If ASEAN were one economy, it would be the sixth largest in the world, and one of the fastest growing.[1] The regional intergovernmental organization and trading bloc comprises Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. As was the case in the 2008 recession, ASEAN is projected to make another impressive recovery going into 2021, with real GDP forecasted to rise by six per cent.[2] The resumption of growth is in one part fuelled by the economic recovery spending and rollout of vaccines by member nations, and in another by their regional integration, co-ordination, and sectoral strengths. In November, ASEAN put forward the ASEAN Comprehensive Recovery Framework (ACRF), which focuses on accelerating digital transformation and achieving sustainability.[3]

For its part, Canada has been eyeing a free trade agreement with ASEAN for years, publishing a joint-feasibility study to assess the possibility.[4] Furthermore, as ASEAN deepens its engagement with Australia, China, Japan, South Korea, and New Zealand through RCEP’s recent entry into force, seizing opportunities will be of particular importance for securing competitive advantages in the region.

Canada’s current outbound investment flow to ASEAN is led by Vietnam, the Philippines and Singapore, respectively, accounting for more than 65 per cent of investment into the bloc. But in the digital, clean energy, and R&D sectors, Singapore dominates in all categories. This case study focuses on opportunities and risks in Singapore’s recovery plan and how the city-state can be used as a bridge to ASEAN’s market.

Singapore’s Budget 2021: “Emerging Together Stronger”

The 2021 “Emerging Together Stronger” budget announced more than C$95B in stimulus and support spending. Half of the budget is allocated to social development and special transfer expenditures, primarily focused on supporting businesses, workers and jobseekers during the crisis.[5] Another 26 per cent is earmarked for economic development, with the focus on moving from “containment to restructuring” to equip “businesses and workers with deep and future-ready capabilities."[6] In this aspect, the government is seeking to support transformation by “helping [businesses] digitalize, adopt new technology, innovate, collaborate and gain access to global markets.”[7] Finally, Budget 2021 unveiled Singapore’s Green Plan 2030. Accordingly, Budget 2021 includes a variety of measures around the digital, clean energy, and R&D sectors.

Budget 2021 leverages a variety of “capital tools to co-fund transformation,” with the primary focus on digital transformation.[8] The new Emerging Technology Programme co-funds the costs of trials and adoption of next-frontier technologies like 5G, AI, and trust technologies.[9] With COVID-19 accelerating the digitization wave worldwide, the program is designed to speed up the commercialization of digital innovation, proactively setting Singaporean businesses up to seize up on global investment opportunities as they arise.[10] This is just one of many programs aiming to speed digital transformation through either co-funding or connecting businesses with strategic advice from consultancies, such as the new CTO-as-Service program for SMEs and the Digital Leaders program. With digitization as a top priority, opportunity is ripe for Canadian companies looking to tap into the market.

Digitization is likewise emphasized as a priority area within the government’s new innovation and R&D measures, which aim to establish Singapore as “Asia’s Silicone Valley.”[11] Singapore’s Open Innovation Platform, established in 2018, matches “problem solvers” (innovative companies) with “problem owners” (sector agencies and Trade Associations and Chambers), co-funding the prototyping and deployment of solutions.[12] Another big-ticket item is the enhancement of the Global Innovation Alliance (GIA). GIA connects businesses with global innovation hubs for co-innovation and market expansion. The program co-funds the costs up to 70 per cent and Budget 2021 promises to expand the network of overseas partners, which could unlock opportunities for engagement with Canadian firms.

Finally, with Green Plan 2030, Singapore has joined the ranks of many other Asia Pacific economies aiming for a “green recovery”.[13] The first goal under the Energy Reset pillar of the plan is to phase out internal combustion vehicles and switch to cleaner energy vehicles by 2040.[14] Toward this end, the government has earmarked C$28 million over the next five years and introduced a host of incentives to encourage the transition.[15] The Energy Reset also aims to increase the use of solar energy fivefold by 2030.[16] To achieve its solar targets, the plan intends to tap into clean energy sources from ASEAN and globally by upping electricity imports.[17] Lastly, the government has announced C$19B of public sector green bonds, which it projects will catalyze “green issuers, capital, and investors to (its) financial centre.”[18]

