With the signing of the United States Mexico Canada Agreement (USMCA), the immediate reaction of trade experts was that this clears the way for the Trump administration to pursue its trade war with China. At the same time, the inclusion in the USMCA of an unprecedented new measure – the Article 32.10 clause concerning trade agreements with non-market economies – raises a new hurdle for Canada in advancing its trade diversification program by effectively making a Canada-China free trade agreement hostage to U.S. acceptance. Canada's engagement with the Asia Pacific is threatened on both grounds. For Canada, it is a matter of urgency to do what it can to foster the return of trade peace to the region.

China appears to have been surprised by the sharp escalation of its rivalry with the United States into a full-blown trade war – and also to have initially misread the situation as one it could dispose of by writing a cheque before getting on with business as usual.

Rivalry is not necessarily destructive, especially if channelled into constructive endeavours such as improving economic infrastructure or developing next-generation consumer products. This is, after all, the driving force of markets as well as economic competition between nations. But war by its nature is destructive, even if restricted to trade. If the United States is hell-bent on a trade war for the geopolitical aim of reducing China – which cannot be excluded given the influence of China hawks within the Trump administration – there is nothing that China can do within reason to assuage the United States, as any concession would simply lead to more demands. This is the implication of the requests tabled by the United States in its talks with China – requests that were described as "economically wrong-headed, diplomatically toxic and legally destructive" by none other than the sober and generally pro-American Financial Times.

So China must parry U.S. moves – and it can be taken for granted that it will continue to do so in generally tit-for-tat fashion. It has done this by announcing retaliatory tariffs on US$60B of imports from the United States in response to the United States' latest escalation of imposing tariffs on an additional US$200B worth of imports from China. This will come at some cost to China (and the United States) – and this cost has now been largely committed, even though the bills in terms of damage to trade will keep coming in over the months and years. Unfortunately, this conflict also creates risk to the global trading system. Equally unfortunately, the Trump administration is not one to be reasoned with – this is clear even to the United States' closest trading partners. With China having clearly established its posture, it is now heavily in China's interest to dial back the conflict. This interest is shared by the international community and particularly by those nations with a stake in open transpacific trade, including Canada.

There are several practical options available for China to de-escalate the conflict – options that Canada and others in a position to play honest broker should use their good offices to facilitate. And if China draws the right lessons, and trusts in it its own statements that trade is win-win, the current discord can be harmoniously resolved to the benefit of all. Specifically, China could do the following:

• Engage third parties without geopolitical interests, such as the European Union (EU) and multinational corporations, to identify steps China can take that are constructive and de-escalatory without making concessions to the United States itself; this would be in China's own and the general interest and would not constitute appeasement of aggressive behaviour;

• Adjust its external policy targets, in particular by accelerating the reduction of its external surplus; and

• Contribute to World Trade Organization (WTO) reform by making unilateral concessions on contentious issues as down payments to WTO reform. While these concessions may entail some short-term pain, they are likely to benefit China in the long term.

Alongside these strategic moves to de-escalate the conflict, China could take some unilateral steps to offset the damaging effect of U.S. tariffs. By the same token, this will help build bridges with third parties, which is in China's interest. Moreover, China could read the lesson being taught concerning the value of genuine soft power by the United States' abandonment of it. What economics teaches is that competition is healthy, rivalry is acceptable (within established bounds), war is destructive, and winning is not everything – indeed, winning (which results in monopoly) is bad and is to be resisted. The objective is to stay in the game and to be competitive on terms congenial to everyone.

Tactics

Respond to Requests on Trade from Third Parties

First, China could respond constructively to requests made by parties that are not the United States. For example, EU concerns that are not coloured by the geopolitical objectives of the United States (which are of a win-lose nature) can be considered on their own merit. The EU developed a detailed analysis of China's policies for purposes of administering its trade remedy laws, which address distortions such as dumping and state subsidies, in the EU's international trade. In many areas, the issues raised by the EU (dealing with discriminatory internal policies, state-owned enterprises, subsidies, and intellectual property practices) overlap with U.S. demands. So China can de-escalate the conflict with the United States by working with the EU to shrink this list, without any culturally damaging loss of face.

Similarly, China could respond constructively to the concerns of multinational firms active in China. These subsidiaries are de facto Chinese establishments, contributing to the Chinese economy, and are there for the long haul, drawn by the prospects for economic gain (e.g., IBM, 2018). Insofar as there is an unlevel playing field for foreign firms established in China competing with Chinese state-owned enterprises, it is within China's regulatory power and in its own interest (from the perspective of promoting healthy competition in its own economy) to make appropriate reforms. Again, U.S. demands in many cases overlap with those of multinational firms; consulting with the firms and addressing their concerns can de-escalate the conflict with the United States indirectly without any loss of face.

