La version française est à venir.

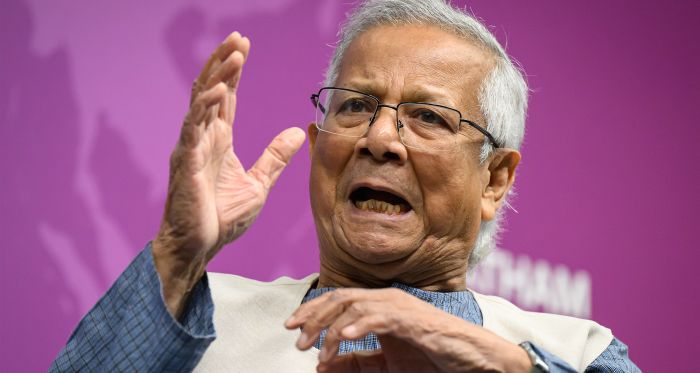

Since August 2024, Bangladesh has been led by an interim government, with Muhammad Yunus, a Nobel Peace Prize winner and pioneer of microfinance, at its helm.

This government was appointed after student-led protests over a controversial job quota system spiralled into nationwide unrest in July 2024 and left an estimated 1,400 people dead, prompting the once-powerful prime minister, Sheikh Hasina, to resign and flee to India.

Yunus began his tenure with an ambitious mandate, including ensuring justice for the victims of the government-led crackdown, reforming key institutions, and holding democratic elections, all while managing a fragile economy.

Ten months later, his government’s track record is mixed. Yunus and his team have nine months to instil confidence in the country’s financial and democratic future ahead of a much-anticipated national election in April 2026, the first vote since Hasina’s ouster.

Before Yunus, Economic Strengths Masked Structural Weaknesses

In some respects, the economy on the eve of Hasina’s departure showed signs of strength. During her second tenure in office from 2009-24, Bangladesh’s annual GDP growth surged, peaking at eight per cent in 2019. The ready-made garment sector in particular thrived, accounting for around 13 per cent of the country’s GDP and generating nearly 85 per cent of total export revenue in fiscal year 2023-24. GDP per capita also rose by an impressive 276 per cent, from C$929 in 2009 to C$3,489 in 2023.

However, beneath these impressive growth figures lurked deep structural problems. One of the most concerning issues was youth unemployment, a key driver of public discontent and a major factor behind the July 2024 protests. Although those aged 15 to 29 made up about 28 per cent of the Bangladeshi population, they accounted for 83 per cent of the unemployed in 2023. Informal employment, which provides little job security compared to public sector jobs, has dominated the labour market, accounting for 85 per cent of all jobs in 2022.

Meanwhile, inflation rose sharply, from 5.36 per cent in July 2021 to 11.7 per cent in July 2024. This rise squeezed household budgets, including those of garment sector workers, who have long protested low wages and poor working conditions.

Frustrated and financially strained, many of these workers joined the 2024 protests. The unrest, in turn, dealt a severe blow to the garment sector itself: prolonged demonstrations, curfews, and internet shutdowns disrupted factory operations, supply chains, and order fulfilment, leading to the cancellation of orders and a halt in production. In the weeks following the political transition, the sector reportedly incurred losses exceeding C$547 million, compounding the economic insecurity for the industry’s four million workers.

Corruption was another major issue inherited by the Yunus government. Soon after coming to power, Yunus commissioned an independent, 12-member committee to produce a ‘white paper’ on the state of economy. The committee found that during Hasina’s tenure, Bangladesh lost more than C$326 billion — an average of C$22 billion annually — to illicit financial outflows.

The paper identified 10 banks that were technically bankrupt; discovered that the costs of large-scale public infrastructure projects had been inflated to the tune of C$118 billion; estimated that up to 40 per cent of the funds earmarked for the Annual Development Programme (a yearly investment plan that outlines how the government will allocate funds) had been embezzled; and flagged the banking, infrastructure, energy, and information technology sectors as the most corrupt in the country. While some criticized the report for the lack of transparency in the data sources and methods used, its findings nonetheless underscored the scale of institutional dysfunction passed down to the new administration.

Amid this economic turmoil, Yunus also faced the critical task of unlocking the second and third disbursements from the International Monetary Fund’s C$6.4-billion loan programme. The release of these funds was contingent on a demanding set of reforms, including raising tax revenues, tightening monetary policy to curb inflation, implementing exchange rate reforms to enhance flexibility, and carrying out banking sector restructuring — all while navigating intense political pressure and institutional fragility.

