While much focus has been given to global trading relationships in the time of COVID-19, especially in terms of health-care goods, Canada and the Asia Pacific have foreign direct investment (FDI) links in broader health care sectors. With cross-Pacific FDI disrupted and delayed amid lockdowns, health crises, and travel restrictions, we can expect lower dollar amounts in health care – and in 2020 FDI more generally – as new COVID-19-induced government investment restrictions among key players make it even more challenging to invest in the sector.

But dollar values are only one dimension of FDI, and cannot fully ‘paint the picture’ of Canada’s economic relationships with the Asia Pacific. The Asia Pacific Foundation of Canada’s Investment Monitor, which tracks investment details beyond the dollar value, lets us peer deeper into the specifics of transactions between Canada and the region, allowing us to better understand Canada’s footprint in the Asia Pacific, and vice versa. With additional research, it also helps us identify health care links across the Pacific, where established links have faced challenges, and where cross-Pacific ties have strengthened pandemic responses. This piece illustrates those links, looking first at investments coming into Canada across various health-care-related sectors, followed by an examination of similar Canadian investments in the Asia Pacific.

Inbound

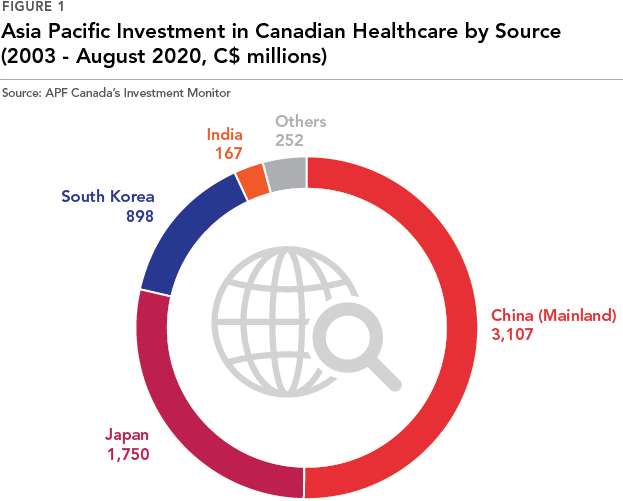

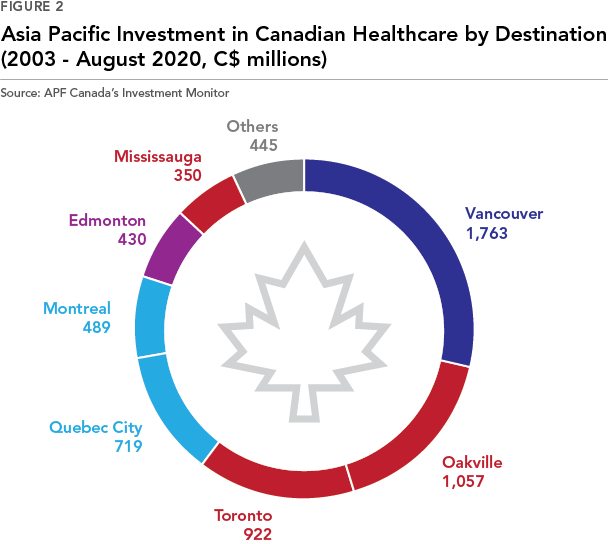

Over the past 17 years, health-care-related sectors in Canada have received C$3.7 billion* in foreign direct investment from the Asia Pacific, with flows increasing in recent years: C$1.3 billion was invested between 2012 and 2015, and an additional C$2.2 billion has been invested since 2016.

The bulk of Asia Pacific investments since 2016 was concentrated on health-care equipment and services, at C$1.7 billion invested. The remaining C$429 million flowed into the pharmaceuticals sector and C$30 million flowed into biotechnologies. Mainland China leads the pack of investors, with C$1.9 billion in investment into Canada since 2016, while Vancouver leads among the destinations for investment, at C$1.6 billion received during the same period.

Investment in Healthcare Services and Diagnostics: Anbang and Sekisui

Much of these recent flows were driven by one transaction in 2017. Cedar Tree Investment, a subsidiary of China’s Anbang Insurance Group, invested C$1 billion to acquire Vancouver-based Retirement Concepts, which owned and operated two dozen long term care facilities.

That transaction has since been hit by controversy on multiple fronts. The state-run China Insurance Regulatory Commission took control of Anbang in 2018 amid a fraud investigation, only ending state control in February 2020. Over a six-month period in late 2019 and early 2020, the BC Government took over four Retirement Concepts’ facilities, citing significant issues in care, while the Alberta government took control of a fifth in May, citing concerns over care amid outbreaks of COVID-19.

Recent investment challenges in the health-care facilities sector go beyond Anbang’s, especially given COVID-19’s impacts on multiple facilities in Canada. For instance, Singapore Press Holdings’ plan to buy six senior housing properties in Ontario and Saskatchewan for C$233 million, a deal halted in late March.