Reduce Current Account Balances

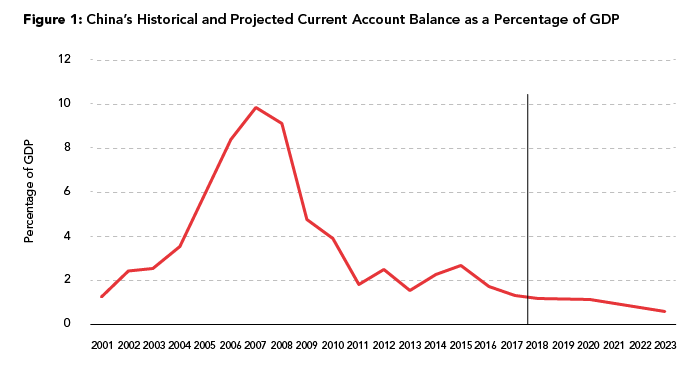

Second, after allowing its current account surplus to soar to 10 percent of gross domestic product (GDP) in 2007, China has managed its current account balance so as to hold at a surplus of about 2 percent of its GDP in recent years (Figure 1). Maintaining a small surplus is not imprudent for a developing country, given the risk of destabilization that these countries run when they become dependent on foreign capital. However, China has amassed sufficient reserves and has only a leaky rather than totally uncontrolled regime for international capital flows and should not be at risk of a destabilizing episode of capital flight.

Based on the latest projections of the International Monetary Fund, China aims to reduce its current account surplus gradually to 0.6 percent of GDP by 2023; this target should be accelerated and deepened to zero. This would not be imprudent, would be beneficial for Chinese consumers, and would help support the global economy at a time of potential instability. For example, investment is slowing because of uncertainty about the future trade climate; China has an abundance of needed investments that do not depend on that climate and so is in a position to provide that stimulus and concurrently wind down its external surplus.

Source: International Monetary Fund. Note: The “current account” captures all cross-border transactions, including trade in goods and services, investment income and payments, licence fees and royalty payments, and transfer payments; it is the broadest measure of the balance in a country’s international commercial transaction in a calendar year.

Accelerating the reduction of the current account surplus can be done in three complementary ways that avoid disruption to either China's own economy or of the economies of its trading partners:

• The Chinese government should lean against market pressures to lower the value of its currency (the yuan): markets are pushing down on the yuan due to the damaging effects of U.S. tariffs. China has been resisting the decline and should continue to do so, since this will, in principle, support the reduction of its external surplus.

• Channel the domestic savings surplus into investments targeting China's pressing needs, including cleaning up its environment. Fiscal activism will be necessary for China to weather the pressure on its exports in any event; China can turn this to advantage through an accelerated investment program on pressing needs such as environmental protection.

• Unilateral liberalization on a most-favoured nation status will likely contribute to a reduction in China's external surplus, while boosting Chinese exports and thus countering the restrictive effect of U.S. tariffs. One channel through which this effect works is the exchange rate – more imports reduce the international surplus and result in a lower currency valuation. Another channel is the increase in intermediate imports, which would make China's production more efficient and thus also increase the competitiveness of China's exports. China's reduction of its import tax on autos to 15 percent from 25 percent, even as it applied a retaliatory tax of 25 percent to imports from the United States, is a good example of a measure that China can take to attenuate the damaging effect of U.S. tariffs.

Undertake WTO Reforms: Special and Differential Treatment, Over-capacity, and Subsidies/State-Owned Enterprises

Third, China could constructively engage in discussions on the WTO reforms proposed by both the European Commission and Canada. In doing so, China can assist Canada and the EU to stave off a looming crisis in the WTO, which is spawned by the U.S. refusal to consent to the appointment of new members to the WTO Appellate Body, a key mechanism of the WTO dispute settlement system.

China should consider discussing reform in three areas, as proposed by Canada and the European Union: 1) the need to limit access to special and differential treatment provisions for more advanced developing countries that should be fully complying with WTO rules; 2) the issue of over-capacity in heavy industries, which has been handled (ineffectually) outside of the WTO; and 3) the impact of subsidies on export competition.

Developing Countries and WTO Rules

WTO rules allow developing countries not to comply with the full set of disciplines that developed countries assume. These so-called "special and differential" provisions, which give developing countries special rights, cover many countries that many believe should be treated like developed countries. China is one of those countries. The part of China that interacts with the rest of the world is clearly developed and indeed technologically pushing the frontier in many sectors. The fact that there is a hinterland that remains in developing-country mode is an issue for China's domestic policy. China should, accordingly, unilaterally rescind its WTO rights to special and differential treatment and accept the full set of developed-country obligations.

Over-capacity in Some Industries

A number of sectors, notably steel, have featured excess production capacity. Although this issue is arguably overblown as an excuse for unilateral protectionism, China itself has already recognized the need to eliminate capacity in so-called "zombie" companies, consolidating production in more efficient and environmentally cleaner facilities, while reducing overall capacity. China has been temporizing, however, because of the domestic adjustment challenge in terms of transient unemployment and impact on local communities.

With the current U.S. tariffs, which are likely to negatively affect China's economy, the need to close down inefficient plants is more pressing than in the past. If China pursues adjustments in these sectors, it would no longer need to export its adjustment pressures in these sectors to other countries. As a result, frictions between China and its trading parties will be attenuated.