An overarching principle of the budget, particularly around the business measures, is internationalization. A Double Tax Deduction for Internationalization allows Singaporean businesses a 200 per cent tax deduction on market expansion and investment development expenses, of up to C$142,000 (S$150,000). Furthermore, Heng announced in his budget speech that Singapore would continue to work with ASEAN partners on sustainability and digitization through the ASEAN Smart Cities Network and the Southeast Asia Manufacturing Alliance, with the goal of the latter being to “promote a network of industrial parks to manufacturers who are looking to invest in Singapore and the region.”[19]

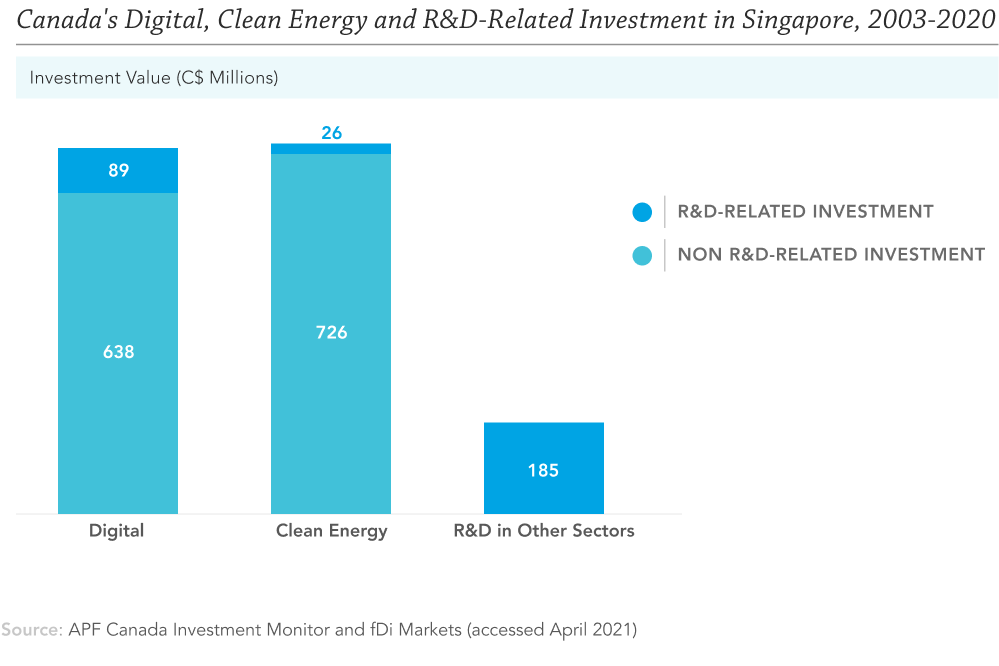

Since 2003, Singapore has been the eighth-largest recipient of Canadian outbound FDI in the Asia Pacific, with C$6.9B invested through 109 deals. Among ASEAN economies, Singapore is the third-largest recipient of Canadian FDI, following Vietnam and the Philippines. But turning to the digital, clean energy, and R&D sectors, Singapore ranks first in outbound investment value among all ASEAN economies. These sectors together represent 24 per cent of Canada’s FDI investments into Singapore. Budget 2021 presents opportunities to further strengthen investment relations with Singapore in these high-growth sectors.

Collectively, Canadian companies have invested C$727M into Singapore’s digital sectors through 37 deals since 2003. In 2020, APF Canada’s Investment Monitor recorded its largest ever Canadian investment in Singapore’s digital sector. Ontario Teacher’s Pension Plan (OTPP) made a C$300M greenfield investment in Princeton Digital Group, one of Asia’s leading data centre companies. In the clean energy sector, there have only been three outbound deals recorded since 2003, but these represent C$752M in value. The largest deal was once again made by OTPP in 2020 through a C$545M greenfield investment in Equis Development Pte Ltd (EDL). EDL develops and operates renewable energy infrastructure in Australia, Japan, and South Korea.[20] Ben Chan, OTPP regional managing director for the Asia-Pacific, said, “We see data centres as a compelling investment opportunity given their essential role in the rapid digitalization and growth of data occurring in Asia and around the world.”[21]

APF Canada also identified seven R&D outbound investments, totalling C$300M. A recent notable deal was Hydro Quebec’s C$46M investment in the opening of a laboratory focused on developing new nanomaterials and nanotechnologies for electric vehicles. This supports Green Plan 2030’s target of transitioning to cleaner energy in transportation. The lab was opened jointly with the Agency for Science, Technology and Research (A*STAR), another government initiative that has been enhanced under Budget 2021. Through the A*STAR Partner Centre at Suzhou Industrial Park, companies can draw on the expertise and advanced facilities of A*STAR before getting their products ready for entry into the Chinese market.[22] This program could provide a launching pad for other Canadian companies looking to do the same.

