At this economic symposium on October 21, 2025, the fifth such event organized by the York Centre for Asian Research’s (YCAR) Canada-ASEAN Initiatives program, Canadian and Southeast Asian participants shared their perceptions of how tariff turbulence is incentivizing Canada and the Association of Southeast Asian Nations (ASEAN) to intensify their economic ties, but also how the two sides face practical challenges in translating those intensions into meaningful outcomes.

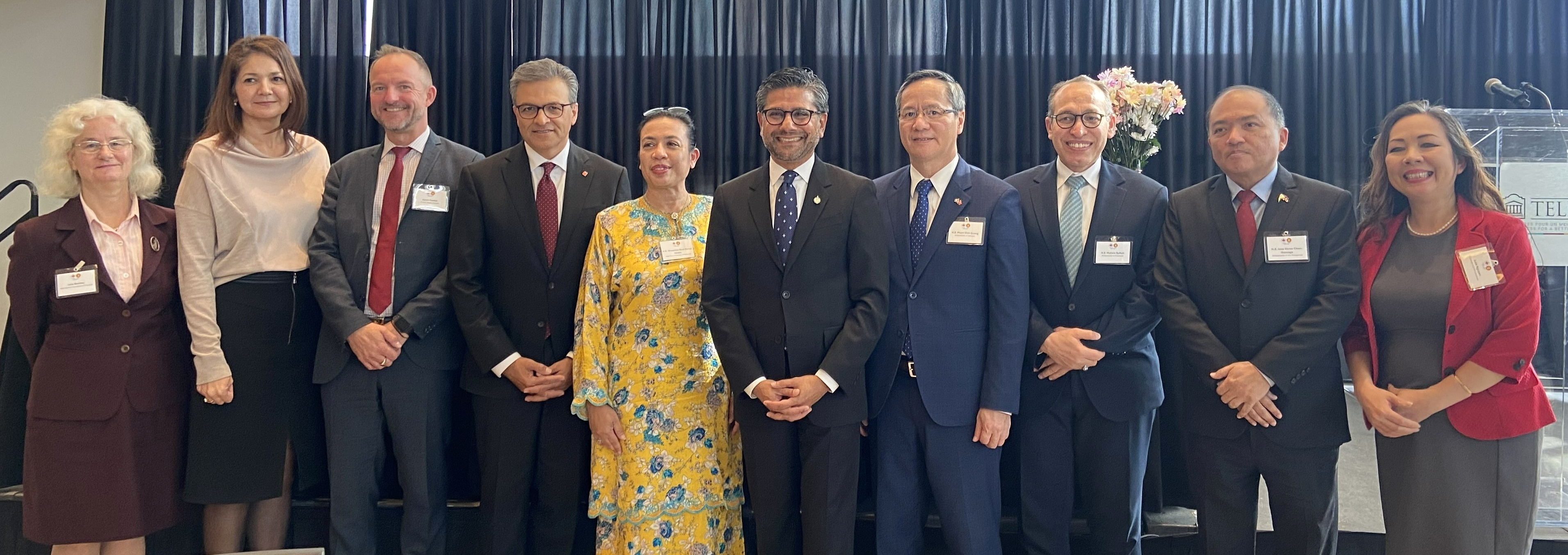

The symposium was hosted in Ottawa by the University of Ottawa’s Telfer Management School, with support from the ASEAN Committee of Ottawa (currently chaired by Vietnam) and the Asia Pacific Foundation of Canada. It brought together stakeholders from the Canadian federal government and the diplomatic, business, and academic communities. They included Global Affairs Canada’s Chief Trade Negotiator, Aaron Fowler; Goldy Hyder, President and CEO of the Business Council of Canada; and the ambassadors of Indonesia, Malaysia, the Philippines, and Vietnam. Remarks by Yasir Naqvi, Parliamentary Secretary to the Minister for International Trade, and by Senator Yuen Pao Woo, provided parliamentary perspectives on Canada’s engagement with Southeast Asia.

