For over three years, our University of Toronto team has been looking closely at Canadian companies that have established themselves in Asia, and the location of over 600 companies and organizations are now recorded on our interactive CanAsia Map (viewable online here). The interesting story behind this map is that it is small and medium-sized enterprises (SMEs) and services-related firms that comprise the majority of these Asia locations. Which tells us that even small Canadian companies can go global quickly in response to the pull of Asia’s burgeoning markets.

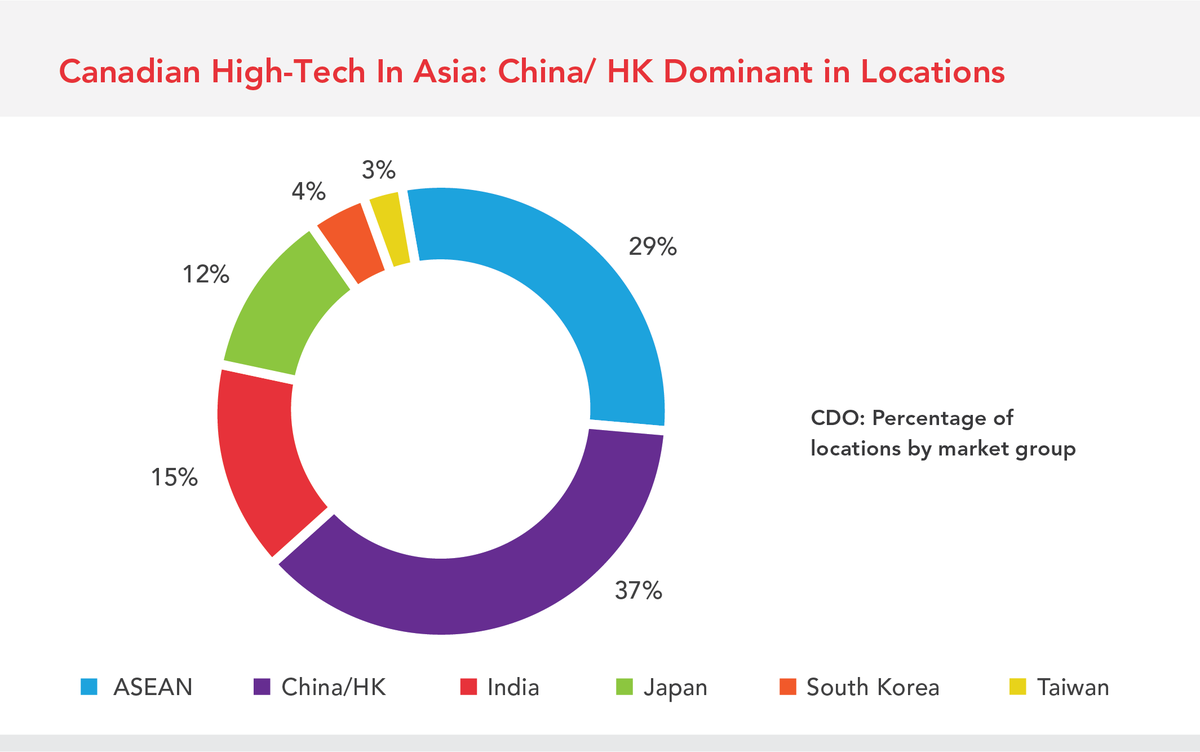

As part of our Innovation Policy Lab research for the University of Toronto’s Munk School of Global Affairs’ Creating Digital Opportunity (CDO) project, our team looked at Canadian high-tech companies in Asia, in particular the “micro-multinationals,” or companies that apart from Asia have locations in either the U.S. or Europe, or both. The CDO dataset of Canadian high-tech companies consists of 199 companies that have locations in Asia; the micro-multinational dataset consists of 120 companies. Below, you can see the geographical location of these Canadian high-tech firms.