For its part, the Canadian government has taken notice of the potential and has set up the Southeast Asia Cleantech Canadian Technology Accelerator. The program offers Canadian companies potential investment, partnerships, and guidance to enter the markets of Singapore, Vietnam, Malaysia, and the Philippines.[23] Further, with Canada’s entry into CPTPP alongside Singapore, Canadian companies investing in Singapore will enjoy competitive advantages against non-members. While CPTPP includes four of 10 ASEAN members (Singapore, Brunei, Malaysia, and Vietnam), investing into Singapore can provide Canadian companies with export access to the whole of ASEAN.

Soft Barriers to Investment

Singapore enjoys a strong international business reputation, ranking second among 190 economies for ease of doing business by the World Bank.[24] However, investors should be aware of potential barriers to investment as well. On the human capital front, the government has introduced measures to partially subsidize the cost of recruiting Singaporean workers, to reduce the ratio of Singaporean to foreign workers.[25] Another potential barrier is that of competition with monopolies of government-related enterprises in sectors such as financial services, professional services, media, and telecommunications.[26] Furthermore, in terms of regional reach, companies looking to set up headquarters in Singapore with the goal of establishing subsidiaries in ASEAN nations may face a degree of regional uncertainty in their investments due to ongoing political turmoil in Thailand and Myanmar.

This is an excerpt from the Investment Monitor 2021: Report on Post-COVID Recovery and Foreign Direct Investment Between Canada and the Asia Pacific. For the full report, please click here. For case studies in other economies, please click below:

Endnotes

[1] “Joint Feasibility Study on a Potential Canada-ASEAN Free Trade Agreement.” Global Affairs Canada. Government of Canada, March 4, 2021. https://www.international.gc.ca/trade-commerce/trade-agreements-accords-commerciaux/agr-acc/asean-anase/joint_feasibility-faisabilite_conjointe.aspx?lang=eng.

[2] “ASEAN Economies Poised for Robust Recovery with 6% Real GDP Growth in 2021, Says GlobalData.” GlobalData, February 15, 2021. https://www.globaldata.com/asean-economies-poised-robust-recovery-6-real-gdp-growth-2021-says-globaldata/#:~:text=15%20Feb%202021-,ASEAN%20economies%20poised%20for%20robust%20recovery%20with%206%25%20real,growth%20in%202021%2C%20says%20GlobalData&text=The%20six%20largest%20ASEAN%20nations,GDP%20growth%20rates%20in%202021.

[3] “ASEAN Comprehensive Recovery Framework and Its Implementation Plan.” ASEAN, November 12, 2020. https://asean.org/asean-comprehensive-recovery-framework-implementation-plan/.

[4] “Joint Feasibility Study on a Potential Canada-ASEAN Free Trade Agreement.” Global Affairs Canada. Government of Canada, March 4, 2021. https://www.international.gc.ca/trade-commerce/trade-agreements-accords-commerciaux/agr-acc/asean-anase/joint_feasibility-faisabilite_conjointe.aspx?lang=eng.

[5] Choy, Natalie, Joseph Ricafort, and Tin May Linn. “Singapore Budget 2021: Breakdown of Revenue and Expenditure Estimates.” The Straits Times. The Straits Times, February 17, 2021. https://www.straitstimes.com/multimedia/graphics/2021/02/singapore-budget-revenue-and-spending-breakdown-2021/index.html?shell.

[6] Choy, Natalie, Joseph Ricafort, and Tin May Linn. “Singapore Budget 2021: Breakdown of Revenue and Expenditure Estimates.” The Straits Times. The Straits Times, February 17, 2021. https://www.straitstimes.com/multimedia/graphics/2021/02/singapore-budget-revenue-and-spending-breakdown-2021/index.html?shell.