Progress and Pitfalls in Reforms

To meet the IMF’s economic reform conditions, address the structural weaknesses his administration inherited, and lay the groundwork for economic recovery, Yunus launched a wide-ranging series of institutional, fiscal, and monetary measures.

To kickstart these efforts, the Yunus administration appointed Ahsan H. Mansur, a former IMF economist, as governor of Bangladesh’s central bank. Mansur introduced policy measures designed to tame soaring inflation and a worsening banking crisis, including hiking interest rates, replacing the boards of 11 troubled banks, initiating efforts to recover bad loans, and repatriating laundered money. In parallel, to address corruption issues, the administration appointed an Anti-Corruption Commission.

While these steps marked a strong start, the results have been mixed. Inflation has eased from 11.6 per cent in July 2024 to 9.05 per cent as of May 2025, but youth unemployment remains a pressing concern.

Between July and December 2024, the economy lost an estimated 2.1 million jobs, with women accounting for more than 85 per cent of these job losses. Nearly two-thirds of young women in Bangladesh are classified as NEET (i.e. not in employment, education, or training), a significant underutilization. Moreover, although Yunus previously advocated for higher wages in the garment sector, no such wage hikes have been announced under his administration.

On the plus side, export performance has shown signs of resilience: merchandise exports rose by C$5.4 billion between the July–May period of 2023-24 and the same period of 2024-25, with ready-made garment exports growing by 10 per cent. In addition, when the interim government presented the national budget, it did so via live broadcast for the first time since 2008, a gesture that signalled transparency and an effort to gain public trust.

Many were surprised, however, that the budget was trimmed to 7.9 trillion taka (C$88.5 billion) from 7.97 trillion (C$89.3 billion) in the previous fiscal year, the first time since independence that an annual national budget was smaller than the year before.

This reduction of government spending, along with the adoption of a flexible exchange rate system and the undertaking of tax administration reforms, including the dissolution of the National Board of Revenue and the creation of two separate units aimed at increasing revenue and improving revenue management, enabled the country to meet the IMF’s requirements. This, in turn, unlocked C$1.76 billion in delayed IMF payments.

Some critics noted, however, the absence of deeper structural reforms to stimulate job creation and private investment, and political parties across the spectrum described the budget as overly conservative and driven by IMF directives, calling it “more of the same” as previous budgets and failing to reflect the transformative aspirations of a ‘new Bangladesh’ to revive growth and social welfare.

Yunus’s Regional Reset and Bangladesh’s Future

One of the most consequential shifts initiated by Yunus is a recalibration of Bangladesh’s regional partnerships. In a landmark development, the government revived trade relations with Pakistan after decades of diplomatic stagnation following Bangladesh’s war of independence from Pakistan in 1971. The two nations have since reopened visa channels, re-established direct shipping routes, and agreed to launch a joint business council.

Yunus has taken an even more proactive approach towards China, Bangladesh’s second-largest investor and a major development partner. In March 2025, Yunus’s visit to Beijing yielded C$2.9 billion in loans, investments, and grants, a sharp contrast to the C$137 million offered to Hasina during her visit to China in July 2024.

Furthermore, nearly 30 Chinese companies pledged another C$1.3 billion to establish a Chinese Industrial Economic Zone in Chattogram, home to Bangladesh’s largest and most strategic seaport, Chittagong, which handles 90 per cent of the country’s maritime trade. Located on the Bay of Bengal, the port offers China access to the Indian Ocean, which is crucial for its Belt and Road Initiative. This partnership has raised concerns for some, including the U.S., about future military use and deepening Chinese influence in the Indo-Pacific. On May 30, 2025, Chinese Commerce Minister Wang Wentao led a delegation of 100 Chinese firms to attend the Conference on Investment and Trade in Bangladesh, where Yunus invited them to “make Bangladesh their home and their production hub.”

As the first South Asian country to join the Belt and Road Initiative in 2016, Bangladesh’s move to deepen its Comprehensive Strategic Cooperative Partnership with Beijing, along with recent discussions on initiating a free trade agreement, aligns with China’s regional aspirations to expand its economic influence, secure a strategic maritime foothold in the Indian Ocean, and counterbalance Indian and Western influence in South Asia.

Additionally, in a notable geopolitical shift, Dhaka formally opposed “Taiwan independence” for the first time in a joint statement issued during Yunus’s visit to China in March 2025. This pivot has come at a cost. During his visit to Beijing, Yunus pointed out that India’s northeast region is landlocked, and suggested there was a “huge possibility” of an “extension of the Chinese economy.” These remarks sparked a backlash in India, once Bangladesh’s closest regional partner. In response, New Delhi restricted visas and port access and cracked down on 2,000 undocumented Bangladeshi immigrants. India’s powerful textile sector has lobbied against Bangladeshi imports, and usage of a trans-shipment facility used by Dhaka was abruptly terminated.

