since investment from the Asia Pacific took off in Canada at the start of the 2000s, there have been two technical recessions – one in 2008-09 and another in 2015. Using APF Canada’s Investment Monitor, a uniquely rich dataset of two-way direct investment flows between Canada and the Asia Pacific, we can better understand deal flow during these two recessionary periods and the lessons it holds for today.

When it comes to foreign direct investment (FDI) between Canada and the Asia Pacific, we have already begun to see changes in deal flow that mirror that seen in these two past recessions: typically, declines in both the number of deals and the total value of concluded deals for Asia Pacific investment in Canada, and for Canadian investment in the Asia Pacific. Although many investment deals, typically long in the works, have still closed in recent months, others have been called off. In March, Singapore Press Holdings’ plan to buy six senior housing properties in Ontario and Saskatchewan for C$233 million collapsed, an early victim of the pandemic’s effects on service sector and sector adjacent investments. On the other hand, China-based Shandong Gold Mining’s May announcement of its C$207-million intention to acquire Toronto-based TMAC Resources reflects the impacts of COVID-19 on the world’s natural resource markets as cash flow problems for some miners presented buying opportunities for better capitalized firms. These early shifts in deal flow portend the changes to come in the world of direct investment over the next few years.

Inward investment into Canada grew in the period after the Great Recession

During the Great Recession, even as global economic activity was broadly contracting, Asia Pacific investment into Canada was increasing nearly across the board. In 2008, Japan invested C$2.3 billion into the Canadian automobiles and parts sector, Australia invested C$1.5 billion into Canada’s alternative energy, and, by 2009, mainland China had invested C$5.1 billion into Canada, a large share of which flowed to industrial metals and mining.

By 2009-2010, investment flows from the Asia Pacific into Canada nearly doubled, with Thailand investing C$2.7 billion into Canada’s oil and gas production, and South Korea investing C$2.6 billion into various sectors. Investment from mainland China also began to rise substantially in oil and gas production.

Canadian investment into the Asia Pacific region shrunk following the Great Recession

In contrast to an increase in inbound investment, the levels of new Canadian investment in the Asia Pacific declined across the 2008-09 crisis as Canadian firms’ ability to invest in the region became more constrained during and after the recession. At the onset, investment levels did increase in the region overall, from C$12.6 billion in 2007 to C$17 billion in new investment in 2008. That increase was largely driven by an increase from C$10 million to C$5.1 billion in investment into Vietnam, the result of an investment into the travel and leisure sector. New Canadian investment into the Philippines, however, saw a marked decline from C$3.7 billion in 2007 to C$1.4 billion in 2008, as Canadian investment into that country’s mining sector dropped.

By 2009, the declining levels of new investment in the Philippines brought Canada’s new investment in the country down to C$292 million, dragging down the total for new investment into the overall region. A large decline in Canada’s outbound investment flow in the technology hardware and equipment sector, especially in New Zealand, compounded the drop. Canadian investment in Australia, which stood at C$826 million in new investment in 2007, grew to C$2.5 billion in 2009 as a result of strong levels of investment into the financial services sector, but was not enough to offset Canada’s decline in the region. Declines continued from 2009 into 2010, led by drops in new Canadian investment in mainland China, from C$3.5 billion to C$964 million, with alternative energy investment hit especially hard.

2015’s technical recession saw a slow in inward investment

A downward oil shock and years of falling commodity prices led to two quarters of economic decline in 2015, in turn triggering a ‘technical recession.’ Reflecting oil’s challenges, the decline between 2013 and 2015 in Asia Pacific investment in Canada was almost entirely a story about mainland China’s investment flows. They hit a peak in 2013 at C$17.8 billion in new investment as investment flowed mainly into Canada’s oil and gas production, only to dramatically shrink to C$989 million by 2015. The decline was accelerated across 2014 and 2015, as Australia’s investment flows dipped from C$3.1 billion to C$143 million, and Malaysia’s dropped from C$1.7 billion to just C$37 million, in both cases driven by declining investments in oil and gas production. In fact, of all sources of investment into Canada, only South Korea increased its flows between 2014 and 2015, from C$43 million to C$675 million in new investment, driven by increases into pharmaceuticals.

