The Asia Pacific Foundation of Canada’s Guidebook for Doing Business in the Asia Pacific: A Resource for Indigenous Businesses is a unique online resource created to help catalyze Indigenous business engagement with the Asia Pacific. Supporting Indigenous community and social goals, the Guidebook:

- Explores why opportunities in the Asia Pacific are increasingly important for Indigenous Canada

- Provides an outline for the creation of successful Indigenous Canada-Asia Pacific business strategies

- Consolidates and details the financial, logistical, planning, and networking supports available for doing business in the Asia Pacific

This guidebook – the first of its kind in Canada – is intended to be a resource for Indigenous businesses interested in importing and exporting goods and services and attracting investment. Indigenous entrepreneurs, Indigenous-owned small, medium, and large enterprises, and economic development corporations will find useful information here, whether they are non-exporters in exploratory stages, or more experienced international players looking to expand or attract investment.

The guidebook can help you prepare for visits from Asia Pacific stakeholders or for your Asia Pacific in-market endeavours. There are introductions to topics like exporting 101, networking, financing, and cross-cultural business, along with links to external resources like websites, tools, and guides that can provide deeper dives into further understanding the opportunities, challenges and approaches to Asia Pacific business engagement.

APF Canada's Guidebook for Doing Business in the Asia Pacific: A Resource for Indigenous Businesses is available as a downloadable PDF (above), and as an online document (below).

Using the Guidebook

What Will it Provide? Who is it For?

This guidebook is intended to be a resource for Indigenous businesses interested in doing business with the Asia Pacific region, specifically importing and exporting goods and services and attracting investment. Given the diversity of Indigenous communities in Canada (First Nations, Métis, Inuit) and in type, size and sector of Indigenous businesses in Canada, this guidebook focuses on general considerations and resources rather than the details of how a particular business or community should or should not engage, although many of the resources introduced in this guidebook can assist in answering such inquiries.

Indigenous entrepreneurs, Indigenous-owned small, medium, and large enterprises, and economic development corporations will find useful information here, whether they are non-exporters in exploratory stages, or more experienced international players looking to expand or attract investment. The guidebook – or parts of it – may be shared with chief and council, your board of directors, and/or managers to present the case for engaging with Asia Pacific businesses. The guidebook can help you prepare for visits from Asia Pacific stakeholders or for your Asia Pacific in-market endeavours. There are introductions to topics like exporting 101, networking, financing, and cross-cultural business, along with links to external resources like websites, tools, and guides that can provide deeper dives into further understanding the opportunities, challenges and approaches to Asia Pacific business engagement.

Navigating the Guidebook

The guidebook can be read as a whole document. Online, you can use the chapter navigation at the top of this page to jump to the relevant section(s) for your interests and needs. You also can download a PDF of the whole report (See button above), or of the three sections here: Why the Asia Pacific?; Background, Best Practices, and Winning Strategies for Indigenous Exporters; and, Tips, Tactics, and Resources for Success.

Section 1: Introduction provides an overview of the guidebook and presents the case for why doing business in the Asia Pacific might be a viable and fruitful option for your community to meet its social, cultural and economic goals. Section 2: Background, Best Practices and Winning Strategies for Indigenous Exporters provides a narrative introduction to the opportunities, challenges, and approaches to doing business with the Asia Pacific. Section 3: Tips, Tactics, and Resources for Success provides more detailed information on specific topics and lists of actionable resources focused on different topics of interest, like industry information or cultural guides.

Throughout, the guidebook will help answer the following questions for Asia-interested Indigenous businesses, economic development corporations, and communities, to help grow their presence in the Asia Pacific:

- What government resources are there in Canada and abroad?

- What non-government resources and organizations are available?

- What Indigenous resources are available for aiding in Asia Pacific expansion?

- Where are the obstacles and opportunities for potential Asian investment, business, or trade?

Executive Summary

The Asia Pacific Foundation of Canada presents the Guidebook for Doing Business in the Asia Pacific: A Resource for Indigenous Businesses. This resource aims to help catalyze Indigenous business engagement with the Asia Pacific region.

The Asia Pacific is a dynamic region that accounts for the largest portion of the global population and global Indigenous population, and will soon account for most of the global economy, middle class, and ultra-wealthy people. The region has a large interest in Indigeneity, not only among their own Indigenous populations, which are becoming more prominent, but also among other countries like Canada. Historical similarities including colonialist patterns and cultural similarities between the Asia Pacific and Indigenous Canadians can provide the grounds for deep engagement. A long history of Indigenous globalism and recent institutional changes have made it increasingly opportune for Indigenous businesses in Canada to enter the global economy with specific attention to the Asia Pacific. The resources and economic development goals that Indigenous peoples have and the diverse industries they operate in – such as energy, natural resources, agriculture, fish and seafood, the arts, tourism, and digital/technology economies – are complimentary with increasing demand from the Asia Pacific region.

Indigenous peoples are the fastest-growing demographic in Canada and have significant economic potential. There were 55,255 First Nations, Métis and Inuit -owned businesses in Canada in 2016 spread across every province and territory in a wide variety of sectors; this is an increase from 43,000 in 2011 and from 37,445 in 2006. According to one survey, these businesses export at a greater rate than the average Canadian business, and for each dollar lent under the Aboriginal Business Financing Program, C$3.60 is added to the Canadian GDP.

Despite these positive indicators, going global can be a challenge for Indigenous businesses and communities, especially when acting independently. Obstacles include capacity, having the experience to properly plan and prepare, accessing financing and support programs, understanding and engaging with other cultures, and utilizing resources for business purposes that are in line with community goals. Indigenous nations have many assets, but they can also be challenging to utilize and make doing business difficult. For example, the organizational structure of nations can make it quicker and easier to do some projects, and stall others. Overcoming the many obstacles and challenges is important, as connecting to the global economy is often seen as the next step to Indigenous economic development, which itself is a key to reconciliation.

The guidebook covers some general strategic considerations. For example, co-operation among Indigenous businesses and nations to increase their communications abilities, represent their interests, build partnerships, and increase autonomy in the global economy may help overcome some of the mentioned challenges. Many Indigenous businesses have deep experience in Canada and the United States, which is a positive predictor of success overseas among other factors like having a business plan. For a successful crosspacific partnership, you will have to learn the formal and cultural aspects of doing business in Asia, just as your partners will have to when in Canada. The importance of cultural competency cannot be overstated.

There are many resources and tips to help you, but the outlook on going global should be one of cautious optimism. Different business strategies may work differently for different businesses and nations, bringing to light positives and negatives that may be difficult to foresee. And just as many studies have taught us, like the insightful Harvard Project on American Indian Economic Development, access to all manner of resources and having a plan does not guarantee success. Success hinges on internal factors such as the thoughtful leadership of an enterprise or making hard decisions for the long-term that run counter to the immediate struggles of nations, like spending money on international travel or spending large amounts of time on proposals. This guidebook will not discuss how those decisions should be made or how difficult it will be. Nor is it a how-to guide for every possible configuration of potential Asia engagement.

This guidebook details the many financial, logistical, planning, networking, and Indigenous business supports for doing business and strategizing with the Asia Pacific. It shows which federal and provincial programs and offices, business associations, and Indigenous organizations might be able to help minimize risks and maximize successful engagement in Asia Pacific markets, and can help address some of the obstacles and challenges mentioned. By capitalizing on their resources, cultural and historical similarities, and overlapping goals, Indigenous businesses can be leaders in engagement and seizing opportunities in the Asia Pacific on their own terms.

Introduction

Why the Asia Pacific?

There are many reasons that Indigenous people in Canada might be interested in developing or increasing engagement with the Asia Pacific region. Whatever your strategic considerations, the Asia Pacific region will come to play an increasingly important role in the future.

Asia Pacific Is Diverse and Its Population Is Growing

There are around 50 economies in the Asia Pacific that account for more than half of the world’s population and a third of the world’s languages.

There is a mix of developed (e.g. Japan, Australia) and developing and emerging economies (e.g. India). Demographically, there are economies that are aging (e.g. Hong Kong, Japan, Singapore, South Korea, Taiwan), those with youth bulges (e.g. India, Indonesia, Malaysia, Pakistan, the Philippines), and those somewhere in between (e.g. China).

Like elsewhere in the world, urbanization is on the rise and the region is home to the world’s largest and fastest-growing cities; over half of the cities with a population of five million people or more are in the Asia Pacific.

The Asia Pacific is also home to an estimated 70% of the global Indigenous population of approximately 370 million, many of whom are interested in or are already actively participating in the global economy.

Asia Pacific Fuels the Global Economy

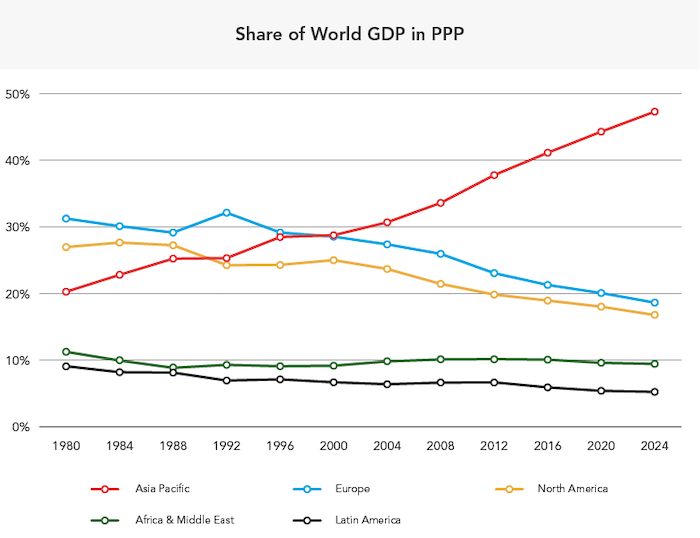

The region continues to be the main source of global economic growth; it already accounts for the world’s largest share of gross domestic product (GDP) in current prices and adjusted by purchasing power parity (PPP).

Source: IMF DataMapper, "GDP based on PPP, share of the world."