[7] ”Emerging Stronger Together: Supporting Our Businesses.“ Budget 2021. Government of Singapore, 2021. https://www.mof.gov.sg/docs/librariesprovider3/budget2021/download/pdf/fy2021_business_booklet.pdf

[8] “Emerging Stronger Together.” Budget 2021. Government of Singapore, 2021. https://www.mof.gov.sg/docs/librariesprovider3/budget2021/download/pdf/fy2021_budget_summary.pdf.

[9] “Transforming to Seize Opportunities: Key Budget 2021 Measures to Accelerate Digital Transformation.”

PricewaterhouseCoopers. PricewaterhouseCoopers, 2021. https://www.pwc.com/sg/en/tax/singapore-budget-2021/commentary/transforming-to-seize-opportunities.html.

[10] “Transforming to Seize Opportunities: Key Budget 2021 Measures to Accelerate Digital Transformation.” PricewaterhouseCoopers. PricewaterhouseCoopers, 2021. https://www.pwc.com/sg/en/tax/singapore-budget-2021/commentary/transforming-to-seize-opportunities.html.

[11] “Transforming to Seize Opportunities: Key Budget 2021 Measures to Accelerate Digital Transformation.” PricewaterhouseCoopers. PricewaterhouseCoopers, 2021. https://www.pwc.com/sg/en/tax/singapore-budget-2021/commentary/transforming-to-seize-opportunities.html.

[12] “Open Innovation Platform.” Infocomm Media Development Authority, 2020. https://www.imda.gov.sg/programme-listing/open-innovation-platform.

[13] Choy, Natalie, Joseph Ricafort, and Tin May Linn. “Singapore Budget 2021: Breakdown of Revenue and Expenditure Estimates.” The Straits Times. The Straits Times, February 17, 2021. https://www.straitstimes.com/multimedia/graphics/2021/02/singapore-budget-revenue-and-spending-breakdown-2021/index.html?shell.

[14] “Energy Reset.” Singapore Green Plan 2030. Government of Singapore, 2021. https://www.greenplan.gov.sg/key-focus-areas/energy-reset/

[15] “Budget 2021: Building a Sustainable Singapore,” Government of Singapore, February 17, 2021, http://www.gov.sg/article/budget-2021-building-a-sustainable-singapore.

[16] “Energy Reset,” Singapore Green Plan, 2021, https://www.greenplan.gov.sg/key-focus-areas/energy-reset/.

[17] “Energy Reset.” Singapore Green Plan 2030. Government of Singapore, 2021. https://www.greenplan.gov.sg/key-focus-areas/energy-reset/

[18] “Green Plan 2030.” Budget 2021. Government of Singapore, 2021. https://www.mof.gov.sg/docs/librariesprovider3/budget2021/download/pdf/fy2021_singapore_green_plan_2030.pdf

[19] “Green Plan 2030.” Budget 2021. Government of Singapore, 2021. https://www.mof.gov.sg/docs/librariesprovider3/budget2021/download/pdf/fy2021_singapore_green_plan_2030.pdf ; Eileen Yu, “Singapore Puts Budget Focus on Transformation, Innovation,” ZDNet, February 16, 2021, https://www.zdnet.com/article/singapore-puts-budget-focus-on-transformation-innovation/.

[20] “Equis Announces US$1.25 Billion Capital Raising,” OTPP, November 11, 2020, https://www.otpp.com/news/article/a/equis-announces-us-1-25-billion-capital-raising.

[21] “Ontario Teachers’ Leads US$360M Investment Round into Princeton Digital Group, Asia’s Leading Data Center Company - Ontario Teachers’ Pension Plan,” October 19, 2020, https://www.otpp.com/news/article/a/ontario-teachers-leads-us-360m-investment-round-into-princeton-digital-group-asia-s-leading-data-center-company.

[22] Emerging Stronger Together: Supporting Our Businesses § (2021).

[23] “Southeast Asia Cleantech - Canadian Technology Accelerators,” GAC, October 2, 2020, https://www.tradecommissioner.gc.ca/cta-atc/singapore-singapour.aspx?lang=eng.

[24] “Ease of Doing Business Rankings,” World Bank, 2021, https://www.doingbusiness.org/en/rankings.

[25] ”Singapore: Country Risk” (Import Export Solutions, March 2021), https://import-export.societegenerale.fr/en/country/singapore/country-risk-in-investment.

[26] ”Singapore: Country Risk” (Import Export Solutions, March 2021), https://import-export.societegenerale.fr/en/country/singapore/country-risk-in-investment.