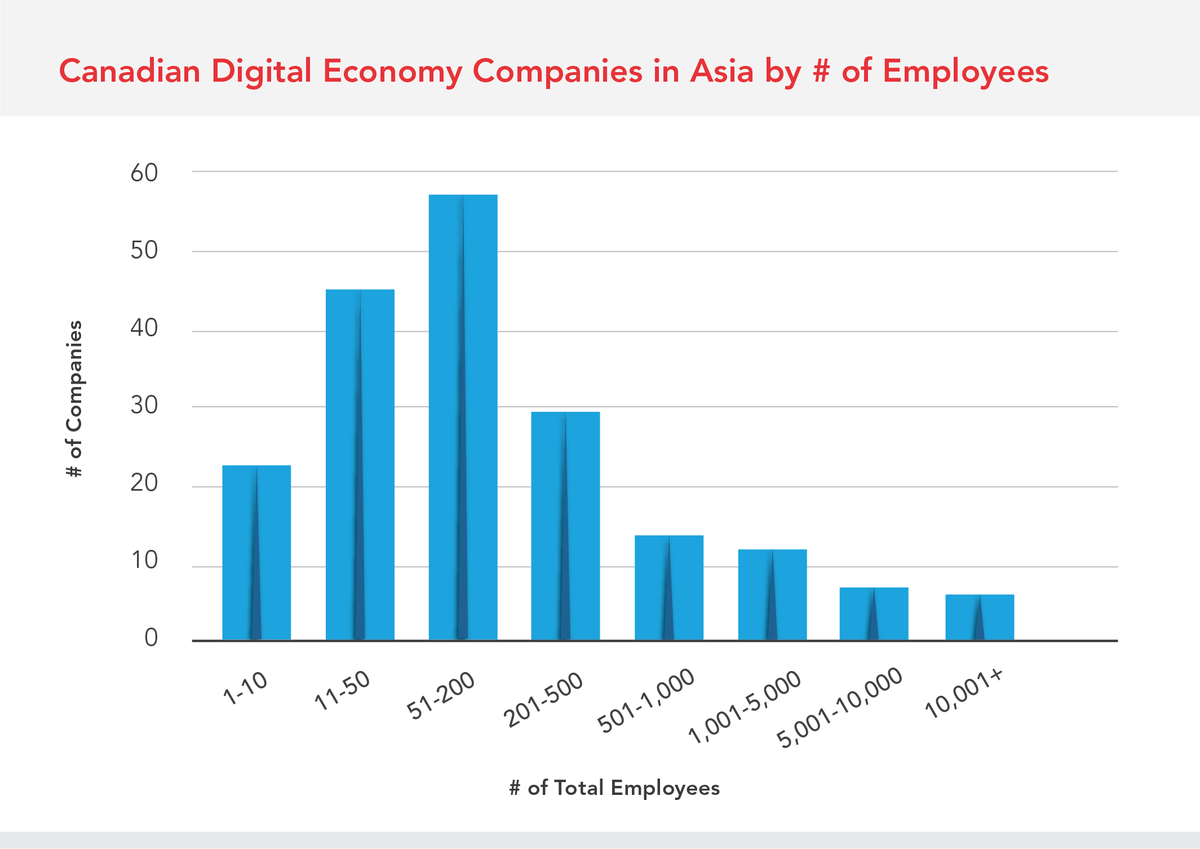

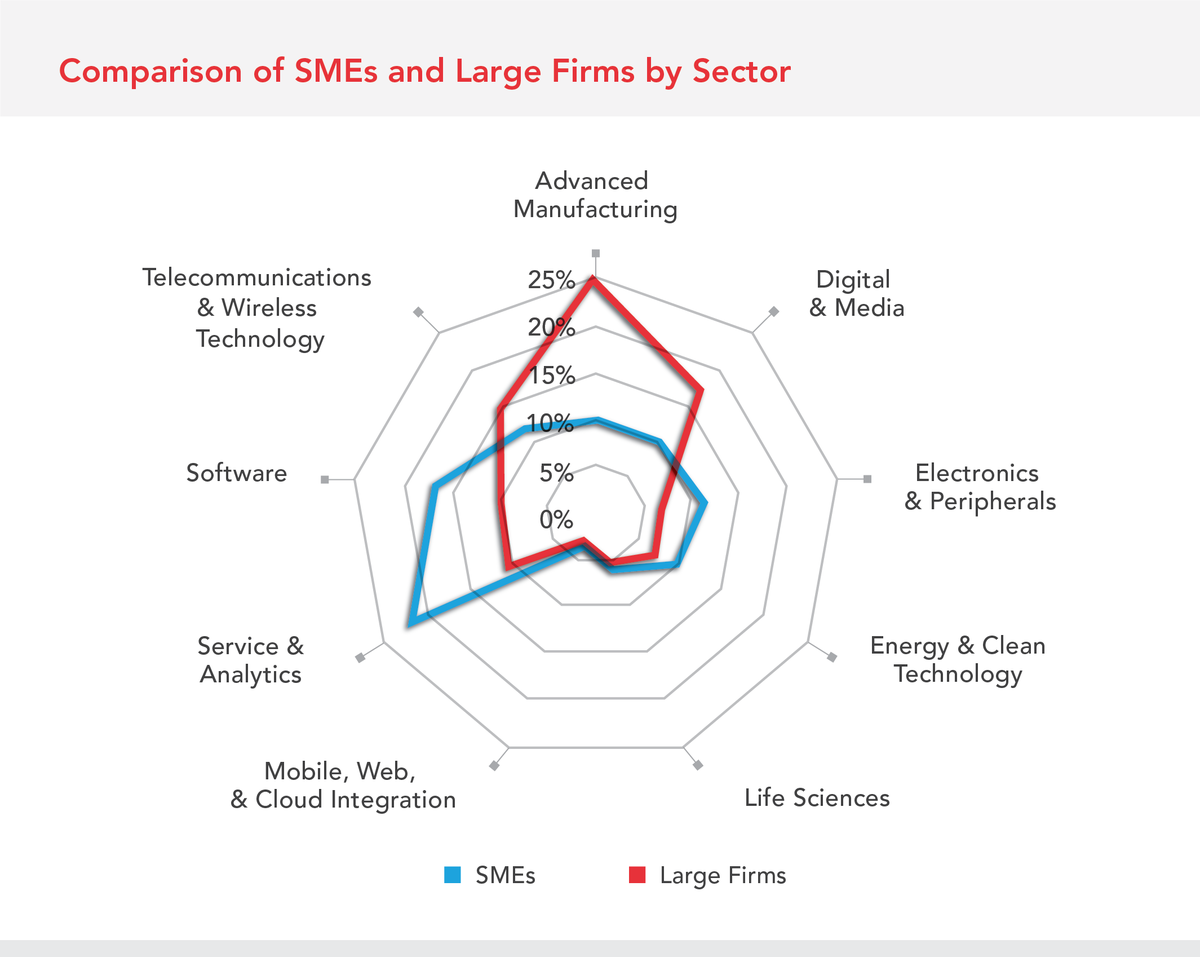

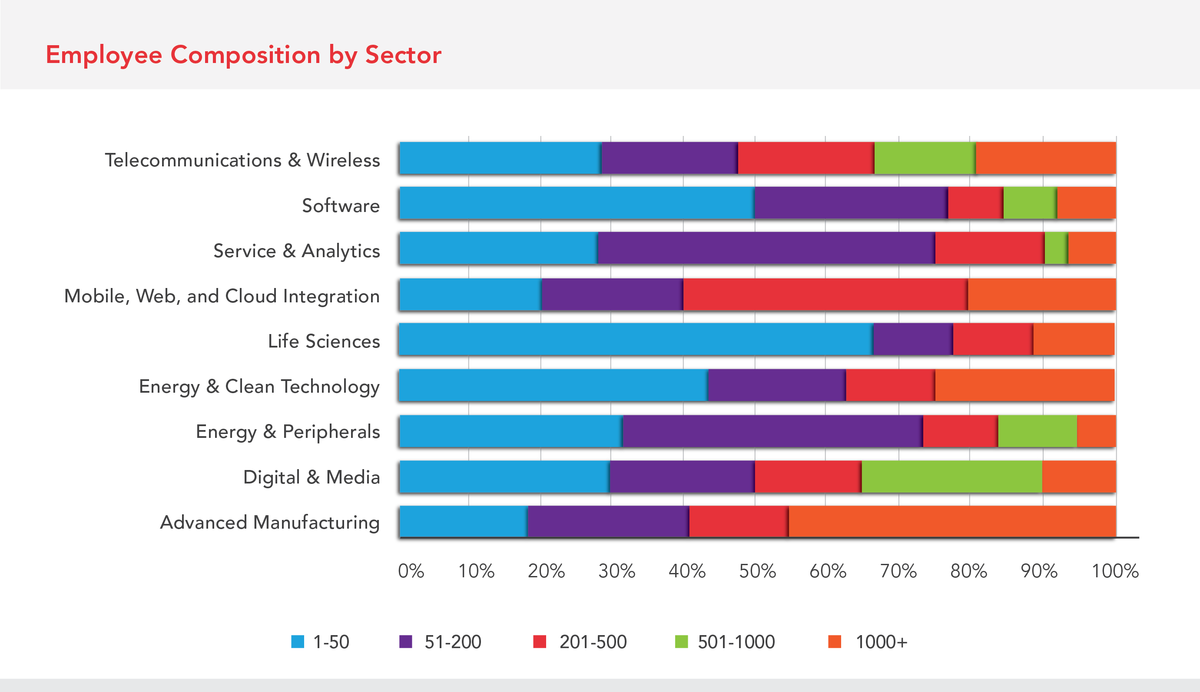

Categorization by size was done by drawing a distinction between large firms – those with greater than 500 employees – and small and medium enterprises (SMEs) – firms with employees less than or equal to 500 employees.The 199 firms in the CDO dataset consist of 48 large firms and 151 SMEs. This graph indicates the breakdown by sector in Asia for the entire CDO dataset. SMEs are an important part of this study – approximately three quarters of the companies in the CDO dataset have 1-to-500 employees. The SMEs in the CDO dataset have over 13,000 employees in total across all of their global locations.