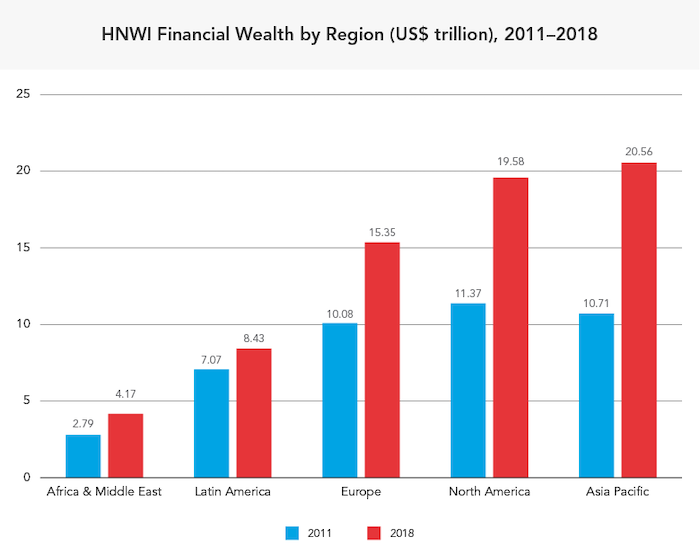

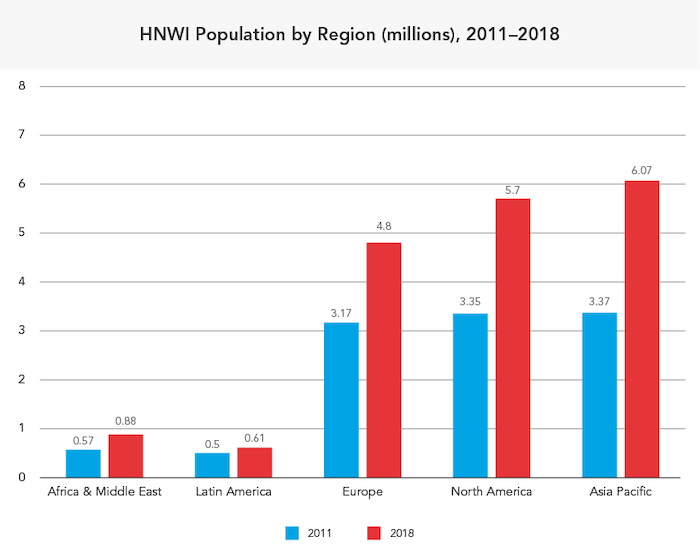

The region will account for half of the world’s middle class by 2020 and already has the largest portion of the world’s ultra-wealthy people or so-called high net worth individuals (HNWI) both in terms of population and wealth.

Source: IMF DataMapper, "GDP based on PPP, share of the world."

Source: Capgemini (2019), World Wealth Report.

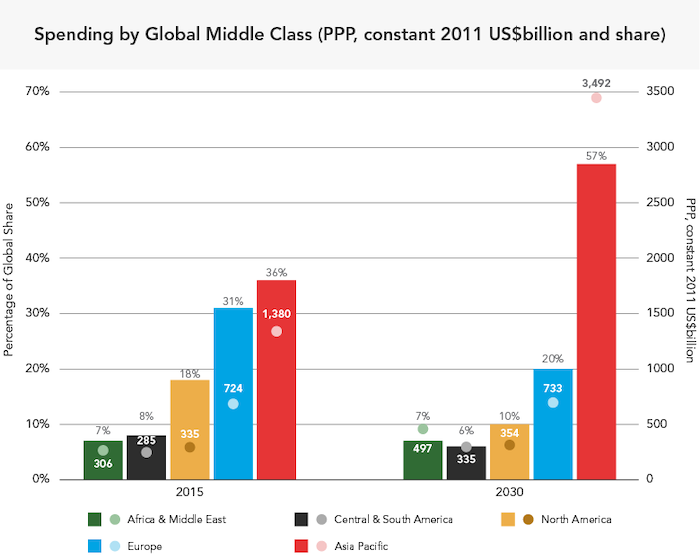

Asia Pacific adds millions of new middle-class consumers each year, who are raising demand for energy and clean energy products, agricultural and food products, services, and are increasingly interested in tourism and cultural products from Canada’s Indigenous peoples.

Source: Hoimi Kharas (2017), The Unprecedented Expansion of the Global Middle Class. Brookings Institute.

The economies and businesses in the region have demonstrated interest in Canadian and Indigenous products, resources, and services, and they often view Canadian products and services as safe, reliable, and of high quality.

Less is known on the current engagement of Asia Pacific stakeholders with Indigenous businesses and communities in Canada, but anecdotal accounts from across the country suggest significant and growing interest in Indigenous Canada from the Asia Pacific.

While all this paints a rosy picture of opportunities in the Asia Pacific, business engagement can be far from easy or straightforward. Many of the Asia Pacific businesses that are engaged internationally are large or even massive conglomerates or state-owned enterprises, while most Indigenous businesses in Canada are micro to small in size. The Asia Pacific is the most diverse and dynamic region in the world; many of the markets are complex, filled with competitors from around the world, and difficult even for established Canadian companies to navigate.

That being so, working to address some of the increasing needs, desires, and opportunities arising from the Asia Pacific can be one means for ready and well-prepared Indigenous businesses to meet their community, social, and economic goals, and seize growth in the region.

Background, Best Practices, and Winning Strategies

Now is the Time for Indigenous Exporters

Entering the global economy on their own terms is a key factor to future Indigenous economic development, and the Asia Pacific region holds particular promise. Participating in the global economy can be done in a way that allows traditional lands, culture, history, and values to play a large role. Globalization can allow Indigenous cultural distinctiveness to survive and thrive by allowing direct marketing and political connections to international actors, in contrast to the common position that globalization reduces cultural diversity. [1] Indigenous peoples have a strong history of global trade, relations, and engagement, but changes to today’s modern institutions, norms, and supports have made it easier for Indigenous communities and businesses to conduct these activities. These changes include:

- The 1989 International Labour Organization Convention 169 (building off its predecessor Convention 107 from 1957) aims to improve living conditions of Indigenous peoples through recognition and respect for Indigenous customs, institutions, and rights;

- The World Bank and regional development banks such as the Asian Development Bank have specific Indigenous policies and safeguards to help foster respect of Indigenous peoples and ensure their active and beneficial participation in projects that affect them;

- The 2007 United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) is supported by most of the world's countries and is the most comprehensive international instrument on Indigenous rights and standards;

- A myriad of court cases in various jurisdictions have ruled in favour of Indigenous rights, title, and claims;

- The Truth and Reconciliation Commission of Canada's calls to action that address education (62-65), professional development (57), and business (92); and

- A new focus in Canada on inclusive trade has resulted in changes to the United States-Mexico-Canada Agreement (USMCA, formerly NAFTA), [2] the June 2019 joint Canadian Council for Aboriginal Business (CCAB)-Global Affairs Canada (GAC) report and recommendations on Indigenous exporting, and a Canadian government announcement of expanded trade services for Indigenous business.

While much work needs to be done, these all speak to the long-term sustained global efforts by Indigenous people for domestic and international economic inclusion.

Indigenous peoples are the fastest growing demographic in Canada and have significant economic potential – the Canadian Indigenous economy was worth an estimated C$32B in 2016 and is growing. There were 55,255 First Nations, Métis and Inuit -owned businesses in Canada spread across every province and territory in a wide variety of sectors in 2016, up from 43,000 in 2011 and 37,445 in 2006. [3]

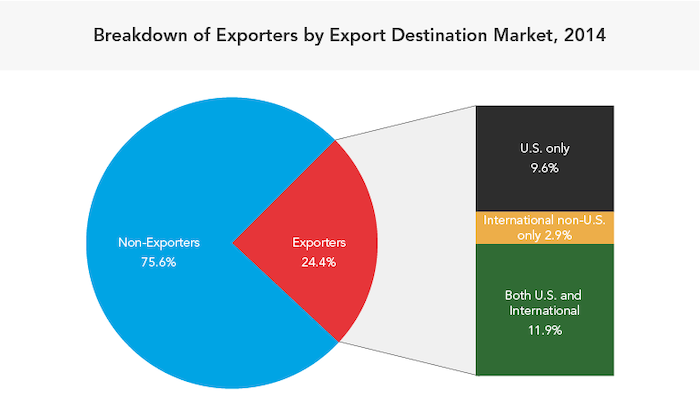

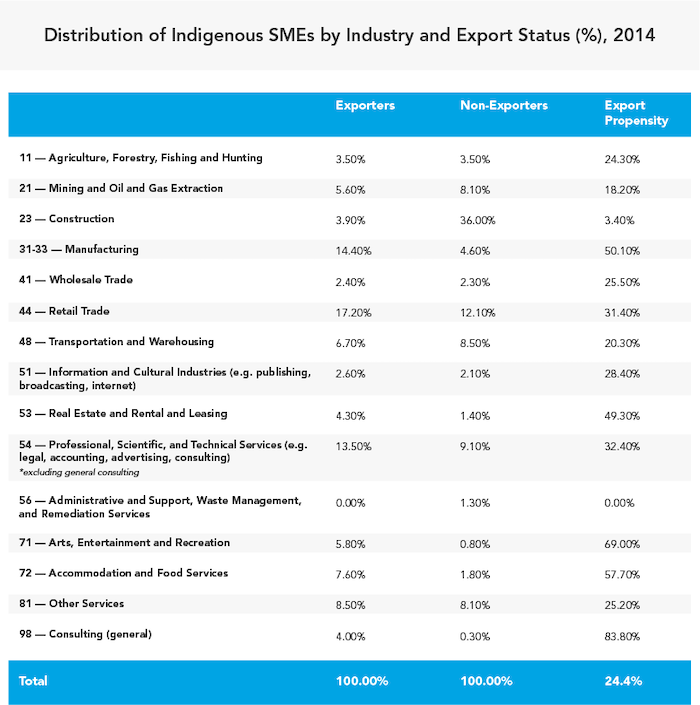

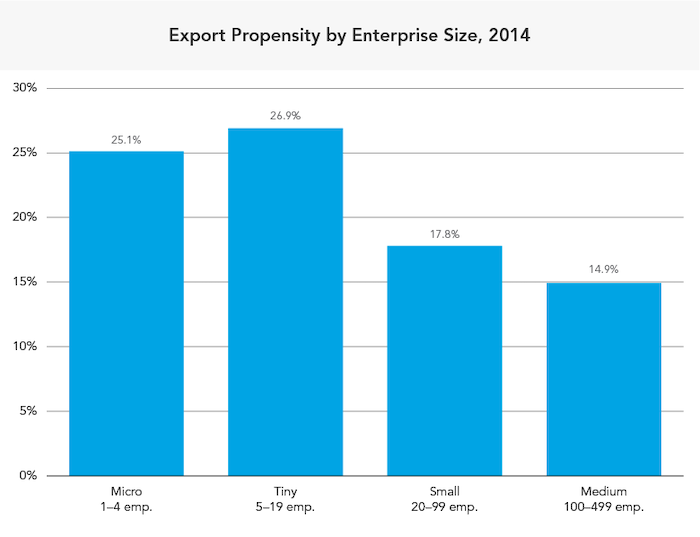

Most recent calculations estimate that Indigenous firms are both innovating and exporting at rates higher than the national average. With some caveats on sample size, a joint Global Affairs Canada–CCAB survey report found that while 11.8% of Canadian SMEs export, 24.4% of Aboriginal-owned businesses are exporting. Exporting goods or services matters for businesses because according to Export Development Canada "companies that export make 121% more money, grow faster, last longer, are better connected within supply chains, are more resilient to economic downturns, and are more productive, competitive and innovative." For each dollar lent under the Aboriginal Business Financing Program, a key nation-wide financial tool for Indigenous business, C$3.60 is added to the Canadian GDP.

