From October 20–23, 2025, top leaders of the Chinese Communist Party (CCP) convened in Beijing for the Fourth Plenum of the 20th Party Congress. This closely watched meeting led to the release of a communique on October 23 and a set of key recommendations on October 28. These documents revealed a preliminary outline of the country’s 15th Five-Year Plan — the blueprint that will guide China’s economic and social development from 2026–30. A full version of the Five-Year Plan is slated for approval at the National People’s Congress in March 2026.

While more policy details will be added to this initial draft, there is a clear sense of continuation of the roadmaps set at the CCP’s recent economic plenary meetings, indicating the ruling cadre’s confidence in its current approach to economic and political governance. The work-in-progress blueprint nonetheless provides glimpses into how China’s top leadership intends to address key economic challenges over the next half-decade, with the expectation that great power competition — particularly China’s geopolitical rift with the U.S. — will be prolonged and intense.

Key Takeaways from the Plenum

- 1. Kicking off an Anti-involution Campaign

The term ‘involution,’ describing excessive internal competition that leads to counter-productive outcomes, first became a buzzword in China around 2021. However, it wasn’t until mid-2024 that the concept was highlighted in top-level policy discussions. The upcoming Five-Year Plan marks the first time policymakers have formally integrated the anti-involution campaign into a document of such importance.

According to the “recommendations,” curbing involution at the industrial level will involve crackdowns on unhealthy competition and price wars, particularly in sectors plagued by overcapacity, such as cement and steel, but also, notably, the country’s poster child in renewable energy — the electric vehicle (EV) sector. In fact, this is the first time since 2011 that China’s Five-Year Plan has omitted the EV sector from its list of strategic industries, highlighting China’s attainment of global leadership but also recognition by the CCP of the need to eliminate damaging saturation in this sector.

One of the main proposals to combat involution is the creation of a ‘unified national market,’ which according to the country’s top economic planner means adopting a uniform set of fundamental institutions and rules (such as protections for property rights, market access and exit procedures, as well as merger and corporate reorganizations) across provinces and cities, while setting high and unified standards to combat monopolies, unfair competition, and unwarranted market interventions by local governments.

The primary goal of this strategy is to address the unco-ordinated development of the ‘New Productive Forces’ sectors — innovation-driven and frontier sectors that the CCP has been championing since 2024, believing these sectors can help transform the country’s economy away from the traditional investment-driven, manufacturing-intensive growth models and towards one featuring high-value chains.

Over the past few years, some local governments have fervently subsidized overlapping ‘cutting-edge’ sectors, regardless of their own specific resource endowment and capability. This has often led not to economic returns, but market fragmentation and regional protectionism. These issues can be traced back to the ‘Made in China 2025’ campaign, during which local bureaucrats felt the urge to pour massive resources into high-tech firms and new industrial clusters, hoping to stand up a few local champions to help bolster both the local economy and their political profiles. Developing nationwide market standards, enforcement rules, and regulations in line with the recommendations will help improve investment efficiency and foster greater complementarity between regional economies.

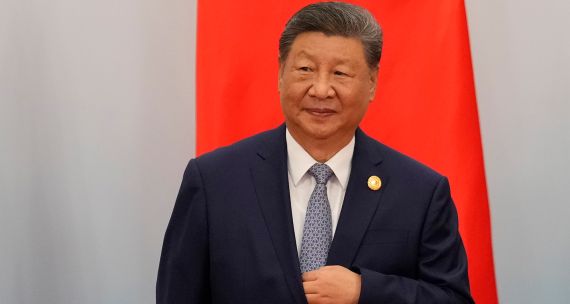

The proposal of a ‘unified national market’ is economically significant to China’s ‘dual circulation’ strategy — a concept spearheaded by Chinese President Xi Jinping since 2020 that aims to expand domestic consumption while maintaining robust international trade and investment.

According to the Fourth Plenum, a primary challenge confronting the Chinese economy in the coming five years is the presence of significant "bottlenecks and obstacles" that impede domestic circulation and contribute to sluggish consumer demand. The unified market plan is therefore intended to alleviate some of these obstacles, which stem from inconsistent market standards and involutional regional competition, thereby bolstering the CCP's objective of expanding domestic demand and fostering dual circulation. However, the communique’s catchphrase of “new supply leads to new demand, and new demand will create new supply” lacked specificity on what supply-side policies are needed for this circulation to become a self-reinforcing virtuous cycle. Observers will be on the lookout for further clues in the full draft of next year’s Five-Year Plan to see what new tools beyond traditional state-led investments will be deployed.

- 2. Self-sufficiency in High-tech Sectors Remains a Major Theme

China’s economic strategy has long prioritized global dominance and self-sufficiency in innovative industries and advanced technologies. In part, in response to export controls imposed mainly by the U.S., Chinese leaders appear to feel an increased urgency to achieve decisive breakthroughs in critical technologies and gain greater dominance over various advanced technologies supply chains. The recommendations committed “nationwide resources mobilization” and “extraordinary measures” to help overcome critical technical hurdles in integrated circuits, industrial machine tools, advanced equipment and materials, basic software, and biomanufacturing. Developing these key mechanical and technical products indigenously, which can be used to manufacture final products such as advanced chips, will be fundamental to China’s goal of building a modern industrial system with minimum external dependence.

Early supporting measures unveiled focus on placing industries at the forefront of innovation. The private sector is expected to increase investment in fundamental research, and it will be supported by additional tax deductions for R&D expenditure, plus increased government procurement for domestically developed innovative products.