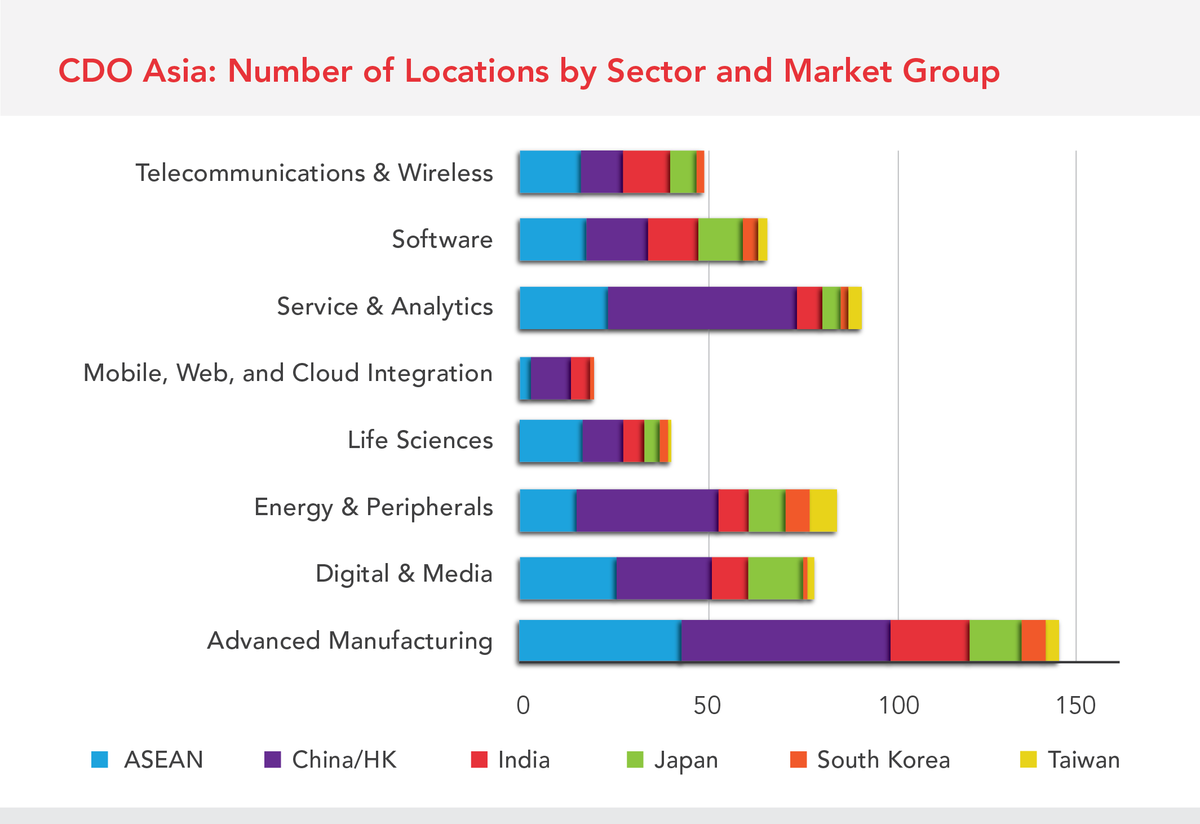

The graph below shows the locations of Canadian high-tech companies in Asia. Note that advanced manufacturing has the largest number of locations.

However, there is no doubt that services-oriented firms predominate. Also note that China/HK, followed by ASEAN, are the markets of choice for locations.

The graph above demonstrates the differences in sector concentration between large firms and SMEs, by comparing the number of companies in that sector as a percentage of the overall CDO dataset. Our findings indicate that larger firms tend to be more concentrated in the advanced manufacturing and digital and media sectors compared to SMEs, which are more concentrated in the software, and services and analytics sectors.

Trends Across Industries

The Canadian high-tech firms (CDO) located in Asia are heavily weighted towards the services sector, especially SMEs, but with a higher percentage of large firms in the advanced manufacturing, telecommunications, and the digital and media sectors. SMEs lead in the software, life sciences, and services and analytics sectors.