Regardless of the reported high rate of exporters among Indigenous-owned businesses, the fact remains that most do not export to international markets outside the United States. Among those that do export, 9.6% export only to the United States, 11.9% export to both US and international markets, and 2.9% export only to international markets outside the United States. While less is known on the portion of Indigenous businesses and entrepreneurs that are presently in or interested in Asia Pacific markets, recent activities ranging from roundtables on the topic to government and private sector trade missions and events show wide-ranging serious interest in the region. [4]

Going global can be a challenge for Indigenous businesses and communities, especially when acting independently. Obstacles include access to financing and support programs, understanding and engaging with other cultures, and utilizing resources for business purposes. The structure of Indigenous nations can be an asset, but it can also make doing business difficult. Strategies may work differently for different business and nations and bring to light positives and negatives that may be difficult to foresee. And just as many studies have taught us, like the insightful Harvard Project on American Indian Economic Development, access to all manner of resources and having a plan does not guarantee success. Success hinges on internal factors such as the thoughtful leadership of an enterprise, a lot of hard work over a sustained period of time, or making hard decisions for the long-term that may run counter to the immediate struggles of nations, like spending money on international travel or spending large amounts of time and resources on proposals.

Authors of a 2016 article in the Harvard Business Review reported that in working with more than 100 global organizations over decades, most responded too eagerly to trends like growing middle classes and positive market indicators when entering new markets, like those we see in the Asia Pacific. Many of those businesses stated that they almost did or didn’t at all meet their performance objectives, which the authors attribute to not having their internal pieces in place. In other words, while engaging international markets can be rewarding, doing it successfully, especially in complex markets in the Asia Pacific, requires planning and commitment over the long term. A checklist to see if you are ready to export and your potential for doing so can be found in Section 3, Number 2: Exporting Preparedness Checklist.

Co-operation among like-minded Indigenous businesses and nations to increase their communications abilities, represent their interests, build partnerships, and increase autonomy in the global economy may help overcome some of these challenges – some communities are already doing this for domestic real estate, energy, and resource related ventures. By capitalizing on their resources, cultural and historical similarities, and overlapping goals, Indigenous businesses can be leaders in engagement and seizing opportunities in the Asia Pacific.

Business Support for Indigenous–Asia Pacific Engagement

This section details the government, nongovernment, and business supports for doing business and strategizing with the Asia Pacific. It also highlights the current efforts to work with Indigenous peoples to enter the global economy on their own terms. Despite the many obstacles and challenges, connecting to the global economy is often seen as the next step to Indigenous economic development, which itself is a key to reconciliation.

Government and Non-Governmental Organizational Support

Diversification of Indigenous business toward the Asia Pacific is an important and already growing component for future economic growth. Indigenous peoples and governments are increasingly partnering to lead trade missions from Canada, Australia, New Zealand, Taiwan, and other economies that are seeking to promote and support the integration of their Indigenous populations into the global economy. State governments are increasingly supportive, such as the Australian government, which provides specific programs and support for global Indigenous business and created relevant reports, guides, and a five-year Indigenous strategy in its Department of Foreign Affairs and Trade. The World Indigenous Business Forum, the International Inter-Tribal Trade Organization, and other non-profit organizations are successfully spurring discussion and action on these topics on the world stage, including on more inclusive trade agreements. Opportunities are arising to conduct business between Indigenous nations around the world. There are also an increasing number of opportunities to get Indigenous youth in Canada thinking about and engaged with the Asia Pacific to foster needed competencies, global mindsets, and skills for their future and future Asia Pacific engagement.

The Canadian Trade Commissioner Service (TCS) provides Canadian companies with free on-the-ground intelligence and practical advice on foreign markets to help potential and current exporters make better, more timely, and more cost-effective decisions in order to achieve their goals abroad. As Canada’s largest network of international trade professionals, the TCS has more than 1,000 trade commissioners located around the world.

The TCS can help exporters:

- Pursue and close more export deals;

- Develop market-entry strategies;

- Identify qualified business contacts;

- Resolve complex business problems; and

- Avoid delays and costly mistakes.

In addition, the TCS offers funding programs and support for companies and communities to help them expand their global horizons and grow their communities.

The TCS also has a dedicated team that offers additional support for Indigenous exporters, including trade missions, events, and business delegations for Indigenous companies to connect them with international opportunities. Further information on these activities, as well as links to funding, resources, opportunities, and connections for Indigenous exporters is available on the Indigenous Business Export Support Program web page. For additional Indigenous international business questions or support, please contact the TCS. IndigenousBusiness@international.gc.ca.

Doing business in Asia is not easy. Setbacks and failures in business and trade delegations as a result of not being prepared are common. Some lessons learned are that even if you have funding, an opportunity, and even a physical presence, you may not be able to sell your product or service. You will need to ensure your business is fully prepared and adapted for the market, both internally and externally. It can be difficult to be that prepared and knowledgeable, and that is one reason why there is such a wide variety of resources dedicated to helping Canadian companies abroad, and why programming regularly changes. Trade commissioners, export preparedness checklists, Canadian and Asian business mentorships, and other tools can increase your understanding of markets in the Asia Pacific and increase your odds of success.

Business Support

In addition to these opportunities, there are also economic changes that increase Indigenous opportunity. In today’s global economy, companies are realizing that they must co-operate with communities where their customers and employees live, and successful integration with the global economic system depends on local processes, where “economic structures, values, cultures, institutions and histories contribute profoundly to that success.” [5] Viewing communities as valued members of a system rather than viewing communities as something external to be dealt with is becoming the norm. For this reason, especially as a matter of economic self-interest, large corporations are increasingly supporting community development in Indigenous communities. This means that Indigenous people can enter the global economy on their own terms, where traditional lands, history, culture, and values play a critical role. [6] To do so will require identifying business opportunities and then gathering the resources and developing the organizations and human resources required to meet them.

Accessing Resources

While opportunities in the Asia Pacific for Indigenous businesses and entrepreneurs are growing, difficulties remain. One piece of the puzzle is identifying and accessing resources and program supports. There is a good indication that many Indigenous businesses may be missing out on opportunities for support from a variety of Indigenous and non-Indigenous organizations, as well as government and nongovernment national, provincial and territorial programs and services. For example, according to a CCAB survey, only 4 in 10 Aboriginal business owners report having used a government program, and there was great variety (27) in the types of programs reported being used. The most common programming accessed was related to loans and grants to small companies for financial support for employment-related activities. And how did owners find out about these government resources? The overwhelming majority cited word of mouth (43%) followed by internet search (16%). Despite their track record of success, Indigenous businesses face challenges accessing financing and in other business functions. With that in mind, this guidebook can be used to help find the services and support needed for Indigenous businesses to engage or increase engagement with the Asia Pacific.

And what were the reasons for not using a government resource? According to the CCAB, the top three were: don’t see a need or value in the programs (41%), were not aware of them or they were hard to find (22%), and there was too much bureaucracy involved (16%). While this guidebook might not be able to fully mitigate these concerns, it can help show many programs’ value to your particular endeavour, save you time finding them, and help target your approach to looking for support.

Creating an Indigenous Business Strategy for the Asia Pacific

Regardless of the size or sector of your business, developing an Asia Pacific strategy will help you find new ways of addressing the needs and aspirations of your business, marketing and selling your products or services, and/or attracting investment from the region. Only 3 in 10 Aboriginal businesses in Canada have a business plan, largely due to not seeing a need or not having the resources to develop one. This is despite business plans being integral to many business functions, such as understanding long-term viability and increasing the ability to raise capital, which almost half of Indigenous businesses struggle with. Business plans are especially important to successfully navigate international expansion. This section will describe some of the broad considerations that go into making a strategic plan for seeking and pursuing opportunities in international markets with a focus on the Asia Pacific – and will provide resources available to develop such plans.

There are three components to developing an Asia Pacific strategy: resources, industries, and institutions. Each of these is addressed below. For example, if you are looking to sell a product or service in Asia, you need to consider what competitive advantage you can draw from your resources, what the competitive forces of your product or service are when looking at a particular country or market, and what institutions – such as regulations, trade agreements, and government offices – are relevant. The three components and relevant information are looked at in the following three sections.

Resources

Assessing your resources will help your organization meet the aspirations of your business or community and find and achieve a competitive advantage. Ideally, your resources should be valuable, rare, and hard for others to imitate or implement. Indigenous resources have been and are increasingly sought by businesses and are marketable throughout the Asia Pacific region. This section will discuss Indigenous resources that Asian economies may be interested in, including but not limited to land and culture, energy and natural resources, organizational structure, e-commerce, and agriculture and agri-food.

Land and Culture

Your Resources

Outright exploitation of land and culture and other Indigenous resources for economic gain is not fully compatible with the goals and interests of Indigenous communities. But some communities may find that such resources can be used to help meet long-term Indigenous economic and social goals, such as providing stable employment in the community and encouraging cultural practices through activities like tourism in a particular area or selling art. Land can be developed for economic purposes by being leased, used for production facilities, used for renewable energy production, tourism, and in other ways.

It is difficult to provide a concise overview of Indigenous lands, as there are First Nations reserves, urban reserves, Métis communities, Inuit lands, Indigenous majority communities, and different regulatory and other considerations for each. Different communities will have their own ideas about how to use the resources available to them. In addition, modern land claim agreements and other changes mean that the current situation will continue to change. Briefly, having ownership and management of land can be beneficial for the reasons mentioned, but some Indigenous nations have had difficulty utilizing their land for business development purposes. These challenges can be due to isolation, governance and organizational structures, regulatory environments, and the decision-making process involved, among others. Overcoming these challenges will be unique to each nation or business venture, and rely largely on internal factors, but it is not impossible. If the challenges are overcome or are small to begin with, land development may be one of the easiest-to-access business options.

Indigenous culture is unique to each nation, making cultural products and experiences like art, beadwork, clothing, and local activities especially valuable to people who are interested in purchasing or experiencing them. Over half a million tourists came to Canada from China in 2017 alone, almost one-third of whom have participated in an Indigenous experience, with even more interested in doing so. And there are similar interest rates across Asia Pacific countries. The Indigenous tourism sector is set to capture demand from Asia as the Indigenous Tourism Association of Canada (ITAC) has set a goal of establishing 50 Indigenous tourism companies that are export ready by 2021 and supporting 200 such companies by 2024, and is providing funds of up to C$10,000 per business to spur such growth. ITAC also has information, such as market information and best practices, that may be useful.