Some foreign investors, on the other hand, have increased their investments in Canada over recent years and during the COVID-19 pandemic. Japan-based Sekisui Diagnostics, a global provider of medical and bioscience diagnostics, expanded its plant in Charlottetown, Prince Edward Island in 2018, touting the importance of improving its North American supply chain for the production of its diagnostic tools.

Investment in Medical Equipment

Since 2003, Asia Pacific investors have invested C$196 million into Canada’s medical equipment sector, with the most significant activity by India’s Jubilant Life Sciences. Its Kirkland, Quebec headquartered subsidiary – part of Jubilant’s commitment to invest C$100 million in Canada over five years – operates Jubilant’s nuclear medicine and radiopharmaceutical activities, developing, manufacturing, and supplying pharmaceuticals used in diagnostics and treatment. While the radiopharmaceuticals division does not appear to be directly involved in COVID-19-related work, Jubilant Life Sciences has entered licensing agreements to manufacture and sell a potential therapy for COVID-19 in 127 countries.

In 2019, Japan-based Terumo, a life sciences company, opened a distribution and warehousing facility in Vaughan, Ontario valued at C$27 million. While Terumo Canada’s hospital and medical device products are for other, non-COVID-19 specific medical procedures, Terumo overall has been active both as a supplier in the medical oxygenation, cardiopulmonary, and monitoring device responses to COVID-19 in other jurisdictions, and as a firm researching COVID-19 treatment in the United States. Depending on the progress of the pandemic and research, the Canadian connection to Terumo’s distribution systems could be important for a country still worried about access to supplies.

A third investor in this space in recent years is a subsidiary of Japan-based Canon, Vital Images. Vital Images expanded its activities in Waterloo, Ontario in 2019 for C$9 million, with Vital’s work centred on medical enterprise imaging and the organization of patient and health-care system data, including images and reports, for use across health-care systems. In light of COVID-19 and increased need for lung imaging, Vital Images has released complimentary licensing of lung imaging applications.

Investment in Pharmaceuticals

Mitsubishi Tanabe Pharma, a pharmaceuticals firm and a member of Japan’s Mitsubishi Group, has also made notable entries in the Canadian market over the past decade, including acquiring the majority share of Laval, Quebec’s Medicago for C$357 million and establishing the Toronto-based Mitsubishi Tanabe Pharma Canada. In May 2020, Mitsubishi Tanabe Pharma announced that Medicago had seen positive results in its COVID-19 vaccine development process. Medicago is poised to scale up production to one billion doses of COVID-19 vaccine at its Quebec factory annually, with Mitsubishi Tanabe Pharma specifically naming Canada and Japan as markets for vaccine distribution.

Other Asia Pacific firms with subsidiaries in Canada have been active during COVID-19. Japan-based Takeda Pharmaceutical’s Canadian sales group, Takeda Canada, moved its headquarters to Oakville, Ontario for C$40 million in 2018. Takeda Canada’s range of pharmaceuticals includes treatments for a number of medical conditions, while Takeda recently announced prospective clinical trials for a COVID-19 treatment. India-based Strides Pharma acquired Varennes, Quebec-based generic drug distributor Pharmapar for C$4 million in 2018, with Strides recently announcing regulatory approval in India for clinical trials of a potential COVID-19 treatment.

Another active investor into Canadian pharmaceuticals is India’s Piramal Pharma Solutions, specifically surrounding the phased expansion of its Aurora, Ontario facility, used for pharmaceutical development and manufacturing, announced in January 2020.

Many investments from the Asia Pacific into Canada’s pharmaceuticals space in recent years have clustered around medicinal cannabis. In 2019 alone, Australia-based Creso Pharma’s subsidiary, Mernova Medicinal, opened a new, C$56-million production facility in Nova Scotia, while Australia’s Althea Group acquired Ontario-based Peak Processing Solutions.