By 2016, that decline reversed, as mainland China added C$4.3 billion in investment into the Canadian economy, especially into commercial real estate and the services sector. Also factoring into the reversal was Hong Kong’s significant levels of new investment into oil and gas production. Year-on-year declines continued in the levels of new investment from many Asia Pacific economies, however, including South Korea’s drop down to C$70 million in new investment, but not enough to offset an overall increase bolstered by mainland China.

2015’s technical recession coincided with a peak in outward investment

In the opposite direction, even as Canada’s economy was hit by the 2015 decline, its investment flows into the Asia Pacific were hitting their peak, at C$22.1 billion. A significant share of that peak was represented by Canada’s C$6.7 billion in investment into Bangladesh that year, spurred by the economy’s alternative energy sector. Increases in Canada’s investment in the Asia Pacific’s industrial transportation sector added to the growth, offsetting drops in new Canadian investment into Pakistan, from C$2.0 billion in 2013 down to zero in new investments in 2015, and a drop in New Zealand, from C$1 billion in 2014 to zero in 2015.

By 2016, however, that peak was diminished. New Canadian investment into Bangladesh dropped to zero, bringing down investment into the overall region’s alternative energy as well. Even an increase in Canadian investment into India, from C$1.4 billion in 2015 to C$2.9 billion in 2016, and increasing Canadian investment in the real estate investment trusts sector, driven by growth in Singapore, was not enough to prevent Canada’s flow of investment in 2015 from dropping by nearly C$10 billion.

Preliminary trends from 2020

As of August 2020, estimating the total flow of investment from the Asia Pacific in the current year and beyond remains challenging. New inbound investment in the first half of the year just passed C$1 billion, with Canada off track to hit the C$9.6 billion received in all of 2019. The region’s two largest investors in 2019, mainland China and Australia, invested C$4.1 billion and C$2.7 billion into Canada that year, respectively, but their combined investment in the first quarter of 2020 was in the tens of millions range, with only the aforementioned, prospective Shandong Gold Mining transaction boosting mainland China’s numbers in the second quarter. If a federal review strikes the Shandong Gold deal down, 2020’s total will be lower still.

Similarly, Canada will face headwinds investing in the Asia Pacific. Across the first seven months of 2020, just C$1.4 billion in investments flowed out of Canada, a far cry from the C$11.7 billion across all of 2019. In 2019, Canada invested C$2.1 billion into India (with high levels of investment in non-equity investment instruments and the technology hardware and equipment sector) and C$2 billion into mainland China (automobiles and parts), but only China has received investment to date.

2020 and the coming years will be a turning point for Canada-Asia Pacific two-way investment. The two recent recessions indicate that Canada can expect major shifts in deal flow – inbound and outbound – over the next few years. Some sources of investment – namely Japan, mainland China, and South Korea – played key roles in dampening earlier declines and driving recoveries, but face historic headwinds of their own in 2020. Further, Canada’s automobile, mining, and oil sectors drove investment numbers back up in previous recessions. Those sectors are likely indicators of potential challenges to or opportunities for attracting similar forms of new investment over the coming years. In the other direction, Canada’s outbound investment in the Asia Pacific took many years to recover after previous recessions, with large declines across nearly all sectors and economies.

As more data on the pandemic and other impacts on 2020 emerge through the Investment Monitor’s reporting on the latest investment trends between Canada and the Asia Pacific, we will increasingly have a better understanding of how deal flow is and is not similar to that during Canada’s recessions of the recent past, thereby giving us insights into which lessons we can pull from previous recession playbooks.

With additional research and writing by Sainbuyan Munkhbat, Junior Research Scholar at APF Canada.

* All dollar terms have been inflation adjusted.