Your Opportunities and Challenges

Viewing the Northern Lights, hunting, and other experiences that Indigenous people are well positioned to provide are gaining in popularity among Asian tourists. The Inuit art global market was worth C$64M in 2015, which has been attributed in part to growing demand in Asia resulting from Indigenous-government promotion of Canadian culture in the area. Leveraging cultural products requires identifying one or more markets that value Indigenous cultural goods and services, and taking steps to ensure that there is some form of authentication of the cultural goods or services so that they cannot be imitated or to differentiate from those that are inauthentic. Section 3, Number 12: Dealing with Asian Governments mentions key points to consider regarding protecting your intellectual property and traditional knowledge.

There are some cultural and historical similarities between Indigenous people in Canada and Indigenous and non-Indigenous people in the Asia Pacific. There is a large amount of cultural diversity, a shared colonial history, and common goals like environmentalism and self-determination. Recognizing and embracing the similarities opens the door to a deepened sense of mutual understanding and respect. For some accounts of this shared history, culture, and values, see Section 3, Number 16: Examples of Shared Indigenous-Asian History, Culture, and Values.

[I]n China, culture is very big. It is a land of great culture; great cultures actually [...] On our trips to China, when our regalia and our masks and drums were brought forward, the dynamics of the meeting changed dramatically. It was culture meeting culture. Talking to each other on a cultural foundation about the long history and long traditions and roots of our respective cultures, we are able to talk on that level [...] You are not talking about bottom lines, dollars, and accents. - Grand Chief Edward John [7]

On the flip side, you will still need to deal with language and cultural barriers. Expect to have to deal with translators, local business agents, and learning new languages or at least a few words or phrases. This will be a difficult task that often leads to international business struggles and failures.

Energy and Natural Resources

Your Resources

Indigenous communities have access to vast energy and natural resources and these communities have continually expressed that they are not anti-development. Rather, they want to be included in the dialogue and benefit from development in line with community values, interests, and goals, which often include strong consideration of social, cultural and environmental variables in addition to economic variables. Some experts argue that the energy and resource sector offers the most potential for country-wide Indigenous economic development and that Indigenous participation is key to the sector’s future. Organizations like the Indian Resource Council, the First Nations Major Projects Coalition and the BC First Nations Energy and Mining Council (BCFNEMC) are proof of this.

With many Indigenous people living near oil and gas deposits, mines, forests, lakes and rivers, and other such natural resources, this is a particularly important industry. Most Indigenous businesses in Canada that already do business with Asian companies or Asian-affiliated companies likely do so as part of natural resource agreements. Some other experts have noted that there exists what closely resembles the “resource curse” in certain areas: despite access to natural resources, many Indigenous peoples do not prosper from those resources. However, the industry is changing and is playing an increasingly important role in Indigenous economic development as more integration, effort, and investment is put into ensuring Indigenous peoples receive proper and sufficient consultation, compensation, and opportunities. And new tools are making it easier for government and industry to award resource sector-related contracts to Indigenous businesses.

Your Opportunities and Challenges

Some Indigenous organizations receive regular inquiries from stakeholders in Asia, indicating the opportunities for investment from Asia into Indigenous-owned energy, natural resources, and resource development. As previously mentioned, the majority of Indigenous businesses that have ongoing relationships with Asian stakeholders do so as part of resource agreements. From 2017 to 2018 alone, there were 21 deals totalling C$29.5B invested from the Asia Pacific to Canada in the energy sector, compared to C$19.46B invested from 2003 to 2010. This and other key investment information in several industries between Canada and the Asia Pacific can be found using APF Canada’s Investment Monitor tool.

The Asia Pacific already uses more energy than it produces, with a 75% increase in CO2 emissions in China alone from 2004 to 2012, and by 2035 the region will consume half the worlds energy supply. Another opportunity is to look for additional business spin-offs, for example in managing, servicing, or maintaining any resource investment projects. The Asia Pacific region is also disproportionately affected by climate change, including rising sea levels, increasing storms, and pollution, leading to increased investment from the region into clean tech. Indigenous people value the environment, and the environment in Asia is becoming increasingly stressed, leading to opportunities to collaborate in making the future a cleaner, greener one through clean energy and clean tech. APF Canada’s China Eco-City Tracker sheds light on the environmental indicators in 31 cities in China and can help businesses identify potential opportunities in that market.

A critical component of resource development projects is the duty to consult, accommodate, and negotiate with Indigenous peoples. This is important for Indigenous–Asia Pacific relations because there have been at least a few instances where Asian partners were unaware of this context or believed it to be a domestic rather than an international issue that they need not concern themselves with. Such misunderstandings can cause costly delays, uneasy relations, or even the cancellation of projects.

A BCFNEMC document succinctly describes the duty to consult and accommodate and negotiation practices:

An essential component of resource development in Canada is the legal requirement to consult and accommodate First Nations whose rights might be adversely impacted by the development. Working closely with First Nations and developing partnerships based on trust, respect and recognition of First Nations rights and title will help ensure the successful development and operation of resource-related projects. By building relationships and securing agreements with First Nations, companies will avoid project risks such as costly project delays due to litigation or injunctions, challenges to permits, restriction of access for works and negative media campaigns. Critical aspects of consultation and negotiation with First Nations on resource projects include:

- Open and honest communication throughout all aspects of the project.

- Agreement that the free, prior and informed consent of First Nations must be obtained before developing projects and activities affecting their communities.

- Negotiation of Impact and Benefit Agreements that include profit sharing, equity, and other social and economic provisions.

- Resource development must be conducted in an environmentally, ecologically, socially, culturally, economically sustainable and viable manner for the benefit of future generations.

- The inclusion of Indigenous knowledge throughout the planning and development of a project.

- Financial resources for the First Nations to engage in the consultation and negotiation process.

- Education, training and capacity to ensure full participation in the planning, construction and operations of a project.

Preparing to discuss such practices and resource participation models with Asian stakeholders can help your potential partners understand the Indigenous community and business context and reduce risks.

Agriculture and Agri-food

Your Resource

The CCAB argues that there is significant potential for Indigenous businesses to grow in the agriculture and agri-food sector, a sector which currently has an underrepresentation of Indigenous businesses despite access to land, water, and sea. In 2016, 30% of Indigenous agriculture businesses exported, almost triple the Canadian average. Indigenous businesses produce and have potential to produce a wide variety of agriculture and agri-food products suitable for Asia Pacific markets, ranging from common to more traditional and niche grains, fruit, vegetables, meat, freshwater fish, and seafood products.

Your Opportunities and Challenges

With the growing economy and middle class in Asia, and the high regard for safe, high-quality, and niche/specialty Canadian agricultural products, Indigenous peoples with these resources or the potential to develop them have an opportunity. With increasing governmental support, including Indigenous funding, participation and skills development, and support for trade with Asia, it is increasingly easy to conduct business and trade in this sector. China is an especially large market for agri-food and seafood products, and many of these items are increasingly sold on e-commerce platforms like Alibaba, but it comes with its own set of tariff and nontariff barriers that can be arbitrarily imposed, and it is by no means the only market. Trade in agriculture, agrifood, and seafood between Canada and the Asia Pacific region has increased by 300% since 2010, indicating the rapid growth in opportunities. However, as recent spats with China and India over canola, pork, and pulses have shown, a large market does not necessarily correlate with ease of doing business, and these are difficult markets to engage. These products rely heavily on the Canadian reputation or brand for safe and quality products and investment.

The Comprehensive and Progressive Agreement for the Trans Pacific Partnership (CPTPP) now gives Canadian products in this sector preferential treatment in member countries, which includes Japan, Vietnam, Malaysia, Australia, and New Zealand, and the Canada-Korea Free Trade Agreement reduces or eliminates tariffs on exports to that market. The CPTPP allows Canadians to provide many other products with reduced tariffs, which provides them a competitive position over other major exporters like the United States. The CPTPP provides a variety of other benefits and advantages, including reducing non-tariff barriers to trade.

Organizational Structure

Your Resources

The organizational structures of Indigenous organizations have potential to provide an ease of doing business that other businesses cannot. Self-governing Indigenous nations that have jurisdictional control may play a stronger role in development within their territories. In theory this could translate into making it easier to navigate the regulatory environment and to access key decision-makers and take less time to approve and scale projects. Some Indigenous nations have their own independently governed economic development corporations. Being independently governed can help minimize business risk, and therefore these businesses make attractive partners.

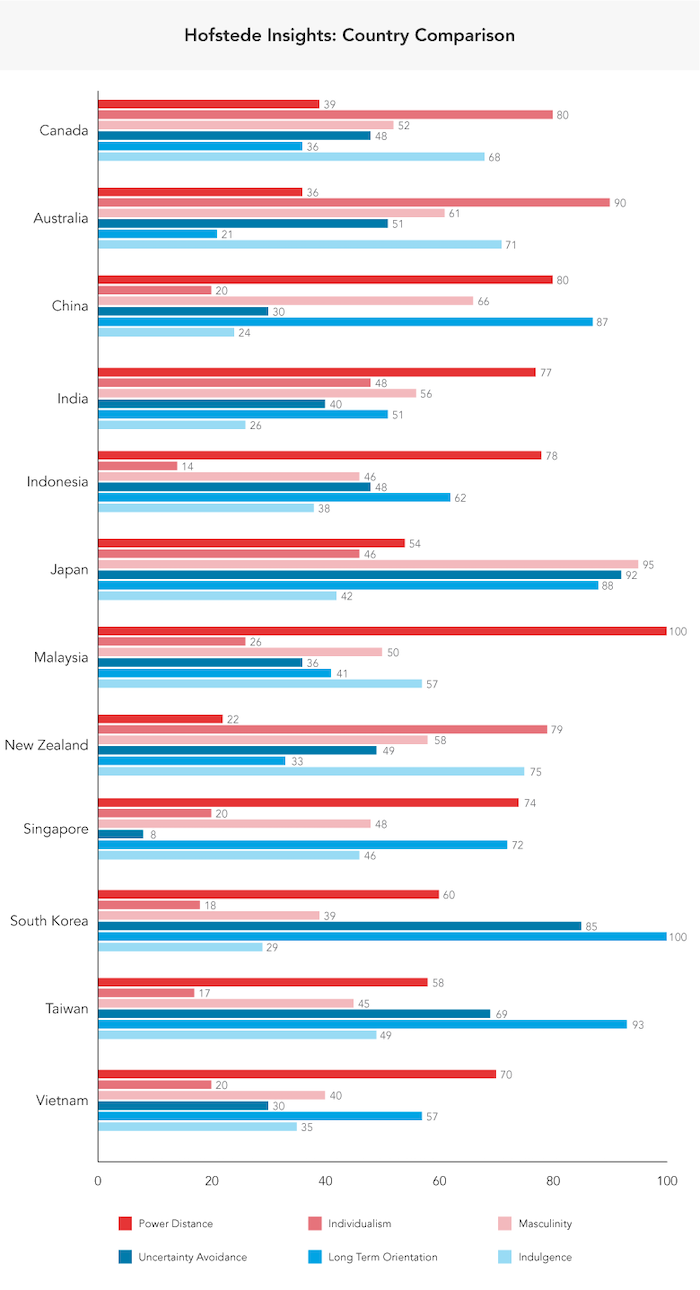

Indigenous cultures typically lend to a long-term orientation, meaning that Indigenous peoples generally think about the long-term consequences of business decisions today, and might prefer long-term relationships rather than focusing on short-term business dealings. Many countries in the Asia Pacific have a similar longterm orientation, meaning that they too prefer long term relationships and well-thought-out deliberation of business deals and their long-term effects. These similarities will act as a strength in Indigenous–Asia Pacific business, where both partners can feel comfortable and respected in the structure of their relationship.