These discussions took place in Ottawa less than a week before the 14th ASEAN Summit in Malaysia and coincided with Mark Carney’s inaugural trip to Asia as prime minister. Participants emphasized their shared concerns about increasing trade protectionism, fragmentation of the rules-based international order and global instability, and the importance of diversification to fill the vacuum created by the U.S.’s retreat from international engagement.

These discussions took place in Ottawa less than a week before the 14th ASEAN Summit in Malaysia and coincided with Mark Carney’s inaugural trip to Asia as prime minister. Participants emphasized their shared concerns about increasing trade protectionism, fragmentation of the rules-based international order and global instability, and the importance of diversification to fill the vacuum created by the U.S.’s retreat from international engagement.

Highlights from the discussions are summarized below.

Insights from Canadian Businesses

Speakers from the Business Council of Canada, Canadian Manufacturers and Exporters, and the Canadian Chamber of Commerce suggested ways to intensify Canada’s trade with ASEAN, including the need for Canada to pursue an interest-based rather than value-based foreign policy. Other recommendations include:

Stabilize relations with the U.S. Canada needs to remind Washington that the U.S., Canada, and Mexico together constitute a winning team. This stabilization is key to attracting capital from Asian investors who have indicated that if the Canada-US-Mexico Agreement (CUSMA) is not renewed, they will likely invest in the U.S. rather than Canada.

Strengthen Canada’s economy from within. This means dismantling interprovincial trade barriers; adopting a competitive tax regime, including adjusting corporate tax rates; and addressing challenges in the Canadian immigration and higher education systems. Canadian Manufacturers and Exporters, in advocating for a better business environment and better training to improve efficiency, view the recent tariff turbulence as distracting from the pressing long-term need to address workforce issues and productivity. Without these improvements, hiring and investment will stall.

Participants were reminded that many in Asia need convincing that Canada will be a reliable trade and investment partner, especially if it is not building the kind of infrastructure needed to facilitate trade, including port and rail expansions and national pipelines. Speakers from the business sector underscored that it is within Canada’s control to build this infrastructure, improve its competitiveness, and capitalize on the country’s energy reserves.

Diversify trade and investment to reduce exposure to the U.S. Regardless of what happens with CUSMA, tariffs are likely to remain for the foreseeable future. Canada should use its middle power influence to help build a multipolar world through its energy resources and infrastructure.

Effective utilization of the forthcoming ASEAN-Canada Free Trade Agreement (ACAFTA) will help catalyze more robust economic ties, but benefiting from this Agreement will depend on the private sector leveraging it. Technology, infrastructure, and financial services were identified as low-hanging fruit for greater economic Canada-ASEAN engagement. Size and scale are needed to compete in Asia; hence, it is important that major Canadian corporations take the lead, in contrast to Canadian government efforts to boost Indo-Pacific engagement by small and medium enterprises.

Effective utilization of the forthcoming ASEAN-Canada Free Trade Agreement (ACAFTA) will help catalyze more robust economic ties, but benefiting from this Agreement will depend on the private sector leveraging it. Technology, infrastructure, and financial services were identified as low-hanging fruit for greater economic Canada-ASEAN engagement. Size and scale are needed to compete in Asia; hence, it is important that major Canadian corporations take the lead, in contrast to Canadian government efforts to boost Indo-Pacific engagement by small and medium enterprises.

U.S. tariffs make North American manufacturing less competitive globally, requiring tough policy decisions by the Government of Canada. The competitiveness of ASEAN economies makes them attractive for long-term partnerships with Canadian companies willing to look beyond short-term “extractive” transactions, for example, in building supply chains to reduce tariff exposure, and collaboration in skills development, technology transfer, and digital adoption.