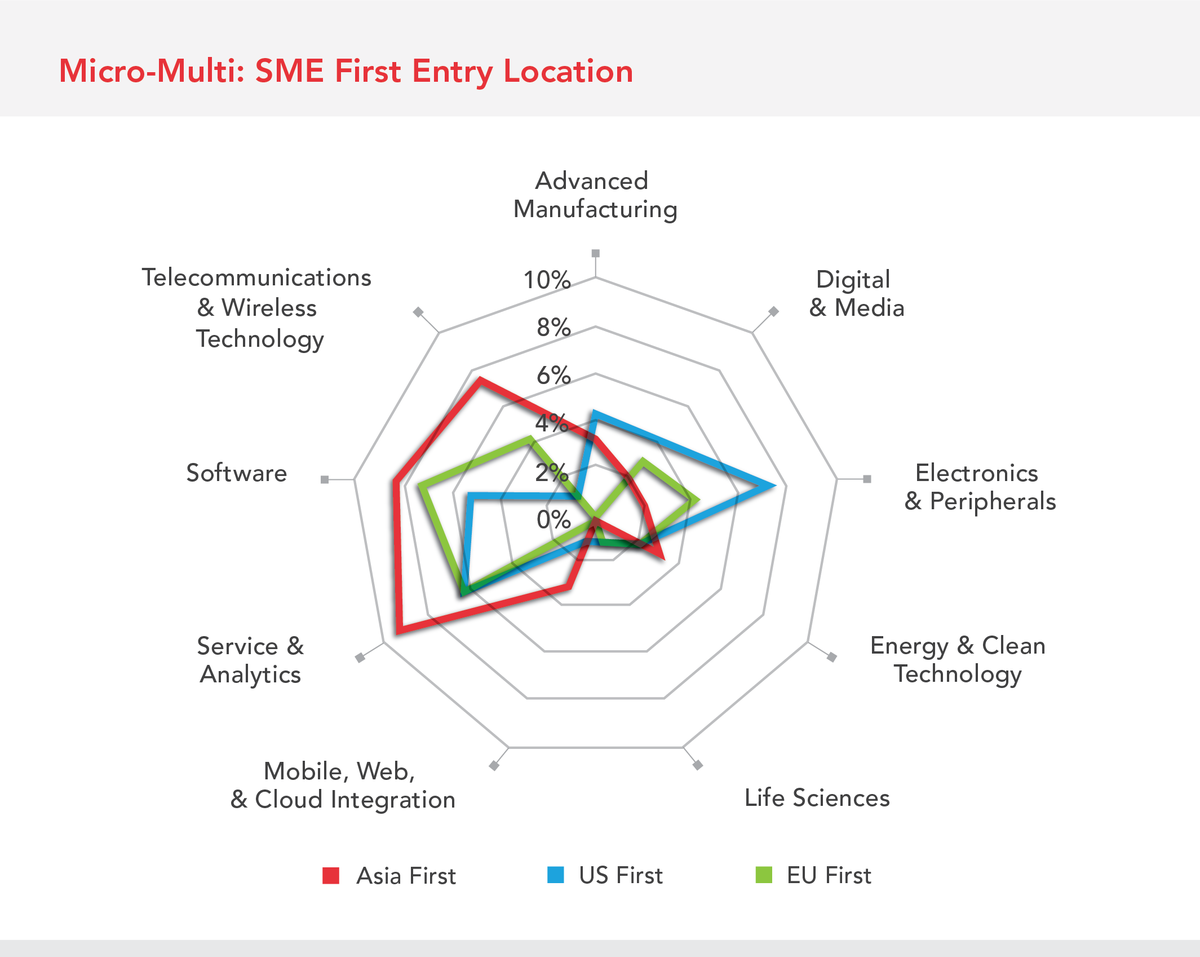

Among the firms located in Asia, we compare first entry locations of large firms and SMEs. For SMEs, Asia is by far the most prevalent first entry location in the software, services and analytics, and telecommunications sectors.