Your Opportunities and Challenges

In practice, the organizational structure of Indigenous organizations often leads to a more difficult business environment, such as making it more difficult to access loans by providing collateral on reserve. The regulatory environment can also be complex and often spans Indigenous, local, provincial, and national regulatory frameworks, organizations, and decision-making authorities. Indigenous leaders have large portfolios of responsibilities and must make business decisions that account for more than just maximizing profits, leading to decision-making being less straightforward. These issues are being addressed to some extent as communities strengthen their governance and self-determination, as community and business leaders use creative governance and organizations structures, and as different levels of government recognize the issues and take initiatives to streamline bureaucracy and co-ordinate better, assess Indigenous barriers to business, and create new financial tools.

When developing your Asia Pacific strategy, understand that Indigenous organizational structures can be a strength, and communicating that internally to your team and to potential partners will help them understand that it is advantageous to partner with an Indigenous business or organization. Being well prepared for projects by understanding exactly what regulatory processes, decision-making, and internal factors are required can help. Many Asian stakeholders will not be aware of such Indigenous organizational structures and accompanying challenges and advantages. It may be challenging to have partners understand why and how Indigenous entities are advantageous, so be prepared to describe your unique context, such as how key decision-makers will be easy to communicate with or how less red tape can lead to more productive and mutually beneficial relationships.

E-commerce

Your Resources

E-commerce platforms have marketing channels with access to global markets that have demonstrated demand for Indigenous products and services. As such, every venture should consider how e-commerce fits into its Asia Pacific business strategy. Some products, such as freshwater fish, wild meat products, artisan crafts, and tour packages, are well suited to e-commerce. Some Indigenous entrepreneurs have spoken about the ability of e-commerce to overcome common Indigenous business challenges, such as securing a loan, setting up a retail location, going to a bank, and accessing customers. For example, a Financial Post article noted that “By 2007, about 60 per cent of the world’s online gambling traffic ran through servers in Kahnawake,” a Quebec First Nations reserve. In addition, the CCAB found that less than half of Indigenous non-exporters use social media while 7 in 10 exporters have an online presence.

Your Opportunities and Challenges

The Asia Pacific is a leader of e- and mobile commerce; China’s market alone has over 800 million internet users, 98% of whom are mobile users, and the country is expected to become the world’s largest e-commerce market with transactions of C$9.4T in 2020. The Asia Pacific region is home to 8 of the top 20 internet companies in the world, based on revenue. China-based e-commerce giant Alibaba, for example, is one of the world’s top 10 most valuable companies, worth around US$400B. Japan-based Rakuten, another one of the world’s largest e-commerce companies, had 82 million online shoppers in 2017, and South Korea has over 30 million online shoppers every year. Consumers in the Asia Pacific have some of the highest rates of online shopping, and consistently buy fairly priced and quality products from around the globe. APF Canada has free e-commerce reports on succeeding in China, a C$9.4T e-commerce market, Japan, the world’s fourth-largest e-commerce market, and South Korea, the world’s third-largest e-commerce market.

When preparing to use e-commerce for Asian markets, keep in mind that doing so may not be as straightforward or easy as it may first appear. These platforms are often not just a Chinese or Japanese version of Amazon. Not only will you need to navigate each platform’s requirements and peculiarities, you will likely need to provide content customized to the region you are operating in, for example with local language and cultural aspects. The Canadian Trade Commissioner Service has a free E-Commerce in China Guide that Canadians can obtain by emailing the China TCS team, and the World Trade Centre Vancouver offers a one-day International E-Commerce Essentials (ICE) program for BC businesses and will waive the fee for Indigenous businesses. The Asia-Pacific Economic Cooperation (APEC), of which Canada is one of the 21 members, created a free Cross Border E-Commerce Trading tool to help such efforts. Another important e-commerce consideration is how payments will be made and the strategic approach to specific markets. For example, it likely makes sense to begin exporting to a typical Canada-Asia trade hub like Taiwan or Hong Kong, and then scale to China or elsewhere based on success.

While most Indigenous business have access to the internet and consider it reliable, CCAB found that it is used less often and is less reliable in the territories, the Atlantic, and on many reserves. There remains a digital divide in Canada, and many Indigenous communities have no, limited, or unaffordable access to internet services, which hinders them and may contribute to slower economic development than the rest of Canada.

Having an online presence may be a challenge for your business, but many communities are working to find connectivity solutions and modernize their internet capabilities.

Industries

An industry is the group of companies and related organizations in which you operate. For example, if you are looking to attract new investment from the Asia Pacific for your energy company, there will be other companies with potentially cheaper, easier to access, or different sources of energy and related businesses in Canada, in the Asia Pacific, and around the world that you will have to compete or collaborate with to attract investment. Industry information and opportunities are discussed in this section.

Industry Competition and Challenges

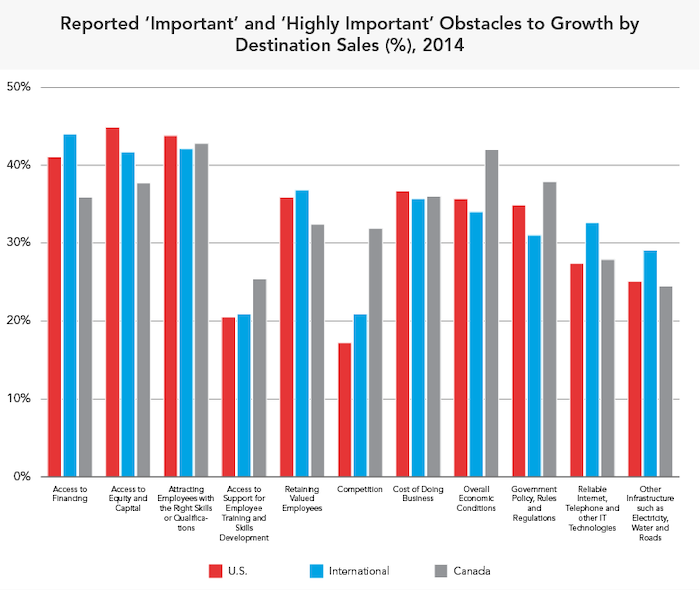

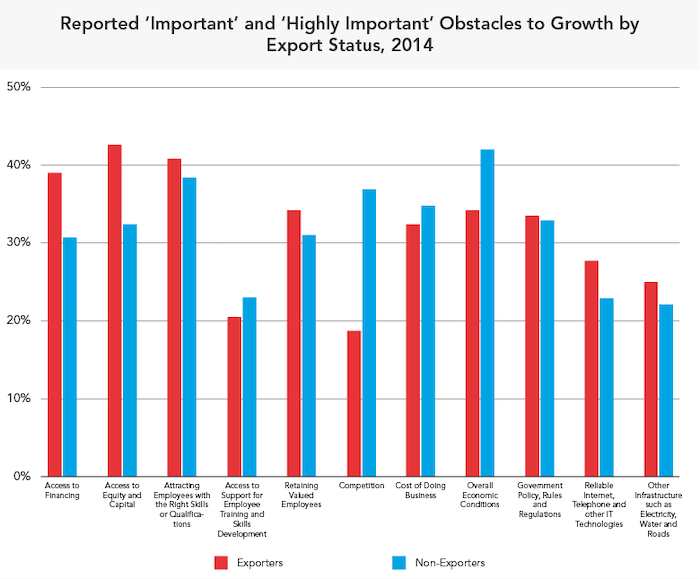

There are several forces that will impact industry-related considerations in your strategy, including the amount of power that your suppliers and buyers have over you, the existing level of competition, and how easy it would be for others to enter the industry or substitute your products and services. Unique competitive aspects of an Indigenous business might include geographic and financing challenges, or the taxation and structure of some Indigenous businesses. Additional Indigenous-specific considerations are shown in Figure 6, which shows the percentage of Indigenous businesses that face barriers to business expansion depending on their market.

While your company may or may not face the same obstacles the figure provides a rough indication of which areas may prove more cumbersome or time-consuming for international exporters (e.g. access to financing and attracting employees with the right skills and qualifications) versus areas that are less likely to be impediments (e.g. access to support for employee training and skills development and competition).