Subsidies and China's State-Led Development Model

The issue of subsidies is a source of controversy between China and other WTO members. Tackling this issue is extraordinarily complex because it juxtaposes two contradictory visions of economic development. In China, state subsidies are woven into the fabric of China's state-led socioeconomic model, which stipulates state intervention in industrial policy. This contrasts with the economic model that (very broadly) characterizes economic governance in the advanced Organisation for Economic Co-operation and Development (OECD) economies, which restricts the state's role in industrial policy.

To move beyond these intractable ideological issues, China can constructively engage the EU in a dialogue over the net benefits of industry subsidies. In December 2016, China submitted a request for a WTO panel to review the EU Trade Remedy Laws, which define China as a non-market economy and allow for special duties on Chinese goods imported into the EU. China should use this panel process, which can provide an objective review of China's legal position within the commitments it made in entering the WTO, to initiate a dialogue focused on economic outcomes, rather than contradicting political principles.

In the first instance, this consultation could start with a transparency exercise in which China discloses its subsidies and enables an analysis of the net effective benefit by industry. This exercise will likely find that pervasive subsidies cancel each other out in terms of providing any industry an export advantage – subsidies to one industry loom large in industry-specific analyses, but pervasive subsidies across all industries largely cancel each other out, in the sense that trying to advantage all ends up advantaging none. However, that remains to be determined and the numbers should be allowed to speak. By engaging in the transparency exercise on subsidies, China can shift the discussion from socialist versus capitalist principles, a discussion that is inherently irreconcilable, to one based on economic science, which is tractable. Such a discussion would be congenial for de-escalation in the conflict between China and OECD countries.

By engaging in this review, China can not only accomplish de-escalation with OECD countries, but also contribute to its own economic development. First, it can help the Chinese policy-makers to make informed decisions on which industries benefit from subsidies and which are handicapped by them. Second, by reframing its industrial policy from one based on political principles (e.g., socialist development) to one based on economic principles, China can better sort out the role of the state and private sector more broadly on the basis of the risk-return metrics of investment. We can consider three specific elements that enter into this calculation. If investment risk is quantifiable, and returns to investment could be appropriated by investors without spillover to third parties and within a sufficiently short time frame, then investment should be undertaken by the private sector. In sectors that do not meet these criteria, however, public investment will be required. As China is contemplating the next stage of the evolution of its economy – from its recently attained "newly industrialized economy" status to a fully developed economy – this would be a good time to advance its policy framework.

How Can Canada Help, and Why Canada?

It is a cliché to state that China plays the "long game." In framing its "peaceful rise" narrative, it sought to allay other countries' concerns regarding its comportment once it had risen. The pushback that China is now getting from the United States reflects in part that China lost sight of that posture. One consequence is a growing trade war that promises to inflict damage on the parties and on the global economy more generally (even if third parties will profit at the margin at both China's and the United States' expense through trade diversion). In many respects, this can turn out to be a good thing, if China draws the right lessons from it.

The strategies outlined above, such as responding to third-party concerns on trade, reducing its external surplus, and making down payments on WTO reforms, all fall into the "no regrets" category – they are useful to follow even if there were no trade war with the United States. The rationale for singling out these strategies is that they allow de-escalation without making overt concessions in response to power plays. Further, they are couched in terms of moving Chinese policies within familiar space.

As to how Canada can help, first, it can engage China on the same terms it is engaging the United States – seeking a positive win-win trade arrangement on a progressive trade agreement. China and Canada have long been talking about a free trade agreement. Now may be the time to launch that negotiation in a serious fashion with a minimum objective of identifying realistic compromise. The conclusion of the negotiations on the USMCA has created a new requirement for the parties to that agreement to consult with one another on trade negotiations and agreements with non-market economies, which has been interpreted in Canada as a loss of Canadian sovereignty in conducting its external trade relations. By initiating talks with China, Canada would be signalling its preparedness to fully exercise its sovereign rights – and characterizing the USMCA measures as addressing commercial matters rather than political alliances. This would be consistent with the Canadian government's indication that it would indeed be pursuing deeper trade links with China. At the same time, by working within the consultation framework of the USMCA, Canada would be situating itself as a go-between for China and the United States.

Second, Canada has now issued its own WTO reform discussion paper. It would make eminent sense to take this discussion to Beijing as soon as possible to identify points on which China could realistically move, but that also address the concerns of the wider trading community.

Third, Canada should consider requesting consultations with both the United States and China at the WTO on grounds that their trade war is impairing Canada's benefits under the WTO. Since other countries could join in, this would create a multilateral forum in which the warring parties could come together to discuss a ceasefire and restoration of trade peace.

It is in Canada's interest to de-escalate trade tensions across the Pacific and to find a workable modus vivendi with both the United States and China. Canada is by all accounts the last one standing firm in the face of the Trump administration's pressure tactics, negotiating in good faith, and holding out for a good deal. And Canada has a long history with China as an honest broker. For China, which was one of the first countries to try to appease Trump through economic concessions only to find out that that did not work, that has to count for something.