The recommendations also highlighted several key emerging and future sectors in which China has made recent (but insufficient) progress. These include artificial intelligence, computing, quantum technology, and aerospace. Notably, “low-altitude economy” was introduced for the first time in a Five-Year Plan. The term encompasses activities fulfilled by drones and flying taxis below 1,000 metres, for commercial or public-service purposes such as tourism, logistics, and emergency response. Despite the fact that Beijing has begun devoting policy support since 2024 to this burgeoning sector, it has had a bumpy start.

One major challenge is that boosting a sector of this nature and achieving broad adoption would require very stringent safety guardrails and trust-building — typically earned through more test flights. While low-altitude test flying isn’t technically banned, these activities, in practice, face many limitations set by regulators. In other words, the industry faces a ‘chicken-and-egg’ dilemma of whether safeguards or experiments should come first. Having a comprehensive ecosystem with domestic parts manufacturing, services, and traffic management, and supporting infrastructure is also crucial.

- 3. Expanding Safety Net to Revive Domestic Demand

For decades, China’s economic growth model has favoured investment and industrial production over household income and consumption. This imbalance has resulted in weak domestic demand, with consumption lingering around 40 per cent of GDP in 2024 — well below the global average of approximately 60 per cent. As external demand for Chinese exports cools, Beijing faces mounting pressure to rebalance its economy towards a consumption-driven growth model. To demonstrate the CCP leaders’ resolve, the recommendations designate “achiev(ing) a notable increase in household consumption as a share of GDP” as part of the first policy objective for the upcoming FYP period. This suggests a shift in goal-setting for economic growth: rather than prioritizing specific GDP growth targets, China will likely quantify and track its progress towards consumption goals.

To “build a robust domestic market” for internal demand, the recommendations proposed measures to increase fiscal spending on public services, strengthen the social security system, and ease household financial burdens to help stimulate consumer spending. Strategies to directly boost consumption include expanding offerings of and spending on service products, cultivating ‘national champion’ brands and tech-integrated goods to appeal to younger consumers, attracting inbound consumption by visitors to China, and clearing up regulatory constraints like restrictions on property and vehicle purchases that have hampered consumer spending.

Dedicating an entire section to social well-being and the continued pursuit of common prosperity, the recommendations vowed to invest heavily in people-centric measures, which will eventually contribute to enhancing its citizens’ power and confidence to spend. To effectively do that, the document emphasized the importance of new economic models that can generate “high quality and sufficient” jobs, particularly for university graduates, migrant workers, and veterans — groups facing the greatest job insecurity in the current downturn.

Additionally, the Plenum highlighted the need for improved income distribution through enhanced mechanisms for minimum wage and collective bargaining. Strengthening social safety nets for the vulnerable populations will also play a significant part in the next five years, with a specific focus on: 1) improving pension and health care for the elderly; 2) enhancing insurance coverage for gig and migrant workers, each of which account for some 20 and 40 per cent of China’s labour force, but often lacking social protections and access to resources; 3) establishing a new model in the real estate sector that ensures adequate housing for people, including increased government-subsidized and other affordable housing options; and 4) alleviating the financial strain from childcare through subsidies and tax deductions for parents.

China’s commitment to boosting domestic consumption through expanded social welfare programs is not a novel concept. While strengthening the social safety net will generally benefit its population, the policies proposed in the recommendations offer largely recycled ideas. Similar and incremental steps, as seen in the past, may fail to significantly alter people’s precautionary saving patterns, keeping the consumption-to-GDP ratio relatively unchanged for the past two decades. Meanwhile, persistent deflationary pressures, sluggish private investment, and local government debt crises continue to weigh on economic growth. Bolder actions to address structural issues — such as recapitalizing local governments, restoring confidence in the property sector, and redistributing income to households — remain largely unelaborated upon. Without concrete implementation plans in these directions, Beijing’s goal of making consumption the primary engine of its economy may prove more rhetorical than achievable.

Conclusion

The first peek at China's next Five-Year Plan, with its emphasis on technological self-reliance and industrial upgrading, signals a more assertive China on the global stage. If next year’s actual Five-Year Plan perpetuates its current emphasis and offers insufficient measures to substantially stimulate consumption, the Chinese economy risks persisting in an imbalance between excess supply and insufficient demand, which will continue to fuel the need to export. Other countries, including Canada, should anticipate a China increasingly focused on economic dominance, fuelled by technological prowess. Mirroring the CCP’s drive in recent years to promote Chinese EVs and batteries in international markets, we could well see producers and authorities ramping up exports of a broader array of products, such as AI models and technologies, once production capacity and quality improve.

If China continues its planned expansion of dominance in critical supply chains beyond rare earths, its ability to restrict these exports could translate into significant leverage to influence economic activities and how it trades (and doesn’t trade) with other countries. The tit-for-tat tariff retaliations and export restrictions that China has deployed multiple times could become more frequent, especially in sectors implicating national security and tech sovereignty. For a Western trading nation like Canada, this reality necessitates a clear-eyed approach to its engagement with China, which will likely continue to be marked by trade conflicts stemming from diverging economic interests and security concerns. The management of these conflicts should remain a priority for policymakers as Ottawa seeks to rebuild a strategic trade relationship with Beijing.

• Edited by Vina Nadjibulla, Vice-President Research & Strategy, and Ted Fraser, Senior Editor, APF Canada.