Outbound

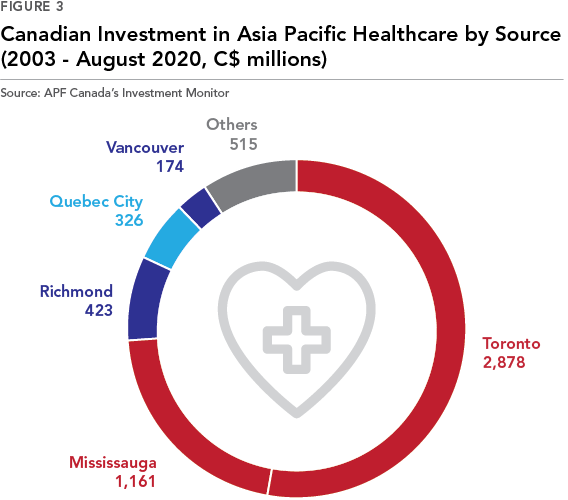

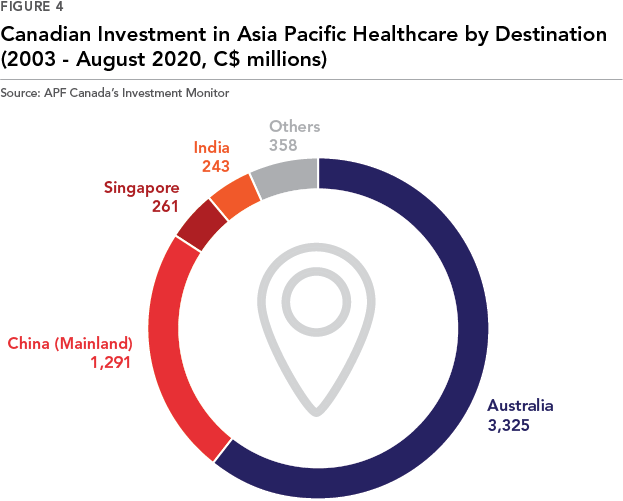

Across the last 17 years, Canadian outbound FDI to the Asia Pacific in health-care-related sectors has totaled C$3.8 billion, with significant increases in flows in recent years. From 2012 through 2015, Canada invested C$273 million into the region, with an additional C$2.8 billion invested from 2016 onwards. Since 2016, billions of dollars in investment in health-care in the region has flowed from Toronto (C$2.3 billion) and Quebec City (C$279 million), with Canada’s overall health-care investment primarily concentrated in Australia, with C$2.5 billion invested, and New Zealand, with C$147 million.

Of these investments, the large majority in dollar terms has flowed into health-care equipment and services, with only marginal activity in biotechnology, and with lower levels of pharmaceutical investment activity, primarily concentrated in Australia’s cannabis sector.

Investment in Health-care Equipment and Services

Since 2016, the bulk of Canadian investment in dollar terms has been directed towards Australia’s Healthscope, the second largest private health-care provider in Australia and the largest pathology service provider in New Zealand. In 2018, Toronto’s NorthWest Healthcare Properties paid C$411 million to acquire a 10 per cent stake in Healthscope, following that transaction with a C$300-million investment into the Melbourne-based company in January 2019, bumping its stake up to 25 per cent stake and acquiring 11 Healthscope health-care properties in the process.

Not long after, Healthscope was acquired by Toronto-based Brookfield Asset Management, along with other institutional investors, for C$4.4 billion, of which C$1.4 billion came from Brookfield. As part of the acquisition, Brookfield became a shareholder in Healthscope’s subsidiary, Labtests NZ, an Auckland-based pathology service provider. In turn, Quebec’s pension fund, Caisse de dépôt et placement du Québec, invested an additional C$270 million into Healthscope in August 2019.

This chain of investments has given Canadian entities a sizable footprint in Australia and New Zealand’s health-care sector. As with other private health-care providers in Australia, the Australian federal government has since worked to integrate Healthscope into the public system’s COVID-19 response; bringing in the private sector was projected to add another 30,000 beds to Australia’s integrated hospital capacity.

In Conclusion

Canada-Asia Pacific health-care investment ties are clearly complex, covering numerous activities and with a range of COVID-19-related outcomes experienced by these firms to date. By drawing out the details of these specific investments beyond just dollar terms, patterns of issues and areas where FDI has challenged Canada’s response to COVID-19 emerge, such as those in health-care services. On the other hand, Asia Pacific-sourced funding is behind a number of ‘good news stories’ in the fight against the pandemic, with Canadian investment funding helping, in turn, in the Asia Pacific.

As economies around the world implement legislation and regulations restricting foreign investment into health care as an immediate response to COVID-19, it will become even more crucial to analyze the differences between investments beyond dollar values, instead incorporating multiple qualitative dimensions. Restrictions based solely on dollar thresholds for review or covering entire sectors may miss the mark: COVID-19 has presented a shock to the system, uncovering both issues in quality of care as well as opportunities to link financial resources and distribution networks, making it important to look at the outcomes of investments.

A number of lessons can be learned in areas where foreign ownership may have hampered health-care responses or led to quality-of-care issues. On the other side of the ledger, successful responses by firms that have received FDI should be identified and highlighted for applicable future lessons. With COVID-induced cash flow crunches hitting even the world’s largest companies, many firms may have only been able to respond to the pandemic due to funds received from investors or parent companies abroad, or due to decisions made by management overseas. These tradeoffs will need to be weighed as economies consider added levels of restrictions on FDI, or move to make some rules permanent.

Additional research and writing by Isaac Lo, Postgraduate Research Scholar at APF Canada.

* All dollar terms have been inflation adjusted.