‘Asia First’ Companies

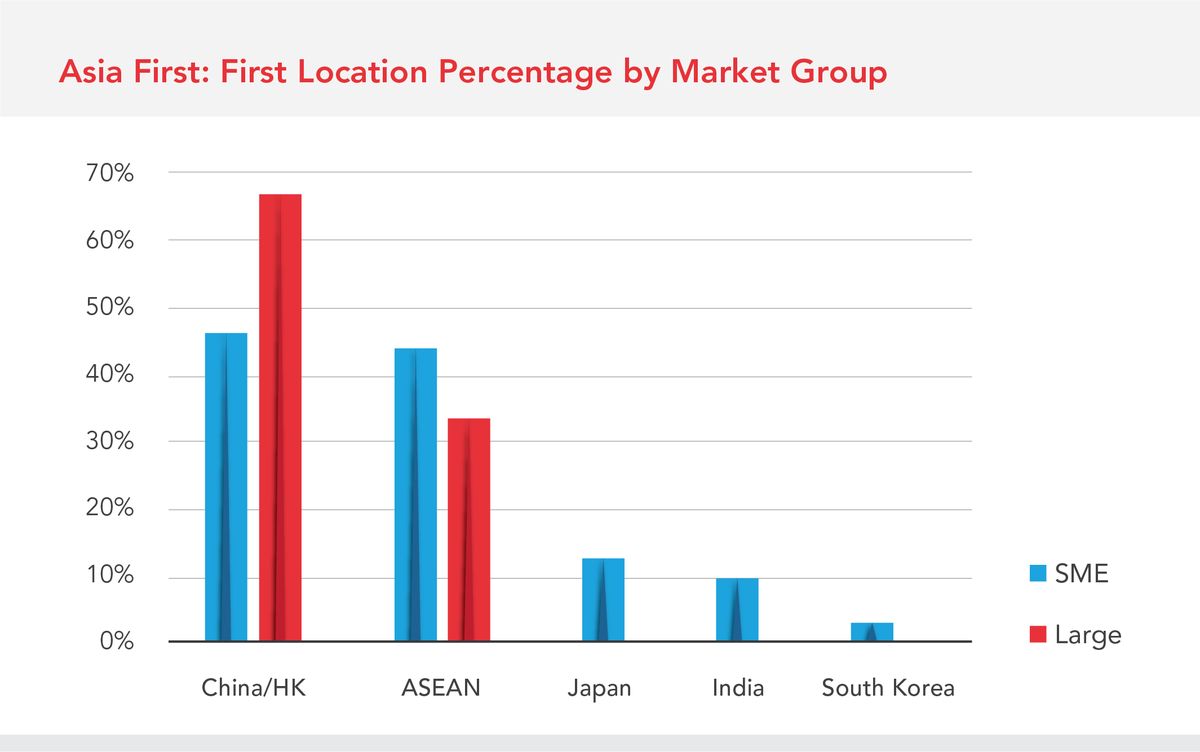

Over a third of micro-multinational SMEs chose Asia as their first location outside of Canada. The graph below indicates that SMEs are more diverse in their first location choices, while large firms are more focused on China/HK and ASEAN as their first entry market. Overall, China/HK and ASEAN are the most popular first entry markets, with the preference for China/HK more pronounced for larger firms.

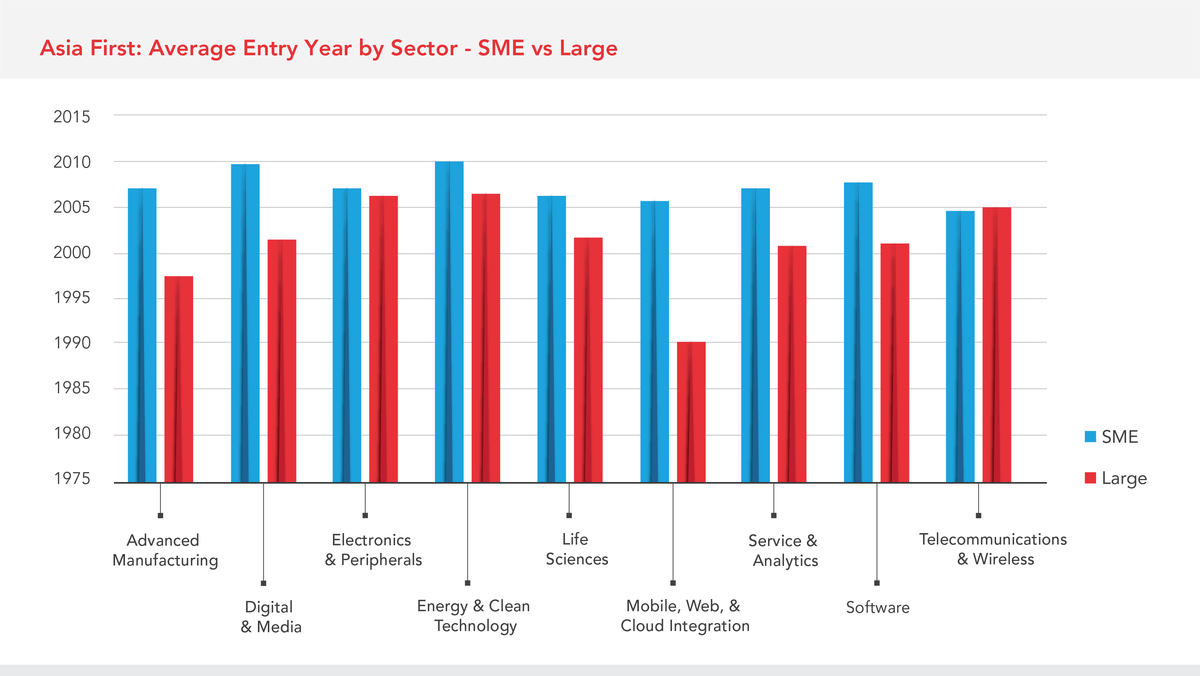

However, in comparing the differences in average entry year between sectors and firm size, we observe a different pattern. On average, larger firms enter the Asian market earlier, with the difference greatest in the mobile, web, and cloud integration sector. However, SMEs entered Asia before large firms in the telecommunications sector.

This is interesting since larger firms entered the Asian market first, yet the majority of companies that went to Asia first are in fact SMEs. Further broken down by sector, on average, telecommunications and wireless technology firms entered Japan and South Korea earliest, while advanced manufacturing firms entered ASEAN member states earlier than China or Hong Kong.