Compounding these tensions is the ongoing trial of Sheikh Hasina, who has been living in exile in India since August 2024. On June 1, 2025, Bangladesh’s special tribunal commenced proceedings against her on charges of crimes against humanity related to the 2024 crackdown on student protests. Bangladesh has formally requested her extradition, but New Delhi has so far given no official response.

With Dhaka increasingly aligning with China and Pakistan, and bilateral tensions with India spilling over into trade and migration, the impact of Bangladesh’s foreign policy shifts is no longer confined to the diplomatic realm — it is reshaping the country’s economic landscape.

Trump, Trade, and Tariffs

Since taking office, Yunus has visited 11 countries — including the U.S. and Japan — to secure trade and investment and boost international goodwill. However, his government is still facing headwinds, particularly with the U.S., Bangladesh’s largest export market and biggest foreign investor. Bangladeshi goods currently face a 15 per cent U.S. tariff, with an additional 37 per cent duty temporarily suspended. Negotiating tariff concessions with the Trump administration will thus be one of Yunus’s most significant diplomatic tests.

Meanwhile, talks on a longer-term free trade agreement, initiated in March 2025, remain fragile due to U.S. concerns about Bangladesh’s preparedness for such negotiations in narrowing the C$8.4-billion trade deficit the U.S. held with Bangladesh in 2024. In response, the interim government has moved to finalize a World Trade Organization-compliant trade package that addresses Washington’s concerns over intellectual property rights, labour conditions, and market access. Further, Dhaka has agreed to purchase more U.S. goods like oil, gas, and cotton, and its latest budget eliminated duties on 110 items, removed supplementary duties on nine items, and lowered duties on 442 others.

Strategic Implications for Canada

While Bangladesh’s tariff reductions are aimed primarily at appeasing the Trump administration, tariff concessions on imports, such as crude and refined petroleum, manufacturing equipment, and agricultural machinery parts, will benefit other trading partners, including Canada.

As Bangladesh seeks to diversify its economic partnerships, opportunities are emerging for Canadian exporters and investors. Notably, Yunus has maintained cordial relations with Ottawa, meeting then-prime minister Justin Trudeau in September 2024 and welcoming Canada’s Indo-Pacific Trade Representative, Paul Thoppil, who led a business delegation to Dhaka in May 2025 that included several Canadian firms, including Bell Textron, BlackBerry, Gildan Activewear, and JCM Power.

Also, despite the political instability in Bangladesh, Canada-Bangladesh trade has held steady, with Canadian exports — primarily consisting of potash, cereals, and pulses — totalling C$1.05 billion, and imports — mostly ready-made garments — reaching C$2.2 billion.

Yet according to the International Trade Centre, there is significant unrealized potential in the trade relationship, including at least C$400 million in additional garment exports to Canada, and about C$412 million in potash and C$215 million in lentil exports from Canada to Bangladesh by 2029.

The bilateral relationship is also reinforced by strong people-to-people ties and development co-operation. In February 2025, Canada committed over C$31.4 million to support Rohingya refugees residing in Bangladesh, as well as another C$272.1 million committed the following month for development projects, including those focused on climate resilience and labour rights.

Bangladesh’s Economic Report Card

The nine-month economic report card for the Yunus-led administration indicates progress on key macroeconomic reforms, including lowering inflation, restoring fiscal discipline, maintaining foreign exchange reserves, while also sustaining export momentum through the garment industry and rebuilding institutional confidence by unlocking funding from the IMF and World Bank.

However, deep structural challenges persist —including high youth unemployment, corruption, and sluggish industrial growth — while ongoing political uncertainty continues to discourage investment. According to World Bank estimates, an additional three million people in Bangladesh could be pushed into poverty in 2025 alone. The outlook is equally sobering on GDP growth, which is expected to slow to 3.3 per cent in fiscal year 2024-25. Compounding these challenges is the looming threat of higher U.S. tariffs, which risk further pressuring Bangladesh’s export-dependent economy.

While Yunus has hosted high-profile investment summits, sustaining investor confidence will require more than global outreach — it will hinge on his government’s ability to maintain domestic political stability. Growing unrest over electoral timelines, contentious reforms, and Yunus’s recent suggestion that he might step down early, risk undermining the momentum for reform. Without sustained calm, Yunus’s efforts to build a stable economic base for a smooth transition could be in jeopardy.

- Edited by Vina Nadjibulla, Vice-President Research & Strategy, and Ted Fraser, Senior Editor, APF Canada