Source: Audrey Bélanger Baur (2019), Indigenous-Owned Exporting Small and Medium Enterprises in Canada, Global Affairs Canada & Canadian Council for Aboriginal Business, p. 34

Indigenous Opportunities and Participation in Industries

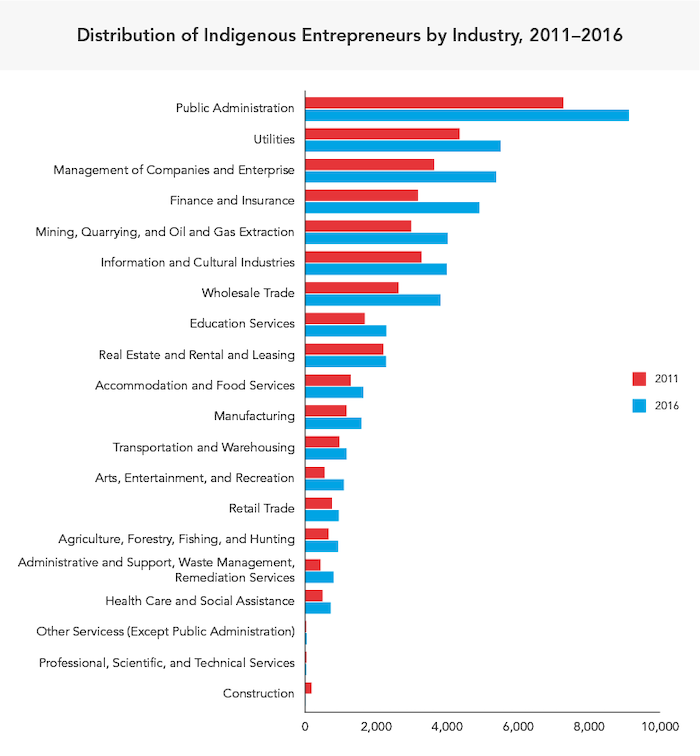

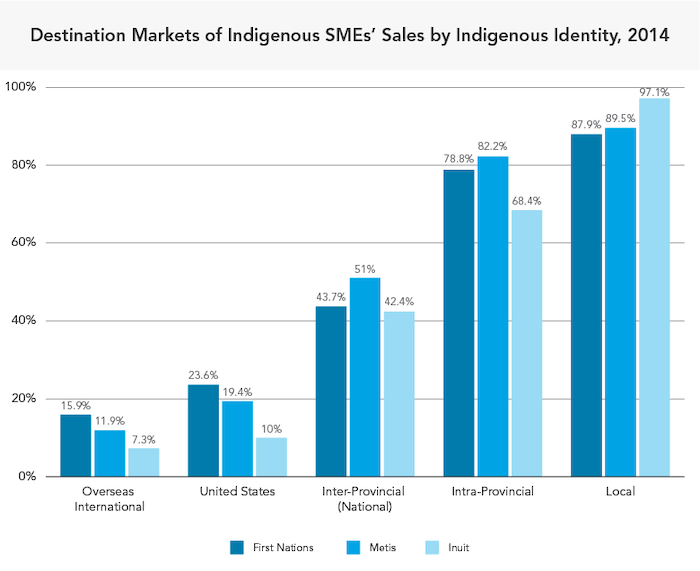

There are a variety of industries that Indigenous businesses are well set to further engage within the Asia Pacific, such as the tourism or seafood products industries. Section 3, Number 17: Trends of Indigenous Participation in Exporting Industries shows several figures that detail what industries self-employed Indigenous entrepreneurs work in, what destinations Indigenous businesses export to, and which industries Indigenous businesses operate in and export from. This helps paint a picture of the current industry landscape, including trends and potential opportunities for exporting for Indigenous businesses.

Despite resource and industry alignment with opportunities between Indigenous Canadian businesses and the Asia Pacific, success is not guaranteed. Some Indigenous organizations have worked proactively to build partnerships and others have experienced difficulty in building partnerships and having their needs and interests adequately represented when engaging with the region.

First Nations have been in a reactive mode when Chinese developers come to their territories. If there isn’t some structure to the relationship, First Nations risk renouncing companies and missing out on opportunities for economic development. – BC First Nations Energy and Mining Council [8]

Some Indigenous peoples have found that partnering to create their own institutions has helped in overcoming these challenges, and recent discussions at APF Canada with industry leaders came to a similar conclusion. It can increase confidence in your ability to meet demand, reduce risk, and is easier to deal with. By creating organizations that bring together various Indigenous nations in Canada or with those in the Asia Pacific, it could be easier to communicate, build partnerships, and increase autonomy. A simple starting point would be to agree to work together to deliver a product or service to the region. Such partnerships can be within or across multiple industries, like an economic co-operative or trade association such as the Nunatsiavut Group of Companies or the Ní’akindè National Business Consortium. It can otherwise be difficult to have a coherent strategy that is heard as many national interests and voices compete for attention in Asia Pacific markets.

Other Industry Opportunities

Retail, residential, and light industrial land development is a large economic driver for Indigenous businesses and has high potential investment from the Asia Pacific, as many communities have access to land that can be used for commercial purposes. Renewable energy, as numerous projects across the country attest, is also a high-potential investment for Indigenous communities with the land required for production and a shared interest in renewables.

Urban First Nations have the additional opportunity for Asian partners to invest in technology manufacturing, especially with a larger and more technical labour force available. For ideas on entering different technology industries, the Innovation Superclusters Initiative can give an approximation of which technologies will have favourable investment, labour, and activity in different areas of Canada. Another example would be to work with Asian partners to test technologies, such as automated online health services, 3D printed housing, and new clean energy technology, on Indigenous lands. Of Indigenous exporters, 14.4% are involved in manufacturing. Although there is no data on what they are exporting, this shows that it is a common activity.

A related example is the previously mentioned First Nations community that hosted around 60% of the world’s online gambling traffic by 2007, an indicator of the opportunity and ability to use technology for business on reserves. The benefit for Asian partners would be that there are favourable organizational structures, testing conditions, and overlapping goals with Indigenous partners. For industry information that can further inform your Asia Pacific strategy, see Section 3, Number 11: Industry and Logistical Information for a Successful Asia Pacific Business Strategy.

Institutions

Institutions are referred to in this guidebook as formal things like laws, rules, or regulations, and informal things like culture or business norms, that dictate how we should act. Becoming familiar with the institutions relevant to your Asia Pacific strategy is important to ensure success. Some global business failures are a result of not knowing one’s institutional environment, such as relevant laws and certain aspects of business culture. It is particularly important to understand the local culture and learn how to do business in that context when dealing with global partners. This section will introduce some relevant formal and informal institutions.

Cultural Know-how for Businesses

Cross-cultural considerations are important in global business. There are many similarities in culture and values in Asia and in Indigenous Canada, including diversity, long-term orientation, importance of relationships, and trust building, which can provide deeper business connections. Indigenous businesses will benefit from having both strong business and Asia Pacific cultural acumen to engage successfully with the region. The onus is on Indigenous businesses to learn as much as they can about the cultures and business practices in their target markets or of the Asia Pacific-based company that is looking to invest in Canada.

Developing Asia competencies, such as language training, networking, and industry knowledge, can support cross-cultural business success. This can be accomplished by sending youth and students for internships, study abroad, job placement, and networking through conferences and ethnic business associations. Signing up for APF Canada’s tri-weekly Asia Watch newsletter, taking adult language classes, having your board meeting at an Asian restaurant, adding Asia competencies to your board matrix and director search criteria, engaging with an Asian business association, or visiting an Asia-based supplier are other ways of increasing Asia-related competencies within your business. Another option is to take the Forum for International Trade Training’s Intercultural Competence course for C$300. For a list of Indigenous and Asia cultural guides, basic phrases in Asian languages, a list of Asia-related centres at post-secondary institutions across the country, and Government of Canada cultural resources on the Asia Pacific region, see Section 3, Number 13: Asia Cultural Guides, Basic Phrases, and Additional Government of Canada Resources.

Not only is it necessary for Indigenous business leaders to have an understanding of the similarities and differences of the people and country of your intended market in the Asia Pacific, it is likely that companies and government officials in the Asia Pacific may be unfamiliar with Indigenous cultures, histories, and business practices. Directing your Asia Pacific partners to available resources that provide Indigenous cultures, histories, and business introductions can help improve mutual understanding and mitigate potential challenges upfront.

While there is currently no document, program, or central organization geared specifically toward introducing Canada-wide Indigenous culture, history and business practices for a pan-Asia Pacific audience, there are a number of free and potentially useful resources. For example, Indigenous Works has created a seven-stage partnership framework for Indigenous and non-Indigenous interactions based on interviews and a survey with over 500 businesses. For a list of such partnership-building practices, see Section 3, Number 9: Resources for Networking and Partnership Building in Canada and Asia.

Meeting Clients and Partners

There are a variety of institutions and organizations in Canada and around the world that can help increase your Asia Pacific success by providing opportunities, including financing, to meet clients and partners in the region and gain market knowledge. The Asia Pacific Foundation, the Canadian Trade Commissioner Service, and the CanExport program are a few examples. To read more, see Section 3, Number 9: Resources for Networking and Partnership Building in Canada and Asia. For more financial and logistic support resources, see Section 3, Number 10: Financing and Logistical Tools. For more information on offices and contacts that can assist in planning, financing, and networking, see Section 3, Numbers 3 to 7:

- Number 3: In-country Resources: Northeast Asia

- Number 4: In-country Resources: Southeast Asia

- Number 5: In-country Resources: South Asia

- Number 6: In-country Resources: Oceania

- Number 7: Provincial Support for Doing Business in Asia

Indigenous Networking in Canada and Asia

Networking with other Indigenous people and organizations can also be beneficial. Some organizations, like the CCAB, have a wealth of related information and resources and often host events around the country. Your network can provide mentorship, connect you with global opportunities, inform you of current events, and partner with you in business, such as by organizing trade events or working together to access a new market.

The first federally led Indigenous trade mission took place in October 2018 on the sidelines of the World Indigenous Business Forum, and the second federally led mission took place alongside the International Inter-Tribal Trade and Investment Organization (IITIO) mission to Texas and Oklahoma in June 2019. There are many other opportunities nationally and internationally. There are also a wide variety of consultancies with an Indigenous focus or department; for example, the Indigenous communications firm Creative Fire recently hosted a roundtable with APF Canada and several Indigenous organizations. For a list of Indigenous organizations that you may want to connect with or that provide networking events and general business networking in Canada and Asia, see Section 3, Number 9: Resources for Networking and Partnership Building in Canada and Asia.

Indigenous businesses have also taken it into their own hands to organize trade missions to Asia and welcome reverse missions from Asia to Canada. Reaching out to organizers or participants to get involved or learn from their experiences could help ensure Indigenous businesses and communities are building from experience and learned best practices rather than reinventing the wheel.

Free Trade Agreements and Investment Treaties with Asia

Free trade agreements (FTA) are treaties that open international markets to Canadian businesses by reducing trade barriers, such as tariffs, quotas, or non-tariff barriers. Some countries use the term “economic partnership agreement” instead of free trade agreement. Canada has 14 FTAs with over 50 countries in force, two of which are with Asia. One is with South Korea, and the other is the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) that came into force on December 30, 2018. Canada and Association of Southeast Asian Nations (ASEAN) member states announced the launch of exploratory discussions for a possible Canada-ASEAN FTA on September 8, 2017, with more discussions taking place in April 2019.

Foreign investment promotion and protection agreements (FIPAs) are bilateral agreements aimed at protecting and promoting foreign investment through legally binding rights and obligations. The Canadian government has concluded many FIPAs with Asian economies and continues to negotiate new agreements. Canada has 38 FIPAs in force, 5 of which are with Asian countries, and 2 of the 14 FIPAs in negotiation are with Asian counterparts. Asia Pacific-related FTAs and FIPAs can be found in Section 3, Number 8: Relevant Canada–Asia Pacific Free Trade Agreements and Foreign Investment Promotion and Protection Agreements.