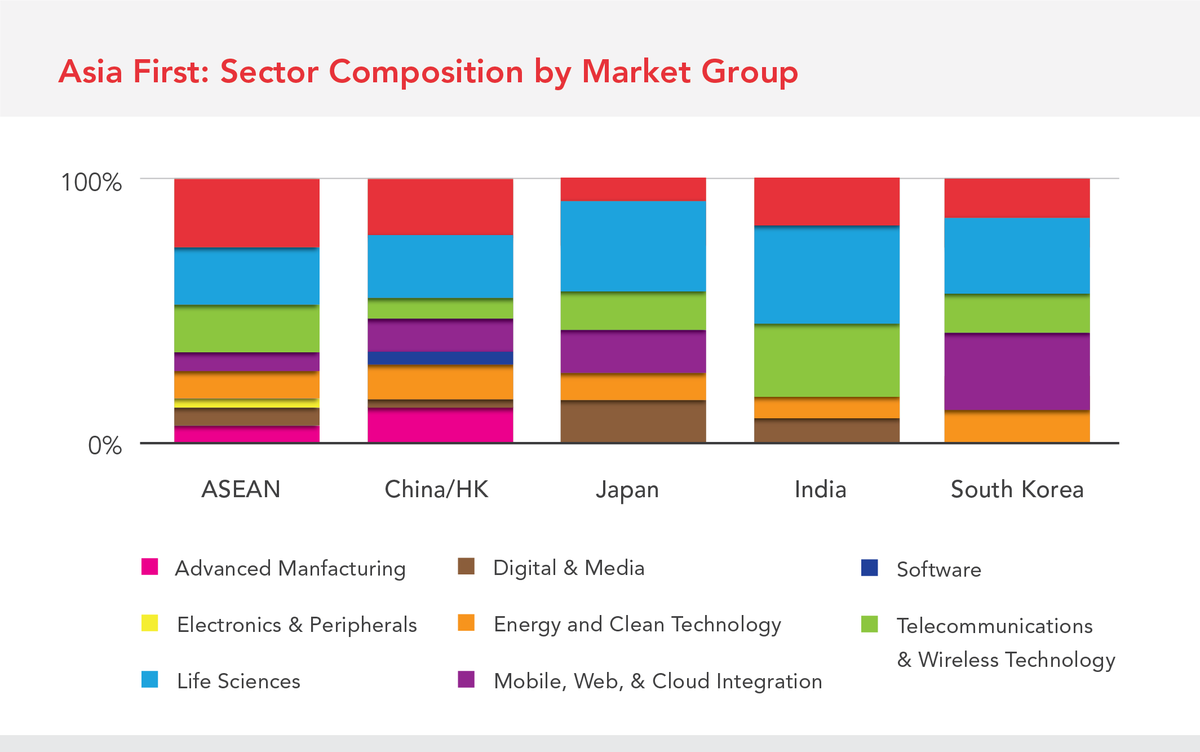

In examining the composition of the sectors within each market group, we can deduce the relative importance of sectors to each market. The graph below shows the percentage of locations by sector among those companies that selected Asia as their first overseas market.

A few points stand out. Firstly, ASEAN and China/HK are the most diverse market groups, with many different sectors present. The relative importance of digital and media companies in Japan should also be highlighted, as is the importance of mobile, web, and cloud integration in South Korea. The relatively higher presence of companies in those sectors is likely due to the characteristics of that market. Japan has high levels of Internet penetration and a vibrant digital media sector, while South Korea is well known for mobile infrastructure investment and development. Additionally, the majority of companies entering India first are software or telecommunications and wireless companies, which also seems logical given the strength of the Indian IT industry, and the large opportunities for telecommunications development. The locations for first entry in advanced manufacturing are also only present in ASEAN or China/HK, suggesting that those markets are the most desirable for first entry in the manufacturing sector.

Conclusions

- Canadian high-tech companies in Asia are overwhelmingly services-related SMEs; the exception is advanced manufacturing, where 45% are large firms.

- There are clear differences between the location preferences of Canadian SMEs and large companies: large firms expand internationally earlier than SMEs on average, yet SMEs are more likely to have their first overseas location in Asia.

- Among the micro-multinationals, the ‘Asia First’ companies’ first locations are concentrated in China/HK and ASEAN.

Click here to learn more about the University of Toronto’s Innovation Policy Lab initiative.