Finally, it was mentioned that during Canada’s G7 presidency, the Canadian Chamber of Commerce participated in the B7 business grouping to advance industry priorities. It now aims to broaden the B7’s membership to the Indo-Pacific, including ASEAN. Bilateral Canadian chambers of commerce in Asia were described as playing a vital role in intensifying economic ties and advocating for private sector priorities, including during trade negotiations, and encouraging full utilization of existing trade arrangements. There is now an effort to co-ordinate Canadian chambers across the Indo-Pacific, which have to date functioned largely in a decentralized fashion.

What’s Next for Canadian Trade Policy in ASEAN?

As participants acknowledged, the current multilateral trading system has been unable to discipline non-market economies in their efforts to dominate certain supply chains. ASEAN is thus an important partner for Canada, especially given its reliability, potential for economic growth, and commitment to the rules-based international order.

This partnership can benefit from several current and future agreements. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) was described as Canada’s flagship Indo-Pacific trade agreement and central to Canada’s trade diversification efforts. The CPTPP, in the five years since its ratification, has resulted in a 38 per cent increase in Canada’s trade with CPTPP member economies. A general review of the operation of the Agreement is being undertaken to enhance the CPTPP and expand its membership.

The Canada-Indonesia Comprehensive Economic Partnership Agreement (CEPA), signed in September 2025, is also promising. Notably, for the first time, this Agreement provides for Canadian development assistance for capacity building. This is part of a shift of Canadian aid to support economic co-operation by strengthening the capacity of trading partners to implement the Agreement while promoting inclusive and sustainable economic growth.

Concluding the ACAFTA, as anticipated in 2026, will require flexibility and pragmatism on both sides. Some challenges include the diversity of economies within ASEAN, the capacity of companies to utilize ACAFTA’s commercial potential, and the perception by some in Southeast Asia that the progressive elements of the Canadian government’s trade agenda may impede the ACAFTA’s timely conclusion.

The recent Canada-ASEAN Economic Ministers Consultation in Kuala Lumpur, Malaysia, on September 26, was described as a “joint therapy session” in which participants shared their woes of being mistreated by the U.S. and having to adjust quickly to shifting geo-economic dynamics. At the same time, the Consultation served as a reminder that Canada and ASEAN can and should engage with each other by consistently supporting the rules-based international trading system and avoiding protectionism, including through the pursuit of bilateral and regional trade agreements such as the CEPA and ACAFTA.

Southeast Asian Perspectives on Navigating Uncertainty and Building a Stable Future

The ambassadors from Indonesia, Malaysia, the Philippines, and Vietnam noted the need to adapt to shifting geopolitics, emphasizing that ASEAN pursues pragmatism in dealing with tariffs and avoids retaliation. They agreed that the key to intensifying Canada-ASEAN economic ties is not market access but market penetration; for ACAFTA to succeed, governments must improve logistics and trade facilitation and increase the private sector’s trade literacy and awareness of provisions such as certification procedures.

The Canada-Indonesia CEPA is the first bilateral trade agreement between Canada and an ASEAN country. An important next step is for both sides to accelerate ratification and translate the legal text into action. This would send an important signal to the business community and provide an operational framework for the private sector. Promoting CEPA implementation requires the active involvement of the business community, universities, think tanks, and trade unions, for example, through workshops and capacity building to help Indonesian companies meet standards that will facilitate their access to global markets. Indonesia’s experience negotiating this Agreement can also serve as a strategic bridge towards the conclusion of the ACAFTA.

Malaysia’s experience as a member of the CPTPP suggests that the CPTPP is not the answer to all commercial aspirations: government can facilitate utilization of trade agreements, but ultimately each business decides whether to capitalize on them – currently the utilization rate of the CPTPP is 25 per cent. In addition, four ASEAN members are also members of the CPTPP, which already facilitates their trade with Canada; therefore, the ACAFTA will open more doors for ASEAN members who are not already CPTPP members.