You should contact a Trade Commissioner or Export Development Canada to discuss how trade agreements might benefit your company.

Institutional Engagement

Engaging with different institutions such as governments and legal systems can be difficult to navigate. For information on dealing with Asian governments, including protecting your intellectual property, government and business law, risk assessment, and trade and investment agreements, see Section 3, Number 12: Dealing with Asian Governments. For tips and insights to ease the difficulty of engaging and doing business in different institutional and other contexts, see the following parts in section 3:

- For tips on doing business in Asia generally, see Section 3, Number 1: Doing Business in Asia: Quick Tips;

- For tips on Indigenous economic development practices, see Section 3, Number 14: Current Indigenous Economic Development Practices; and,

- For examples of engagement actions from previous Indigenous-Asia business strategies, see Section 3, Number 15: Engagement Strategies of Previous Indigenous-Asia Stakeholders and Indigenous Global Business Examples.

Other resources to help get you started on developing your Asia Pacific strategy and set you on a path to begin or expand your business in Asia Pacific include this step-by-step guide, these introductory resources on exporting, and these resources on Indigenous exporting from the Government of Canada.

Conclusion

Engaging with the Asia Pacific provides many opportunities for Indigenous businesses and communities to economically expand while meeting their business, community, and social goals. But doing so will not be for everyone; it will require conscious efforts over a significant period of time, such as ensuring support and interest from your chief and council, boards, and management; careful planning and creation of Asia Pacific strategies; solid market research and preparing your product or service appropriately; making frequent visits to the region; and weathering the ups and downs. Doing so may require building new partnerships with other Indigenous business or communities in Canada or abroad to address scale, brand, risk and capacity challenges. Understanding the context of the resources, industries, and institutions relevant to your strategy will help ensure you move down a good path toward engaging with the Asia Pacific region.

Indigenous individuals and communities have given rise to tens of thousands of businesses with their own resources, voices, and interests, which represent a unique and vital component of the Canadian economy and society. Indigenous peoples can and are increasingly co-operating across the country to represent their interests globally. That a quarter of Indigenous businesses are already exporting in one form or another shows that Indigenous Canada has a strong base from which to grow its globalized economic futures. Working collaboratively and cooperatively across Indigenous nations and organizations has the potential to make it easier to brand, communicate, and engage with the Asia Pacific.

Indigenous businesses can work alongside the rest of Canada toward reconciliation and development; promoting Indigenous opportunities and integration in the global economy can help make progress on both goals. Engaging with the Asia Pacific may help meet your business or community social and economic interests and goals, and this guidebook will hopefully help mitigate risks and maximize opportunities with engaging Asia Pacific markets and stakeholders. Even if you decide direct engagement is not right for you, having a better understanding and grasp of the region will help with long-term planning and understanding of global markets and communities, as the Asia Pacific will continue to be a key driver of the world economy for the foreseeable future.

Tips, Tactics, and Resources for Success

Overview

This section provides more detailed information on specific topics and the most actionable resources that this guidebook holds, whereas section 1 and 2 makes a case for why Indigenous businesses should consider business engagement with the Asia Pacific and discuss the opportunities, challenges, and approaches to doing so. Each numbered item lists information or resources specific to a certain area of interest, such as industry information for specific Asian countries, details on current and potential trade and investment agreements, networking opportunities for Indigenous businesses, cultural guides, and more. All of these tips, tactics, and resources sections are introduced in sections 1 and 2 of the guidebook as they came up in relevant discussion, and below is a list of each with a brief description of what you will find within.

- For tips on doing business in Asia generally, see Section 3, Number 1: Doing Business in Asia: Quick Tips;

- A checklist to see if you are ready to export and your potential for doing so can be found in Section 3, Number 2: Exporting Preparedness Checklist;

- For a list of offices and contacts that can assist in planning, financing, and networking in Northeast Asia, see Section 3, Number 3: In-country Resources: Northeast Asia;

- For a list of offices and contacts that can assist in planning, financing, and networking in Southeast Asia, see Section 3, Number 4: In-country Resources: Southeast Asia;

- For a list of offices and contacts that can assist in planning, financing, and networking in South Asia, see Section 3, Number 5: In-country Resources: South Asia;

- For a list of offices and contacts that can assist in planning, financing, and networking in the Pacific, see Section 3, Number 6: In-country Resources: Oceania;

- For support offered by the provinces, including offices and contacts that can assist in planning, financing, and networking, see Section 3, Number 7: Provincial Support for Doing Business in Asia;

- For a list of relevant current and potential free trade agreements and foreign investment promotion and protection agreements, see Section 3, Number 8: Relevant Canada–Asia Pacific Free Trade Agreements and Foreign Investment Promotion and Protection Agreements;

- For a list of partnership-building practices, see Section 3, Number 9: Resources for Networking and Partnership Building in Canada and the Asia Pacific;

- For lists of financial and logistical support resources, see Section 3, Number 10: Financing and Logistical Tools;

- For industry information that can inform your Asia Pacific strategy, see Section 3, Number 11: Industry and Logistical Information for a Successful Asia Pacific Business Strategy;

- For information on dealing with Asian governments, including protecting your IP, government and business law, risk assessment, and trade and investment agreements, see Section 3, Number 12: Dealing with Asian Governments;

- For a list of Indigenous and Asian cultural guides, basic phrases in Asian languages, a list of Asia-related centres at post-secondary institutions across the country, and additional Government of Canada cultural resources on the Asia Pacific region, see Section 3, Number 13: Asia Cultural Guides, Basic Phrases, and Additional Government of Canada Resources;

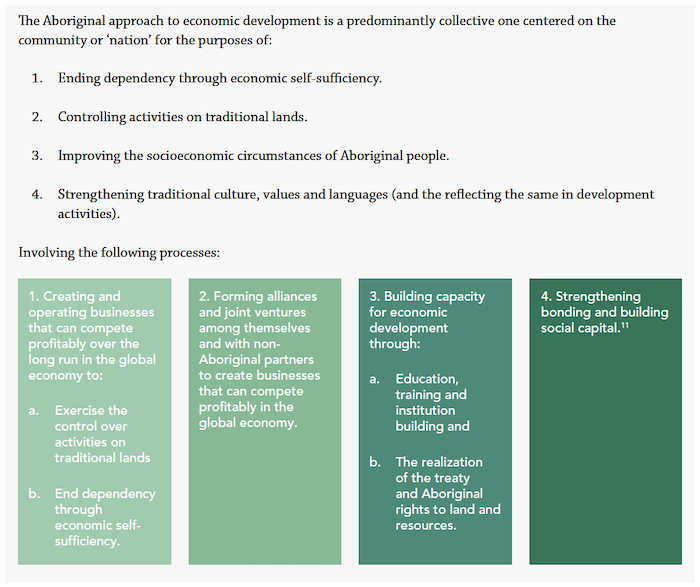

- For tips on Indigenous economic development practices, see Section 3, Number 14: Current Indigenous Economic Development Practices;

- For examples of engagement actions from previous Indigenous-Asia business strategies, see Section 3, Number 15: Engagement Strategies of Previous Indigenous–Asia Stakeholders and Indigenous Global Business Examples;

- For some accounts of shared Indigenous-Asia history, culture, and values, see Section 3, Number 16: Examples of Shared Indigenous–Asian History, Culture, and Values; and,

- For several figures from a 2019 GAC-CCAB report that detail what industries self-employed Indigenous entrepreneurs work in, what destinations Indigenous businesses export to, and which industries Indigenous businesses operate in and export from, see Section 3, Number 17: Trends of Indigenous Participation in Exporting Industries.