One of ASEAN’s priorities under Malaysia’s chairmanship is regional digital trade integration. ASEAN’s digital economy framework agreement, to be concluded in 2026, is intended to foster cross-border digital integration and interoperability, for example, by standardizing trade rules and customs documentation. The anticipated regional digital ecosystem benefiting ASEAN and its partners may offer prospects for intensifying Canada’s digital trade with ASEAN. Following Malaysia’s chairmanship of ASEAN in 2025, the Philippines has identified its priorities as the chair for 2026: resilience (protecting economies and leveraging resources for the greater good), adaptation and innovation (including to digital transformation), and inclusivity and sustainability (with attention to women and micro, small, and medium enterprises, green investment, environmental stewardship, and digital economies).

The participants noted that one hurdle to greater ASEAN-Canada economic engagement is the information asymmetry between the two: while Canadian companies may be familiar within ASEAN, the reverse is not necessarily true. Participants also noted that for Canadian companies to succeed in Southeast Asia, they need to build lasting relationships rather than simply focusing on selling goods and services. Companies in Malaysia, Indonesia, and Vietnam, for example, have demonstrated their capacity to be reliable partners for Canadian companies in electronics supply chains, such as by building semiconductors in Southeast Asia for the Canadian aerospace industry.

The participants noted that one hurdle to greater ASEAN-Canada economic engagement is the information asymmetry between the two: while Canadian companies may be familiar within ASEAN, the reverse is not necessarily true. Participants also noted that for Canadian companies to succeed in Southeast Asia, they need to build lasting relationships rather than simply focusing on selling goods and services. Companies in Malaysia, Indonesia, and Vietnam, for example, have demonstrated their capacity to be reliable partners for Canadian companies in electronics supply chains, such as by building semiconductors in Southeast Asia for the Canadian aerospace industry.

Participants noted that ASEAN has favourable conditions for attracting investment, such as from Canadian pension funds. However, reciprocal conditions are needed to attract Asian investment to Canada, since “capital goes where capital grows.” One participant from the Canadian business community urged ASEAN governments and companies to be clear about what they need from Canada in terms of competitive policies, foreign investment frameworks, energy and transportation infrastructure, technology, immigration, and higher education, adding that such voices can be persuasive in terms of leveraging Canadian capabilities.

Rethinking Strategic Autonomy in Canada’s Foreign and International Economic Policy

Canadian speakers shared thought-provoking impressions gathered from their respective counterparts in ASEAN. These include:

Claiming ‘mindshare’ for Canada among elites and the public in Southeast Asia remains a challenge. Canada’s visibility in Southeast Asia has increased since the launch of the Indo-Pacific Strategy (IPS) in 2022; however, there are many suitors from around the world competing for ASEAN’s attention. Moreover, Canada’s IPS is viewed in the region as a lightweight version of the U.S. strategy, particularly its framing of China as a disruptive power. For Canada, intensifying its ASEAN ties is fundamentally about rethinking strategic autonomy in Canada’s foreign policy.

The IPS has resonated most strongly in the economic and business sphere, with considerably less interest in security and defence engagement with Canada. Early ‘wins’ in strengthening economic ties are necessary to prevent both sides from losing interest.

Crucial Takeaways from the Symposium

The insightful comments of high-calibre speakers and lively discussion at the symposium left participants with a crucial takeaway: now is the time for Canada to strategically strengthen its trade and relationship-building efforts with ASEAN in response to growing tariff and supply chain disruptions. The pressing question is whether Canada can seize this moment to act decisively and leverage the shifting dynamics of the global economic order.

Author Julia G. Bentley is a Distinguished Fellow with the Asia Pacific Foundation of Canada and an External Research Associate of the York Centre for Asian Research. She produced this summary in consultation with Julie Nguyen, Chair of the Canada-ASEAN Initiatives at York University, with whom she co-organized the Symposium. Ms. Bentley also served as a moderator and gave closing remarks at the Symposium.