1: Doing Business in Asia: Quick Tips

2: Exporting Preparedness Checklist

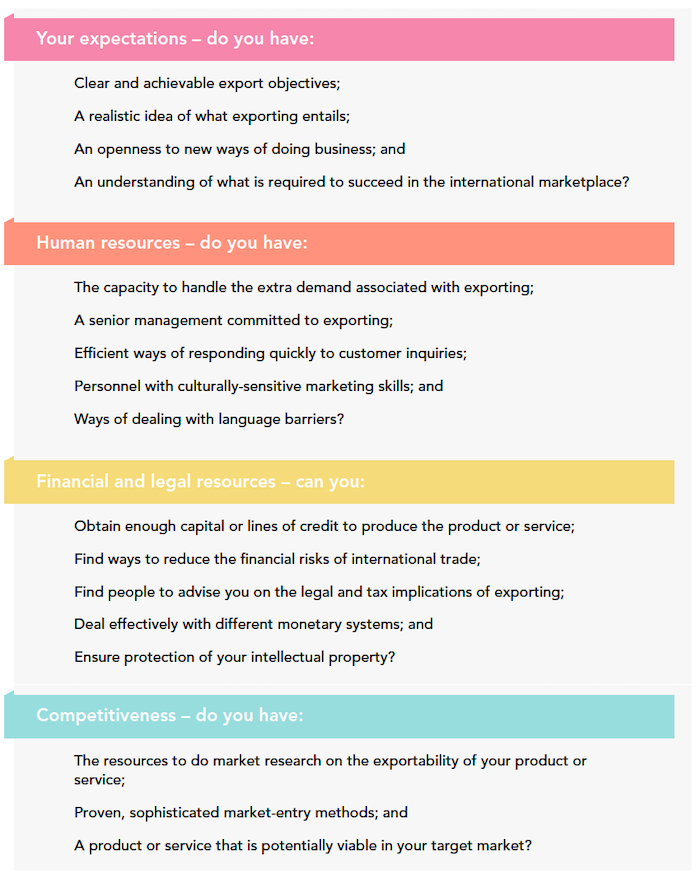

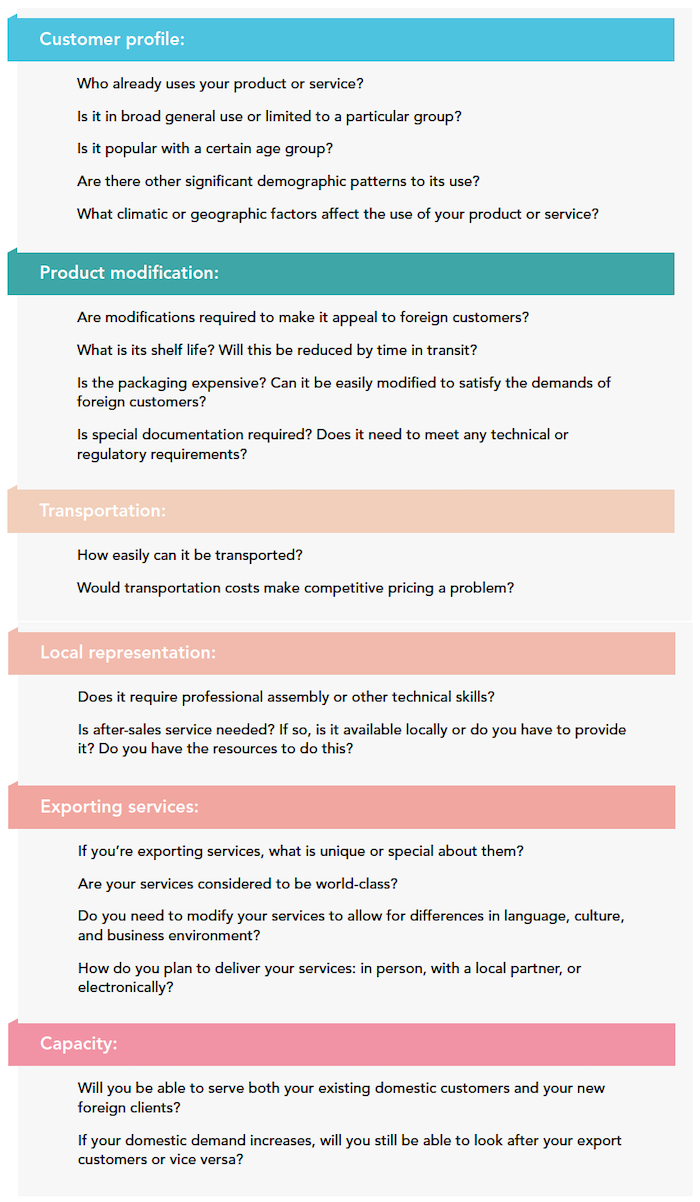

The Step-by-Step Guide to Exporting lists a number of important questions to ask yourself before going global:

The Step-by-Step Guide to Exporting also lists factors to consider when evaluating your export potential:

To help you prepare and navigate the complexities of international trade, take this quick Export quiz to see if you are ready and take a look at this free Step-by-Step Guide to Exporting.

A course to take to ensure you are well prepared for Asia Pacific engagement is the Trade Accelerator Program. TAP, as it is commonly called, was first offered by the Toronto Region Board of Trade in 2015 and is now offered nationwide. Contact an office in your area for more information and to register. The fees will be waived for Indigenous businesses.

3: In-Country Resources: Northeast Asia

The following provides links to various offices throughout Northeast Asia that can be contacted to provide information for planning, financing, and connecting with potential partners.

Trade Commissioner Service Offices

China Offices: Beijing, Chengdu, Chongqing, Guangzhou, Hangzhou, Hong Kong, Nanjing, Qingdao, Shanghai, Shenyang, Shenzhen, Tianjin, Wuhan, Xiamen, Xi’an

Additional resources can be found at the Trade Commissioner Services Canadian SME Gateway to China.

Japan Offices: Kitakyushu, Osaka, Sapporo, Tokyo, Nagoya

Export Development Canada

EDC China:

Chia Wan Liew, EDC Chief Representative

Tel.: (86-21) 3279-2832

Email: cliew@edc.ca

Alberta Trade Offices

China Offices: Beijing, Guangzhou, Hong Kong, Shanghai

BC Trade Offices

China Offices: Beijing, Guangzhou, Hong Kong, Shanghai

Ontario Trade Offices

China Offices: Beijing, Chongqing, Hong Kong, Shanghai

Quebec Trade Offices

China Offices: Qingdao, Shenzhen

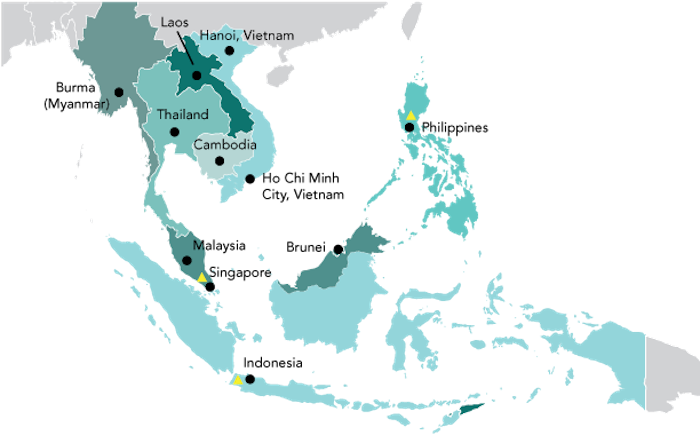

4: In-Country Resources: Southeast Asia

The section provides information for various offices throughout Southeast Asia that can be contacted to provide information for planning, financing, and connecting with potential partners.

Trade Commissioner Service Offices

Vietnam Offices: Hanoi, Ho Chi Minh City

Brunei, Indonesia, Malaysia, Singapore, Burma (Myanmar), Laos, Philippines, Thailand, Cambodia

Alberta Trade Office

BC Trade Offices

Philippines, Indonesia, Singapore

5: In-Country Resources: South Asia

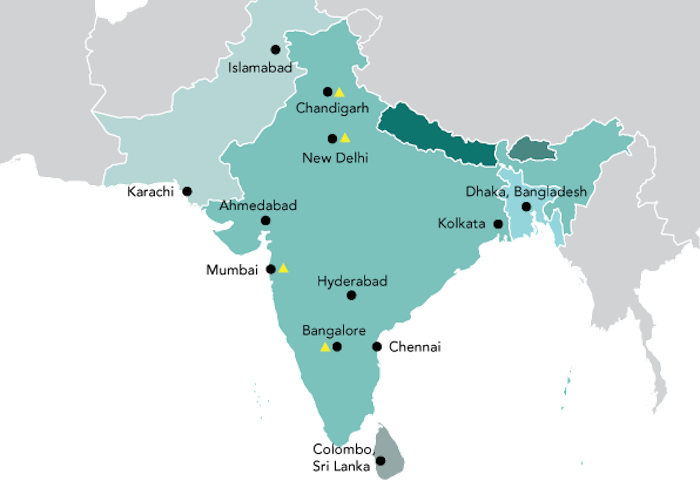

This section provides information for various offices throughout South Asia that can be contacted to provide information for planning, financing, and connecting with potential partners.

Trade Commissioner Service Offices

India Offices: Ahmedabad, Chandigarh, Hyderabad, Mumbai, Bangalore, Chennai, Kolkata, New Delhi

Pakistan Offices: Islamabad, Karachi

Alberta Trade Office

BC Trade Offices

India Offices: Delhi, Chandigarh, Mumbai

Ontario Trade Offices

India Offices: Mumbai, New Delhi

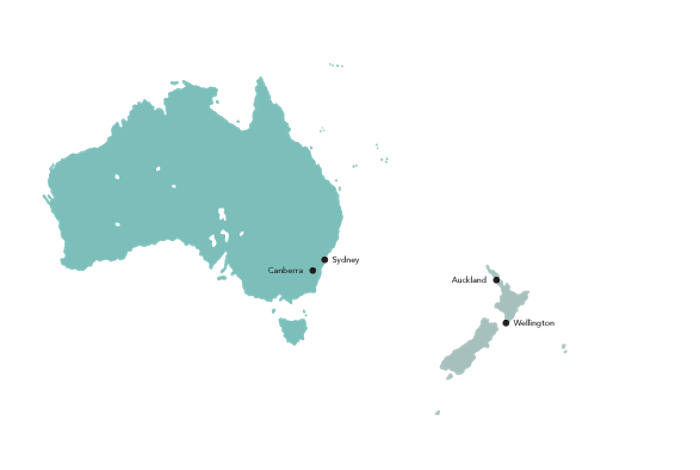

6: In-Country Resources: Oceania

This section provides information for various offices throughout the Pacific that can be contacted to provide information for planning, financing, and connecting with potential partners.

Trade Commissioner Service Offices

Australia Offices: Canberra, Sydney

New Zealand Offices: Auckland, Wellington

7: Provincial Support for Doing Business in Asia

In addition to federal government programming, provinces and territories also have services for supporting international business. Some provinces have their own trade offices in the region. Provinces with international trade offices are listed in numbers 3 to 6 of this section. Information for provincial domestic trade support is listed below.

Alberta Trade Support

Invest Alberta provides support for Alberta companies looking to grow internationally. Nine of the province’s 12 international offices are in Asia.

BC Trade Support

Trade and Invest British Columbia provides support for BC companies looking to grow internationally. They may have services for Asia Pacific regions.

Manitoba Trade Support

The World Trade Centre Winnipeg provides support for Manitoba companies looking to grow internationally. They may have services for Asia Pacific regions.

New Brunswick Trade Support

Opportunities New Brunswick (ONB) provides support for New Brunswick companies looking to grow internationally. They may have services for Asia Pacific regions.

Newfoundland and Labrador Trade Support

International Business Development (IBD) provides support for Newfoundland and Labrador companies looking to grow internationally. They have services for Asia Pacific regions.

Northwest Territories Trade Support

You may find trade support from the Northwest Territories Industry, Tourism, and Investment programs and services.

Nova Scotia Trade Support

Nova Scotia Business Inc. (nsbi) provides support for Nova Scotia companies looking to grow internationally. They may have services for Asia Pacific regions.

Nunavut Trade Support

The Nunavut Department of Economic Development and Transportation has various programs and resources that may provide support for Nunavut companies looking to grow internationally.

Ontario Trade Support

Invest in Ontario provides support for Ontario companies looking to grow internationally. They have services for Asia Pacific regions.

PEI Trade Support

Global Trade Services provides support for PEI companies looking to grow internationally. They have services for Asia Pacific regions.

Trade Team PEI provides support for PEI companies looking to grow internationally. They have services for Asia Pacific regions.

Quebec Trade Support

Quebec International provides support for Quebec companies looking to grow internationally. They have services for Asia Pacific regions.

Saskatchewan Trade Support

The Saskatchewan Trade and Export Partnership (STEP) provides support for Saskatchewan companies looking to grow internationally. They may have services for Asia Pacific regions.

Yukon Trade Support

You may find trade support from the Government of Yukon funding and support for business.

8: Relevant Canada–Asia Pacific Free Trade Agreements and Foreign Investment Promotion and Protection Agreements

FTAs in force

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

This agreement strengthens and diversifies trade and investment; creates new jobs; creates commercial opportunities with new free trade partners (Australia, Brunei, Japan, Malaysia, New Zealand, Singapore, and Vietnam) and existing partners (Chile, Mexico, and Peru); eliminates tariffs and non-tariff barriers for sectors such as agriculture, forestry, industrial machinery, heavy equipment, and services; includes labour and environment chapters; and increases investment protection, predictability, and transparency.

Canada–Korea Free Trade Agreement